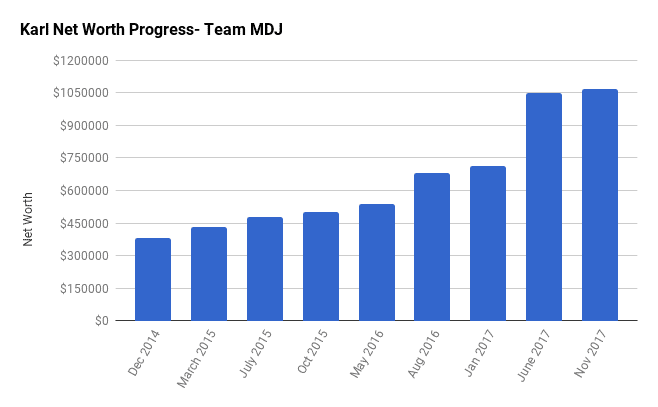

Net Worth Update Nov 2017 – Karl the Real Estate Agent Millionaire (+1.8%)

Welcome to the Million Dollar Journey November 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after my million dollar net worth milestone was achieved in June 2014. Karl the Real Estate Agent was selected as a team member and will post net worth updates on a regular basis. Here is more about Karl.

- Name: Karl

- Age: 35

- Day Job: Full-time Real Estate Agent

- Family Income: $150,000 (Personal full-time job);

$TBD (Income from consulting company); and, $150,000 (spouse full time job). - Goals: Mortgage paid off by 36 (DONE!!!), million dollar net worth by 40 (DONE!!!). $500,000 in RRSP/TFSA savings by 40 (In progress)

- Notes: Almost all of net worth is in the real estate market (principal residence). Starting to invest in the markets now. Also a sucker for holding second mortgages.

Assets: $1,784,500(+22%)

- Cash: $10,000(-33%)

- Registered/Retirement Investment Accounts (RRSP): $170,000 (+94%)

- TFSA: $22,500(+16%)

- Business Account : $16,000 (+6%)

- SAVINGS ACCOUNT : $6,000

- Other Corp Account : $75,000 (+400%)

- 2016 Truck Paid For : $35,000 (-12%)

- Flip Property : $350,000

- Building Lot: $350,000

Consulting Business: $60,000- Principal Residence:$750,000

Liabilities: $715,000 (+74%)

- Principal Residence Mortgage : $0 Paid in Full

- Building Lot Mortgage: $275,000

- Wife’s Car Loan: $30,000

- Line Of Credit Used to Buy Consulting Business, RRSP and Flip Property: $410,000 (+310%)

- MasterCard: $0

Total Net Worth: $1,069,500(+1.8%)

With the help of the crazy real estate market we did it – Million Dollar Journey accomplished! It really is a strange feeling but in the big picture, nothing has changed. No one in

your life really cares lol. My wife and kids don’t love me anymore than before, but there is something inside that feels fantastic. I remember when I found this blog in 2007 I was so jealous of FT’s commitment. I never thought I would be able to follow him along the way. I have to say that being part of TEAM MDJ has truly changed my life and helped me achieve my goals that at one time were only dreams. Now it all seems easy moving forward because I have done the work on the front end (mortgage free) and not spending everything I make (sadly this is the norm in the real estate industry). It really has been super simple. Work hard and don’t spend it all. Saving becomes addictive once you see the results. Just like getting up to go to the gym in the morning (at least that’s what my wife tells me).

Update:

Suffered my first major setback on this journey. The consulting business that I recently purchased didn’t pan out and as such, I had to walk away from it. I haven’t finished my taxes yet to know exactly how much it cost me but regardless, it was the time invested that was the biggest loss (approx 40k).

With the Setback I have learned some valuable lessons:

- You only have one butt for each seat. Juggling multiple businesses that require your daily attention to any degree is extremely taxing mentally.

- As much as you think your existing business is on autopilot if you take your eyes off of it slowly things will begin to deteriorate and it will cost you clients and money.

Now that I have got my life back I am as focused as ever to continue to excel in my current profession. Everything I make is currently savings so I’m hoping to have this $500,000 goal ticked off by 2019. We are expecting approximately $70,000 tax return due to the massive amount that we have put in RRSP’s and have maxed out what we can do this year before we start putting ourselves in a reduced tax rate.

The property we purchased to renovate and sell should be closed before 2018 and all of that is going against the LINE OF CREDIT which we plan to get rid of asap.

As this will be my last update of 2017, I’m looking back over the year and it’s been a whirlwind. I can honestly say that I have never worked harder in my life trying to juggle it all and I’m hoping not to go down that road again in 2018. I’m hoping to be more focused on my goals and hammer away selling real estate only and allowing myself some free time mentally.

I’d also like to share that I’m surprised to say that even though we reached our million dollar goal I still struggle staying committed every day to our financial future. Reaching the $1,000,000 mark wasn’t the relief I thought it would be and I’m prepared that when I meet my next goal it will be the same story.

