Qtrade Review 2025 – Canada’s Best Broker

Qtrade Review

-

Critics Review and Ranking

-

Account Opening

-

Free ETFs

-

Annual Fees

-

For High Volume Traders

-

App Rating

-

Customer Service

-

Portfolio Management Tools

Qtrade Review Summary:

After almost two decades updating my personal Qtrade review, much has changed in the world of Canadian online brokerages. The one thing that has remained the same is Qtrade’s commitment to innovation, customer services, and low fees.

Qtrade is my #1 rated online broker in 2025. They combine excellent usability across both desktop and mobile, with low fees, free ETF trades, and the best-in-class customer service. When you toss in the fantastic cash-back promotion Qtrade has going on right now – it becomes a no brainer.

Here’s what the Globe and Mail’s Rob Carrick had this to say in his Qtrade review:

“No other broker is good in so many different areas and no other broker makes such consistent year-by-year improvements.”

Glenn Lacoste is the CEO of Surviscor, and he summed up Canada’s best brokerage by saying: “We congratulate Qtrade Direct Investing for its top ranking and its well-rounded online-based platform!”

Pros

- FREE buying and selling of 100+ commission-free ETFs

- Consistently rated #1 over the past decade

- Excellent Customer Service

- One of the best apps on the market

- Elite investor research tools

- Ultra-easy account opening

- 2024 Globe and Mail Rating: A

- Very unique Portfolio Simulator and Score Tools

- Great Promo Offer – $150 free + up to $2,000 cashback for new accounts

Cons

- Pesky inactivity fees (can be easily avoided)

- Not the absolute cheapest trading fees in Canada for all instruments

Current Qtrade New Customer Promotion

Qtrade currently has the best cash-back offer on the market in an effort to get you to try their platform.

In brief – they want to pay you $150 to open an account with them.

Details:

| Amount in New Qtrade Account | Cash Back |

| $1,000-$9,999 | $50 |

| $10,000-$24,999 | $100 |

| $25,000+ | $150 |

In order to get your cash back, the minimum you have to invest is $1,000. The good news though is that your amount of “new net assets” can be spread out amongst multiple accounts. In other words, you can put $5,000 in an FHSA, $7,000 in a TFSA, and $13,000 in an RRSP in order to hit the $25,000 threshold and max out your cash back.

It’s also worth noting that if you’re transferring your money from a competing brokerage, Qtrade will rebate your transfer fees (up to $150).

Best 2025 Broker Promo

Up to $150 Sign Up Bonus!

Open an account with Qtrade and get the best broker promo in Canada: $150 in cash back when you fund a new account.

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by October 31, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

What Is Qtrade Direct Investing? Is it Legit?

Qtrade Direct Investing is backed by Aviso Wealth, a national financial services firm owned by the Credit Union Centrals, CUMIS, and Desjardins. With nearly $120 billion in assets under management, Aviso has a solid presence in Vancouver and Toronto, along with regional offices across the country.

But what really sets Qtrade apart isn’t its corporate backing (although that helps some folks feel safe) – it’s the platform’s consistency and reliability. As someone who tracks Canada’s major online brokerages every single month, I can confidently say that Qtrade has the long-term track record to back up their claims to being the best online broker in Canada.

And it’s not just me. The entire Million Dollar Journey editorial team, all with over a decade of hands-on DIY investing experience, agrees that Qtrade is Canada’s #1 brokerage. It’s also been voted the country’s top online broker an impressive 24 times by third-party industry experts like The Globe and Mail, MoneySense, and Surviscor.

We’ve been tracking the evolution of Canada’s online brokers for nearly 20 years, and when we put together our reviews, we don’t skim the surface and copy/paste from other places. We take a deep dive – gathering insights from our entire team, answering reader emails, combing through comments, and analyzing every comparable feature.

One key factor that often gets overlooked? Consistency. A lot of brokers make a flashy entrance: new interface, shiny features, big promises, limited-time free trades, etc. Only to stagnate in the years to come. Before long, they’re scrambling to catch up, throwing money at rushed updates to stay relevant.

Qtrade has never played that game. They’ve consistently been ahead of the curve, rolling out smart features without unnecessary fees, keeping the platform smooth and reliable year after year. You’re not signing up for a broker that’s great today but struggles to keep up tomorrow – you’re getting a steady, best-in-class experience for the long haul.

Because let’s be real here, who wants to deal with the hassle of moving accounts every time a brokerage loses its edge? I don’t have the time or patience for it. Switching platforms can mean paperwork, emails, delays, and frustration. That’s why I stick with Qtrade. I know they aren’t just the best game in town right now – but they also have a significant history of improving every year despite being rated so highly.

Media Ranks Qtrade #1 Canadian Broker

The media has been embracing Qtrade Direct as the one of the best Canadian brokers, and has received particularly glowing reviews in the Globe and the Mail, MoneySense magazine, as well as many of our fellow Canadian personal finance blogs. This Qtrade review is far from being the only highly positive one in the Canadian cyberspace.

“If investing to you is a years-long journey of wealth-building for goals like retirement and your children’s postsecondary education, then you’ll get more value from Qtrade’s tools and informative website than you will by paying a few bucks less per trade: Grade: A+“

Rob Carrick, Globe and mail

Qtrade Commission Free ETFs

As an avid ETF investor, this is a major aspect of the Qtrade Canada review.

Qtrade’s commitment to the free purchasing and selling of ETFs is a deal-breaking-win for me. Other Canadian brokerages offer free ETF purchases, but charge a trading fee when ETFs are sold to withdraw money, or just to rebalance a portfolio.

It’s important to note that not all ETFs are created equal when it comes to the Qtrade commission-free ETF trading policy. That said, you can get exposure to whatever market you want using these ETFs.

You can get super complicated and look into niche ETFs such as the iShares Jantzi Social Index ETF (XEN) if you’re looking for socially responsible investing, or you can use the ultra-cheap broad ETFs that I prefer.

While Qtrade doesn’t technically have commission-free trades available for all ETFs – they do have a list of over 100 ETFs (that they are adding to consistently) that can be bought and sold as many times as you want for the simple price of $0. That Qtrade free ETF list includes easy ways to get exposure to whatever market you want.

You can purchase hyper-focused options (although I don’t advise it) such as the Desjardins RI Canada – Low CO2 Index ETF (DRMC) if you’re looking for socially responsible investing, or you can use the ultra-cheap broad ETFs that I prefer. My personal favourite Qtrade commission-free ETFs are Horizon and iShares portfolio ETF options.

There is no minimum purchase level to qualify for these commission-free ETFs – you simply buy them as you would any other stock or ETF purchase. Also – unlike Questrade – not is the buying and selling of these ETFs completely commission-free, there are no ECN fees either.

This expansive, fee-free ETF selection keeps Qtrade a cut above the rest, especially for those of us who like to keep our investing simple and cost-optimized.

Ultra-cheap broad ETFs to buy for free on Qtrade:

- Horizons S&P/TSX 60 Index ETF (HXT)

- Horizons S&P 500 Index ETF (HXS)

- iShares MSCI Emerging Markets Index ETF (XEM)

- iShares Global Real Estate Index ETF (CGR)

- iShares Canadian Government Bond Index ETF (XGB)

- iShares Core Growth ETF Portfolio (XGRO)

- iShares Core Equity ETF Portfolio (XEQT)

- iShares International Fundamental Index ETF (CIE)

- CI Canadian REIT ETF (RIT)

- If you want the coolest ticker symbol in Canada… “COW” (the iShares Global Agriculture Index ETF) that is also available – although it’s not in my portfolio!

All other ETFs can be purchased at Qtrade’s standard low-commission rate of $6.95 per trade (for Investors Plus members).

Qtrade Fees & Commission

Qtrade’s non-ETF trading fees are decisively cheaper than the fees charged by Canada’s big bank brokerages, but are slightly higher than Questrade’s trading fees.

Qtrade Trading Fees, Commissions and Quarterly fees:

- Everyday investors (those who do not meet the 150+ trades per quarter or $500,000+ in assets thresholds) are charged $8.75 per trade.

- Investor Plus members will see a lower rate of $6.95 per stock trade.

- Options are $6.95 + $1.25 per contract.

- Stock traders between the ages of 18-30 can also take advantage of a reduced commission rate of $7.75 with no minimum balance and no quarterly fees, as long as they set up a recurring deposit of $50+ each month.

- Electronic statements have no fee, while paper trade confirmations cost $2.50.

- To transfer your account out the fee is $150.

- There is a quarterly fee of $25, but that could be easily avoided, as per below.

How to Avoid the Qtrade Quarterly Account Fee

- Qtrade has a $25 per quarter account fee, but there are numerous ways to escape this pesky fee. My recommendation to new investors is to set up an automated contribution to their brokerage account. This simply means that you send $100 (or more) from your bank account to your brokerage account each month. Qtrade refers to this as a “recurring electronic funds contribution” and it has no fees attached. If you set up this solid investment practice, then you can avoid Qtrade’s quarterly account fees no matter what your balance or trading levels.

- Have at least $25,000 in assets on the last business day of each 3-month period (called “quarters” in the investing world).

- Complete two commission-generating trades in the preceding quarter or either trades in the preceding year.

Qtrade Review: Transfer Fees

In order to make it as attractive as possible to make Qtrade your go-to trading platform, Qtrade offers to pay your transfer fees that you will be charged from your old broker when you move over.

This transfer fee offer applies to folks that move over $15,000+ worth of assets, or who move over less than $15,000 and then deposit up to that amount in the first 30 days.

In order to take advantage of this transfer fee reimbursement offer, you need to mail/fax a statement from your old trading platform that details the costs you incurred. Then, within 60 days, you’ll see the account credit pop into your account.

If you choose to move on from Qtrade at some point, their transfer fee is $150. Of course the whole point of reading our Canadian online broker reviews is that you are able to make an informed decision with a long-term choice in mind – and prevent the time-consuming paperwork and transfer fees incurred with a switchover.

Qtrade Review: Account Options

Qtrade has a variety of account types that you can choose from depending on your investing goals and needs.

Cash Accounts: Cash accounts are pretty straightforward. You can buy and sell stocks, bonds, mutual funds, and other investments. Cash accounts are available as individual, joint, corporate, and group. They are obviously the most flexible account type.

TFSA: TFSAs are a valuable account type for Canadian investors. You’ll be able to invest in stocks, bonds, ETFs, and mutual funds, but your earnings and withdrawals are sheltered from tax.

RRSP: Using the Qtrade RRSP account you can invest in stocks, bonds, ETFs, and mutual funds, but the tax will be deferred until you make a withdrawal, ideally upon your retirement. RRSP accounts are available for individuals, as a spousal plan. RRIFs (the natural conclusion to RRSPs) are also available. There are also both Canadian Dollar and US Dollar Account options.

FHSA: The new Qtrade First Home Savings Account (FHSA) allows you to trade in stocks, bonds, ETFs, and mutual funds. It is an excellent option for saving that first downpayment (and is even pretty cool if you plan to never own a home. See our FHSA guide for more details.

Click here to open a Qtrade FHSA account and get up to $200 in top-up cash back.

Margin: Margin accounts allow you to borrow money against your securities to trade at competitive rates. Keep in mind, this is the only account type that you will need to pay interest on.

There is no Qtrade minimum balance required to open an account, but there is minimum balance required to avoid the account fee as discussed above.

Qtrade also facilitates ultra-fast, super convenient EFT transfers to get money from your bank account to Qtrade – and back again.

You can set up Electronic Fund Transfers (EFTs) without worry about uploading a void cheque or anything like that, you simply login to your bank account through Qtrade’s EFT platform and you’re set to go.

Qtrade Review: Customer Service

One of Qtrade’s standout features – and a major reason for its strong reputation – is its exceptional customer service. Unlike many competitors, Qtrade consistently delivers prompt, reliable support from knowledgeable staff who truly understand the needs of DIY investors.