I’ve learned financial freedom is a lot like keeping your weight in check:

- Spend less than you earn; eat less than you burn; focus on the number you want (bank account and scale); don’t lose the faith; and, it doesn’t happen overnight.

Again thanks to all for your comments and kind words. I hope my story in some way helps you reach your goals. MDJ has definitely kicked me in the butt to get me where I am today. Bring on the $500,000 portfolio!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Congrats Karl. Its a big accomplishment to hit the $1M mark.

Would you have advise for someone in your shoes a few years back?

I am an accountant but I want to switch into real estate investing. I bought 3 properties all in the GTA a few years back and now I am planning to go into development and build. Would you recommend entering the market at this point or delay it by a few years until all the regulatory changes crystallize?

One question, what happened to your 2nd mortgages? Do you still hold them?

Yes. My 2nd mortgage came due so I rewrote it inside my wife RRSP.

Congratulations on reaching the million dollar club.

And good for you for being able to bring in $300K/yr and still continue to hustle for more. We bring in $400K/yr and plan to double it again in the next 5 years. You can’t save/invest what you don’t have!

About the failed consulting business, don’t beat yourself up too much. It’s ok to try and fail, but it’s not ok to fail to try!

FT, good job on helping the MDJ team members graduate/reach the goal! Btw since you have reached your $1M goal, what’s your new goal? You should form a new team based on that and invite us to join you :-)

Thanks for the encouraging words. The consulting thing was an awesome experience now that it is behind me. In the infinite wise words of Joe Rogan “Failure is more important then you successes because you learn more”

I truly believe that really will regret only the things you didn’t try, not the things that you fail at.

So what happened to the consulting company? Did you sell it or was the 60K asset value a complete write off? Now that you’re no longer involved in it, what was it? I’m trying to figure out what kind of consulting business would require a 60K buy in and have no residual value a year in.

Are the flip property and building lots held in the corporation? I would think they’d have to be since any gains are taxed 100% income (if held personally) unless you are doing absolutely nothing to them.

The RRSP refund is nice. Make sure claiming it all this year is the best course of action. You can defer some of the claim to later years so as to hit it against your highest marginal tax rate income.

Great to see that RRSP grow so well.

If you have your wife’s car loan as a liability, you should have something down for the corresponding asset (even if it may be below the loan amount). You have a value listed for your truck, so clearly you consider vehicles an asset (even if a depreciating one). I think that’s the correct methodology.

Nobleaa,

I hold all the properties corporately mostly for liability reasons as much as taxation.

In regards to the wifes car you are 100% correct. I try to keep it simple really for noone other then myself. I have other stuff like ATVS and trailers that offset it so I just kind of leave it at that.

The $500,000 RRSP is going to be awesome!! That being said it takes me everything I have to stay on track daily.

That major figure of $1,000,000. It is definitely quite the milestone, and something to be proud of. Keep on trucking towards $2,000,000!

I am curious … the assets listed, for the real estate, are they for current market value of the property, or estimated value after selling (especially in relation to the Flip property)?

it is always interesting to see how people in the financial world include or choose not to include property in net worth – I have seen it done both ways. In your case, with your penchant for investment properties, it would make no sense to do it other than how you have above. Regardless, well done.

James,

All figures for the real estate are conservative values after deducting expenses in selling. I don’t factor the tax implications in at this point because there are so many moving parts that it would get too confusing. The flip property is currently sold for $370,000 as an example. The figures get worked out when they hit the bank accounts. (This must drive all the analytical readers crazy!!! :)

Congrats, but I have to say I am more impressed with FT’s accomplishment doing it in NL, vs you doing in the GTA with 300k family income.

@Andrew, interesting thought. Can you elaborate?

No housing bubble in NL like that seen in Toronto. Toronto is lousy with housing millionaires.

If I’m not mistaken, your (FT’s) household income was not $300k/yr, either. A family can easily live on $80k (quite comfortably), leaving $80k+ in after-tax income that can be saved. My perspective is shame on any family earning this income for now becoming financially independent.

Andrew,

I would agree I’m impressed by FT’s accomplishments as well.

Congrats on reaching the Millionaire status Karl. It’s a great accomplishment. I pretty much had the same feeling when I reached my Millionaire net worth status late last year. Nothing had really changed except for having an extra digit in your net worth.

From a motivation point of view, it’s definitely a game changer for me when I reached the $1M net worth mark. I am more motivated to work even harder to reach my long-term financial goals. I am also more focused on working smarter and investing my money more efficiently.

I discovered that once you’ve built a certain level of wealth and have the financial knowledge and know how you can leverage that wealth to work even harder for you to earn passive income. Hopefully, the passive income will be able to one day replace your main source of income so that working for money will be optional.