“Qtrade excels in every area—especially in customer service.”

Mark Brown, Investing and Rankings Editor for MoneySense

You have multiple ways to reach Qtrade’s support team: phone, email, and live chat. For added convenience, they also offer a ‘let us call you’ feature. Simply leave your number, and a customer service representative will call you back as soon as they’re free. No more waiting endlessly on hold or feeling like you’re trapped in queue purgatory.

If you’ve ever suffered through the agony of a 2+ hour hold, only to get disconnected as the clock runs out on “business hours” when you’re “next in line,” then you know just how much of a game-changer this is.

This level of responsiveness and customer care gives Qtrade a decisive edge over most of Canada’s discount brokers, where solid customer service is often treated as an afterthought. Sure, you might never actually need customer service.

Just remember, no one needs it – until they do. And at that point (when you’re talking about your hard-won nest egg) you’ll be glad that you can get someone on the line sooner rather than later!

Features, Tools, and Ease of Use

Qtrade definitely gets bonus points for having a clear and easy-to-use website and the Qtrade mobile app is a really refined way to trade as well. In a piece for the Globe and Mail, Rob Carrick stated that “it’s mobile app lets you do a wide range of functions and doesn’t cut corners, which many other brokers have.”

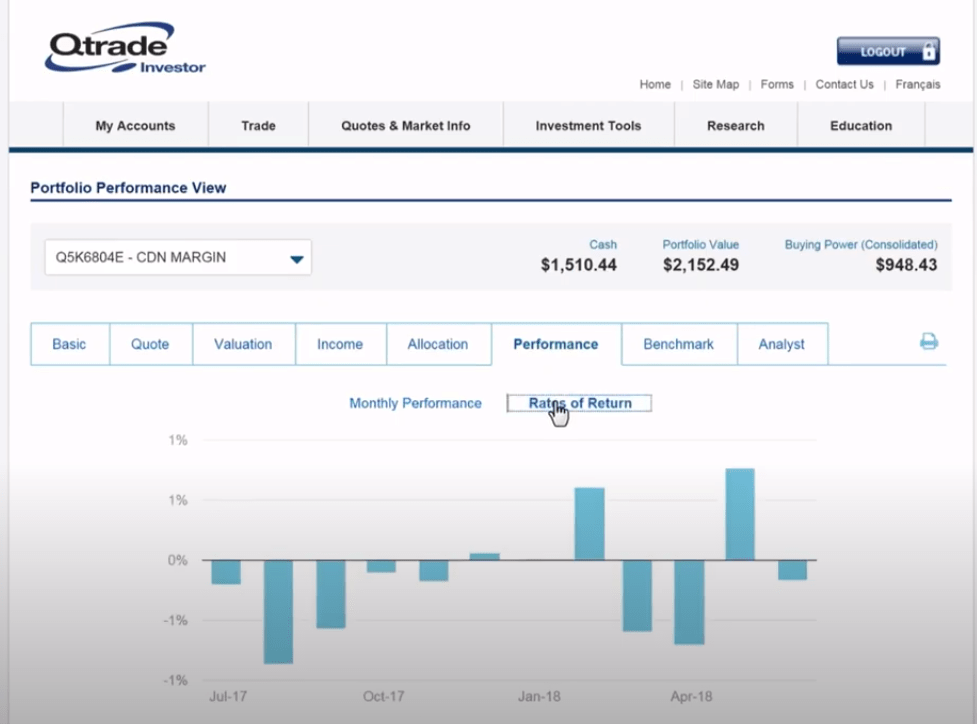

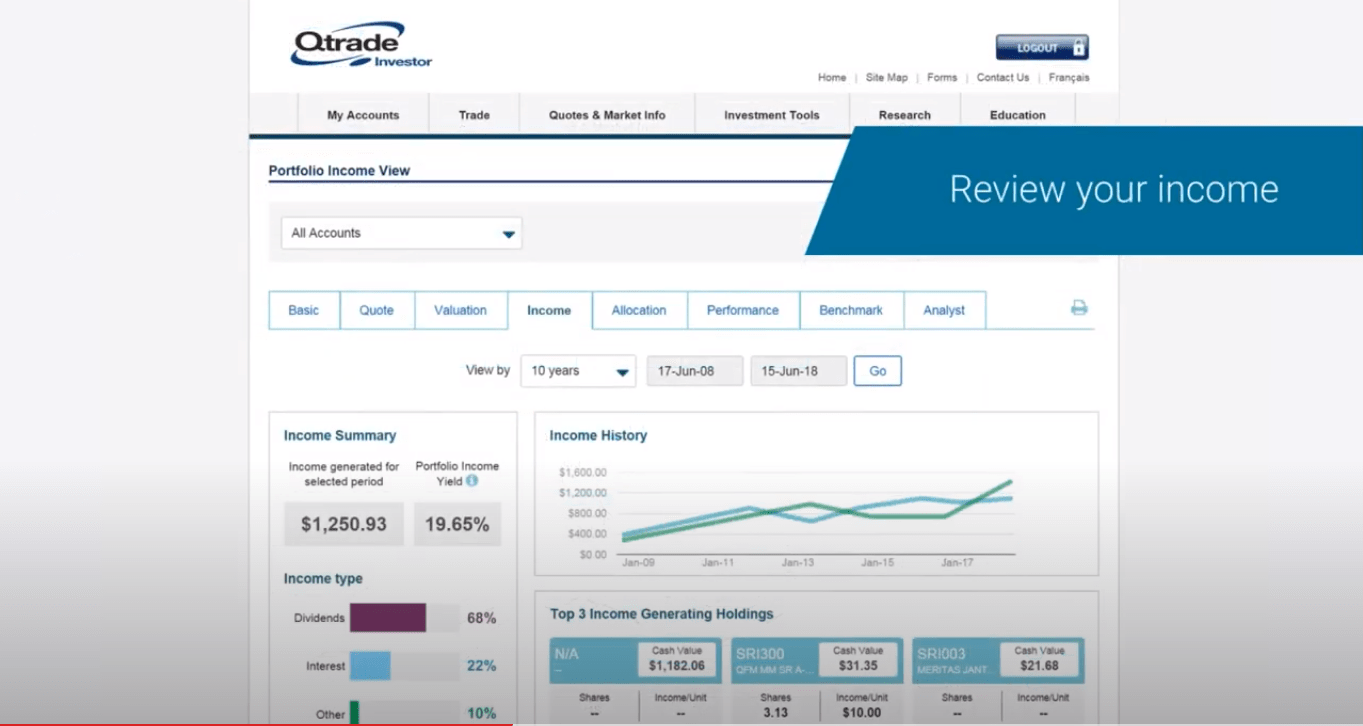

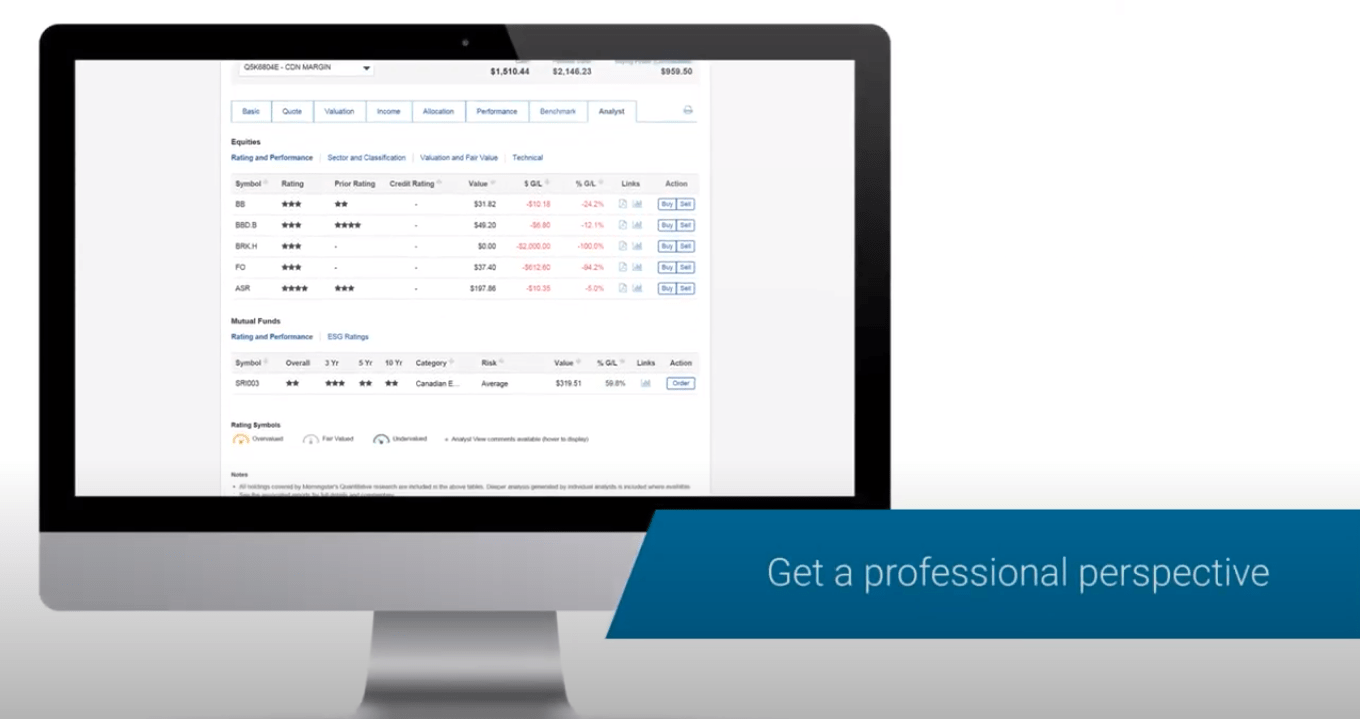

Below is a video demonstrating how their trading system works:

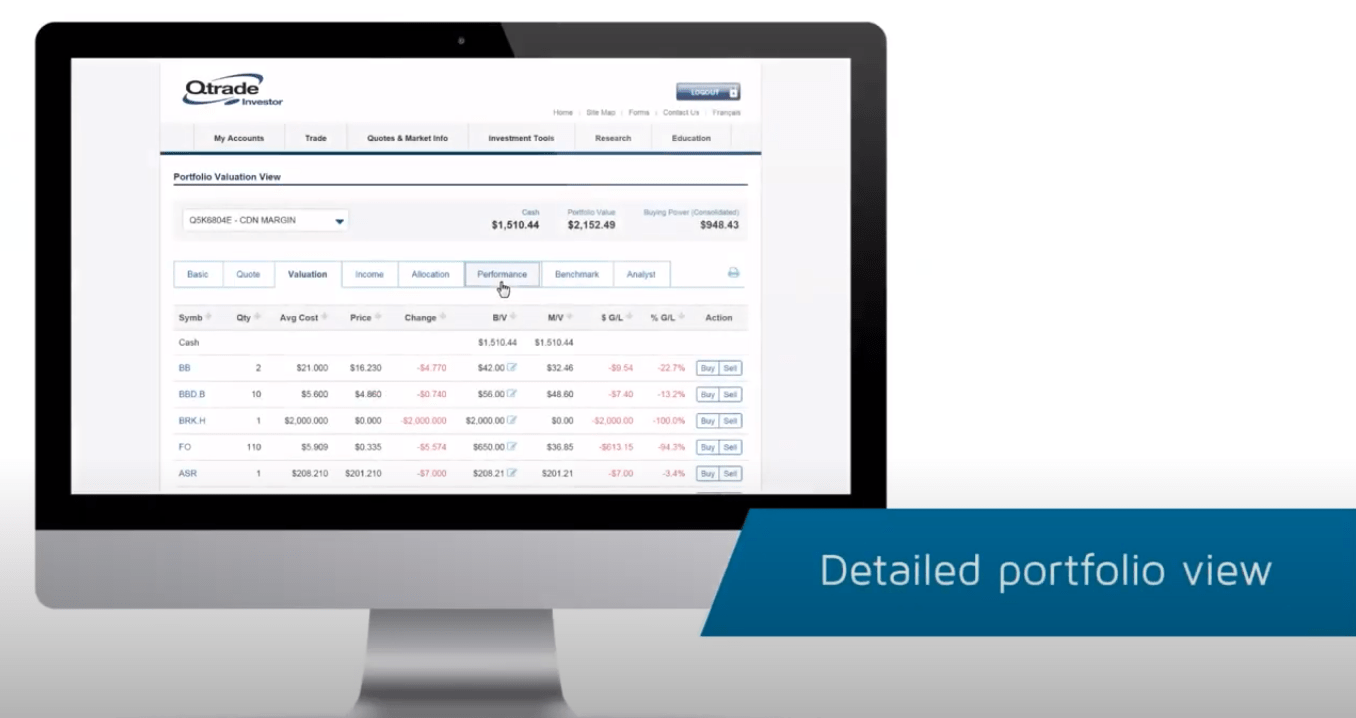

On both the website and the Qtrade mobile trading platform (rated #1 on our best stock trading apps article), Qtrade allows you to easily navigate your investments, watchlists, stock screeners, and market research tools.

The stock screeners are customizable and real-time quotes will show you the current stock price as well as additional information including dividend yield, earnings per share, 52-week highs and lows, and market cap.

Qtrade’s trading platform makes stock trading a breeze as well. A click on the ‘trade’ button will allow you to choose what type of security you would like to invest. You can trade stocks, ETFs, mutual funds, options bonds, and GICs on US and Canadian exchanges. If you want, you can also set limit orders and stop orders.

Investors and columnists are also loving one of Qtrade Direct newest tools; Portfolio Score. This tool essentially gives you a second opinion on your portfolio. You can use the information provided to compare your portfolio against domestic and global benchmarks.

It will also evaluate your securities and grade your portfolio against five dimensions:

- Downside protections

- Performance

- Diversification

- Income

- fees

It’s a handy tool to have to help you invest with more confidence and manage your risk exposure.

The other unique aspect of Qtrade’s trading platform is their Portfolio Simulator and Portfolio Creator tools. Simulator allows investors to test how adding specific ETFs, stocks, or bonds would change the makeup of their portfolio (and note the corresponding change to variables such as inflation, interest rates, and US exchange rates).

Creator generates an all-ETF portfolio designed especially for you (based on your answers to a series of questions). Additionally, for the detail-oriented DIYers out there, it will show you your hypothetical ETF-portfolio’s risk-adjusted return based on the Sharpe ratio, SF Ratio, and the Sortino ratio.

Below you can find additional screenshots from Qtrade’s online trading platform and the Qtrade mobile app below:

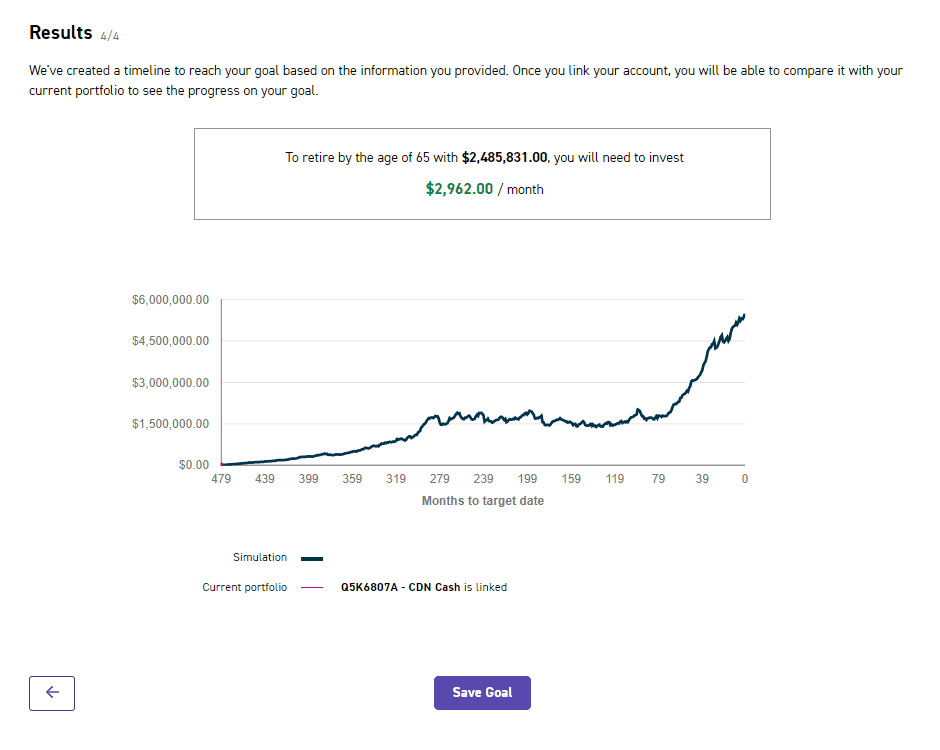

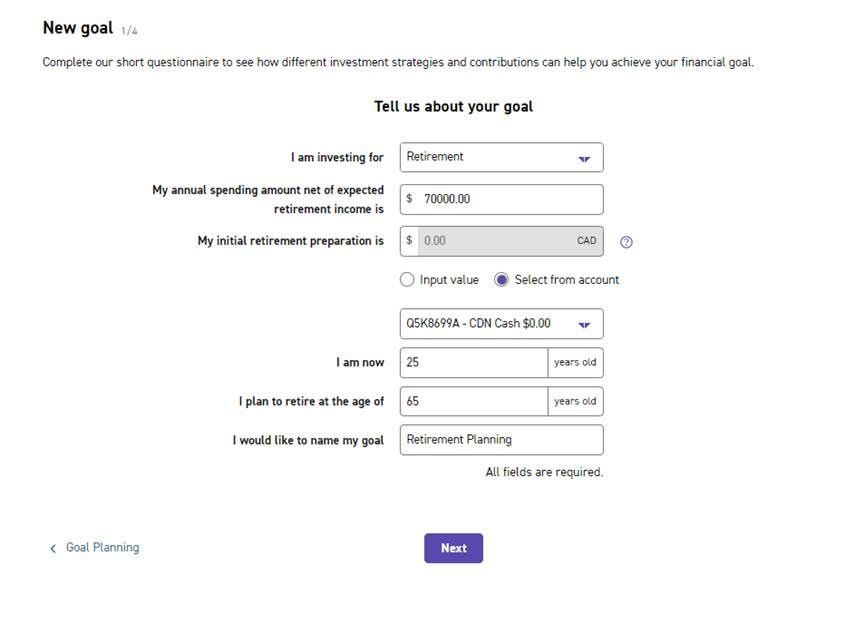

Qtrade New Goal Planning Tool

In May 2023 Qtrade added a very cool new goal planning tool in order to help investors visualize their next steps and future growth. Users can access the tool from their account dashboard.

The goal planning tool was created with the intent to:

- Identify investment goals.

- Understand risk-appropriate investment options.

- Track progress towards identified goals over time.

- Help visual learners by showing visual projections of potential timelines.

- Allow investors to “pivot” or change goals as circumstances change over the years.

Qtrade’s platform innovation information described the new tool as, “A quick and simple way to begin to write your own future. Whether you’re saving for a down payment on a house, planning for retirement, or trying to hit another financial milestone, a user-friendly questionnaire helps you easily set your goals. Track your goals, check in to monitor your progress, and receive personalized recommendations on how much you need to invest each month to give you the confidence you need to achieve them.”

Qtrade Onboarding Update:

Qtrade’s most recent user experience upgrade includes a very DIY investor-friendly onboarding process that guides investors to the right account depending on what their goal is. Of course, if you already understand what you need, you can opt to choose your own account option right away (as you always could).

For investors just familiarising themselves with online brokers however, this is a nice little upgrade that will help more Canadians make the right investment choices for their specific situation.

For example if you select “saving for retirement” as your goal, then Qtrade will ask if you’d like to open a TFSA, RRSP, Spousal RRSP, or LIRA/LRSP. If saving for your child’s education is the goal they’ll not only offer you an individual RESP option, but also a family one.

The Investor Plus Program: Lower Fees

Qtrade has an elite-tier program called the Investor Plus Program which comes with a few perks and benefits (including lower trading fees).

To qualify for the Investor Plus program you must have:

- A minimum of $500,000 in assets across all accounts and under the same client ID

or

- A minimum of 150 online commission-generation equity or option trades during the immediately preceding calendar quarter.

Perks and benefits include discounted trading commission fees, which will be discussed below, as well as a dedicated phone number to ensure faster service plus no fee for USD registered accounts.

Qtrade vs Questrade

Look, the bottom line in the Qtrade vs Questrade battle is that you can’t really go wrong. It comes down to the tradeoff between rock-bottom fees and the best user experience on the market. That said, if you are mainly looking for ETF trading – it’s gotta be Qtrade hands-down.

Here’s a closer look at the Qtrade vs Questrade comparison (click on the link to view a full fledged comparison, this is just a quick summary):

| ||

|---|---|---|

| Canadian ETFs | Yes! Free buying and selling of 100+ ETFs. | Free buying and selling of ETFs |

| User Experience | Consistently ranking #1, high availability and friendly to customers. | Has made big gains over the last three years, rated just behind Qtrade by most publications. |

| Trading Fees | Very competitive, $6.95/trade for Investor Plus Program members, $7.75 for investors aged 18-30, $8.75 for everyone else. |

|

| Research Tools and Education Materials | Has been at the top of Canadian brokerage rankings in this category for over a decade. | Made excellent gains in the last few years. |

| RESP Accounts | Available | Available |

| ECN Fees | None. | Up to $5 per trade. |

| Transfer Fees | Free Electronic Funds Transfer. Additional fee for transferring out. | Free Electronic Fund Transfers up to $50,000 CAD and $25,000 USD. Additional fees for wire transfers and transferring out. |

| promotion | $150 Cash Back | $50 in Free Trades |

| Sign Up | Visit Qtrade | Visit Questrade |

Qtrade Adds TipRanks Ratings for 2023

Qtrade recently announced that they have sealed a partnership with the investing information service TipRanks. Going forward, every Qtrade client will be able to access the research provided by TipRanks Analyst Rating.

Personally, I’m not big on determining my investment decisions via analyst ratings, but it never hurts to have more data points (especially when you get them for free).

The basic idea behind the TipRanks service is that they collect all of the information and predictions that analysts are making in regards to specific stocks, and then presents them in a nice tidy aggregated summary. Metrics such as price targets and estimates will be prominently displayed alongside analyst quotes and recommendations.

Qtrade users will be able to access this new investor information through the “Overview” and “Analyst Ratings” tabs within their accounts.

While DIY investors may wish to use analyst opinions to search for broad trendlines, I would caution them from reading too deeply into any single analyst opinion as analysts have a notoriously difficult time navigating the two-way relationship with the stocks that they cover over the long term.

Qtrade Young Investor Program

Qtrade has recently made a strong push to get young people started on their platform. By offering specially priced $7.75 stock trades – and access to the same Qtrade commission free ETFs menu – Qtrade has made the stock market more accessible to young investors than ever before.

Qtrade has also committed to eliminating the $25 account fees automatically for young investors.

In order to qualify for the Qtrade Young Investor Program you simply need to fall in the 18-30 age group, and set up a $50 per month pre-authorized contribution from your regular bank/chequing account.

Investors who are just starting to manage their own money can take full advantage of Qtrade’s top-tier investor education materials and access to third-party investing reports. This special perk for our most visited age group is one of the driving powers behind this positive Qtrade review.

Rob Carrick’s Qtrade Review 2024

Each year we eagerly await Rob Carrick’s broker ratings at the Globe and Mail to see if he’s uncovered any angles that we missed or if we’re on the same page.

In 2024, the long and short of it is that Carrick continues to be impressed with Qtrade, giving it an A rating for the 5th year in a row. Here’s what he had to say about our favourite online broker:

Qtrade has lived at the top levels of this ranking for ages because it’s always making big and small improvements. One more recent tweak is the addition of a goal-planning tool that allows clients to set a target amount for a specific financial milestone and then track their progress toward achieving it. The big pluses at Qtrade include one of the most user-friendly websites in this ranking, a good app, commission-free trading of 120 ETFs and a Portfolio Score tool that lets clients drill way down into their portfolios to assess risk, diversification and more.“

As a quick reminder, here’s some of the highlight of what Carrick had to say about Qtrade’s online broker over the past three years:

As has often been the case in this ranking over the years, Qtrade Direct Investing is the broker that does it best. Other brokers beat Qtrade in specific areas like commission costs, but Qtrade’s overall goodness becomes apparent as soon as you log in and find a neat little dashboard to get you up to speed on your investments. Qtrade’s consistently strong showing in this ranking speaks to another of its virtues, constant improvement. Other brokers get better in fits and starts, while Qtrade moves ever forward.“

Much like myself, Carrick has been most impressed with Qtrade’s consistency over the long term. Some brokerages will make a gain here or there, and then fall behind over the years. But, it can be a chore to change brokerages, so users mostly just put up with a poor experience.

Not Qtrade!

Year after year they bring the goods as far as maintaining the simple excellence of customer experience, and pairing it with company-wide innovation.

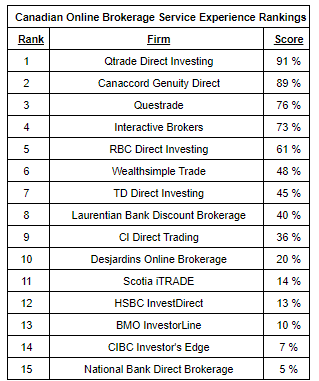

Surviscor Qtrade Review 2024

At the end of 2023 Survisor released their new Canadian online broker ratings, and confirmed what we at MDJ had been hearing throughout the year: Qtrade users are the happiest in Canada.

Glenn LaCoste, the Preside of Surviscor Group stated, “Congratulations to Qtrade Direct Investing for its continued service response excellence and its breadth of service interaction choices for all types of digital investors.”

Christine Zalzal, the Head of Online Brokerage and Digital Wealth over at Qtrade was happy to accept the award stating, “What makes a great online brokerage firm for investors is not only a great online trading experience but also being supported by a great service team. At Qtrade, we’re always listening to our customers. A strong customer-focused culture is embedded into our DNA. As more Canadians explore the world of self-directed investing, we’re continuing to invest in our people and our platform to help build their confidence to build their wealth.”

Given the expertise that Surviscor has 18 years of experience in reviewing Canada’s online brokers, they have substantial credibility with the space. The data is the culmination of approximately 2,200 individual service interactions throughout the previous year.

Right at the end of 2023, Surviscor released their 2024 desktop comparison for Canadian online brokerages. It was nice to see their finding mirror my own, as Qtrade took the #1 position. Qtrade continues to out-innovate, and out-compete their brokerage rivals when it comes to usability and customer experience.

Recent Improvements to the Qtrade Trading Platform and Research Tools:

- New Portfolio Score, which gives a client’s portfolio a health-check by analyzing and grading its performance across five financial dimensions

- News service powered by Dow Jones

- Sector-specific newsletters with pricing predictions from Trading Central

- Expanded offering of USD DRIP-eligible securities

- Spousal USD RRSP and RRIF products

- Updated options trading to enhance real-time information

- Redesigned and expanded ETF and Stock Screeners

Qtrade’s AI-Powered Information Advantage

Qtrade became the first Canadian online broker to partner with PersonaFin. PersonaFin uses advanced AI reasoning to create a personalized news feed that is designed to support your DIY investing decisions. By combining and refining the news items from across all of Qtrade’s content partners, you will get the information you need quicker and more efficiently than ever before.

If you want to check out the new feature, look under the My News tab. Christine Zalzal, SVP and Head of Direct Investing stated, “Partnering with PersonaFin to bring its Personalized News tool to the Qtrade platform will enhance Canadian investors’ confidence in their trading and investment journeys, helping them maximize their investments now and far into the future.”

Kerri Miller, Director of Strategic Partnerships at PersonaFin enthusiastically supported the new venture saying, “At PersonaFin, we’re always seeking forward-thinking, technology-driven financial institutions to partner with, which Qtrade has consistently and continuously shown themselves to be. ‘

We are thrilled to partner with Qtrade to elevate the personalization of financial news, analytical insights, and expertise they deliver, empowering their investors to make more informed trading and investment decisions.”

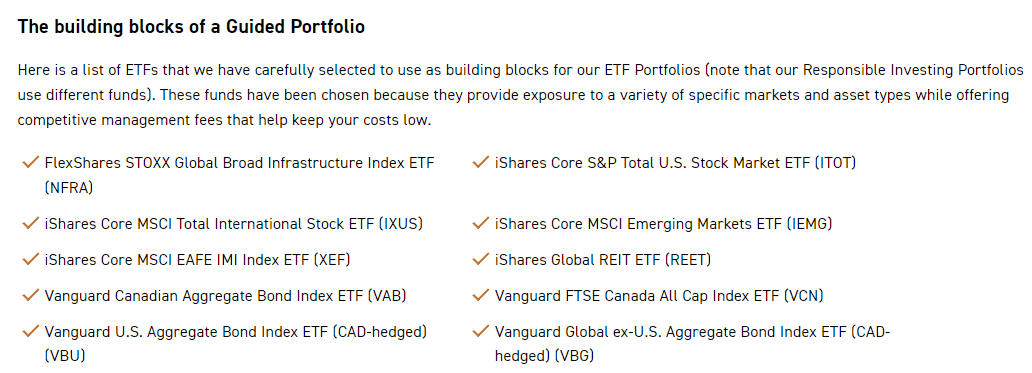

Qtrade Guided Portfolios

In addition to being an excellent discount brokerage platform, Qtrade has also recently released a more “hands-off” way to manage your money, that they’re calling Qtrade Guided Portfolios.

Qtrade Guided Portfolios are a massive leap forward on the company’s old “semi-robo-advisor” known as VirtualWealth.

Here’s the deal on Virtual Portfolios:

- It’s a super fast and convenient way to invest your money using a passive investing strategy that is also known as index investing.

- When you open a Guided Portfolio account, Qtrade will ask you a series of questions to determine what the best overall mix of assets is for someone with your goals and risk tolerance. They want to make sure that you’re getting right balance of stocks and bonds (also known as equities and fixed income).

- Once you have the right fit the money that you put in each month will be split up into ETFs that track pretty much every big publicly traded company in the world – as well as many different government bonds.

- It’s an excellent math-backed investing option.

- Fees are quite low (MER of .60% or lower) and very competitive.

- Can include RRSPs/RRIFs, TFSAs, and other Canadian accounts.

- There are 6 different risk levels – each have their own portfolio: Income, Income + Growth, Balanced, Growth + Income, Growth, Max Growth.

- Each different portfolio will allocate your money slightly differently to these ETFs:

Overall, Qtrade Guided Portfolios are an excellent option for folks that want that ultimate in hands-off investing. The closest comparable product in Canada would be Wealthsimple Invest. If you’re willing to pay a little bit more in fees than if you constructed your own index portfolio, you will get the perfect one-stop solution for building a nest egg.

You can sign up to Qtrade Portfolios by clicking the button below and visiting their website, or read our detailed Qtrade Guided Portfolios review to see how they compare to Canada’s best robo advisors.

Qtrade Pre-Market and After Hours Trading

Qtrade recently announced that they will be offering pre-market trading from 8:30-9:30am ET and after hours trading from 4:00-5:00pm ET. Trading is currently only for US markets (including stocks like Enbridge that are traded on both the Toronto Stock Exchange and the New York Stock Exchange).

Details of the announcement included, “Currently, these trades can only be placed via telephone with an Investment Representative. We plan to add extended market orders to our online platform in due course. We continue to invest in and relentlessly improve our client and partner experience.”

Personally, after-hours trading isn’t my thing as it’s more geared towards day traders. Liquidity can often be very low in the pre-market and after hours markets, leading to fairly large price moves in a rapid fashion. That said, I’m always happy to see Qtrade push the envelope and continue to offer new options for Canadian investors.

Qtrade Review FAQ

Is Qtrade The Best Choice For You?

I first reviewed Qtrade all the way back in 2006, and what stands out to me nearly 20 years later is just how little the core needs of Canadian DIY investors have changed.

People still want the same things: a low-cost brokerage that’s cheap and easy to use, offers the account types they need, and doesn’t ghost them when they hit a snag. Above all, they’re looking for a platform they can count on – not just one that offers them a bauble to sign up – but one that keeps showing up year after year.

That sounds simple. But in the Canadian brokerage world, long-term consistency is surprisingly rare – and it’s exactly what sets Qtrade apart.

Online brokers have been one of the top interests for Million Dollar Journey readers for nearly two decades now, and my rankings are informed by a steady stream of real feedback. That means my Qtrade review isn’t just based on personal experience (though I’ve opened accounts at every major Canadian brokerage) or editorial discussions with the MDJ team – they’re also powered by hundreds of reader emails and comments over the years.

That reader insight? It’s the secret advantage that helps me keep these rankings honest and accurate. They’re also one of the main reasons I feel confident saying Qtrade is the top brokerage in Canada right now.

In addition to having the top-rated investing platform on the market, Qtrade currently offers the best cash-back promotion in the business, as they’ll pay you up to $150 (plus pay the transfer fees) just to give their brokerage a shot.

In an effort to keep my Qtrade review as accurate as possible, I rely on readers to pass along updates in real time (so as to track any changes in customer service). If there are any new customers out there (or long-time ones for that matter) I’d love to hear from you in the comments below!

“We congratulate Qtrade for its convincing win…and for its commitment to innovation and unmatched service levels.”

Glenn LaCoste, President of Surviscor

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

You didn’t mention that QTrade has recently become more competitive in the margin space. At the most privileged tier, margin accounts are being charged 6% interest. Not as good as Wealthsimple’s 4.95%, but on par with the best rates at TDDI and NBDB. Previously, QTrade’s margin rates were ghastly.

Your article doesn’t speak much to how well QTrade integrates with bank accounts at other financial institutions. Less important in the accumulation phase, but very important when one starts living off investment income.

I feel like you oversell the 100+ Free ETFs. In the list of the top 48 ETFs elsewhere on MDJ, there are only 8 of those funds, HXT, HXS, XEQT, XGRO, XBAL, XINC, RIT, QQC that are listed in the 100+ ETF list. Every other fund on the list requires the $8.95 trading fee to complete a trade. I use Qtrade for my daughters RESP using XEQ, XBAl and XINC, but only have a small RRSP account with Qtrade due to this issue.

That’s fair enough Derek. I would say a person could do a lot worse than just going XEQT across the board!

How does Qtrade compares to BMO? I understand that being someone with a smaller portfolio (below $25k) it would be better to go with Qtrade, but long term I am wondering what does a big bank offer that Qtrade doesn’t? Does it offer better economic and educational information? Also, wouldn’t it be best to not pay fees at all (Disnat or National Bank) or would does the added value of analysis, in the end, brings you more value (and money)?

I would say with 100% sincerity that Qtrade’s educational resources are the best amongst brokerages. I honestly don’t know a single thing that BMO would offer as a “big bank” that Qtrade wouldn’t. BTW – Qtrade’s parent company: Avisio Wealth handles $55 Billion+ in assets, so they’re not exactly a small fish. To me, the vast gulf in user experience and customer services between Qtrade and Disnat/National Bank (waaaay better platforms) is worth paying a little extra for. That said, when you consider ETF trades are free with Qtrade, how much extra are you really going to pay?