Net Worth Update July 2011 (+1.69%) – Rising Rates Edition

Welcome to the Million Dollar Journey July 2011 Net Worth Update – Rising Rates Edition. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014). If you would like to follow my journey, you can get my updates sent directly to your email or you can sign up for the Money Tips Newsletter.

Let’s start off with interest rates. With extremely low interest rates since the credit crunch to stimulate the economy, real estate in Canada has been booming and the stock market has been rising. However, relatively cheap money is likely to come to an end, at least according to Mr. Carney who sets the overnight rate policy. I thought we’d see higher rates sooner, as low rates can only last so long before inflation starts to heat up.

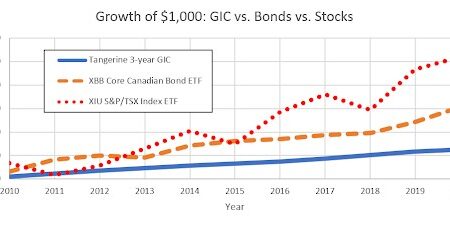

What do higher rates mean? On the bright side, we’ll see higher interest rates for savings accounts/GICs/fixed income and an even stronger Canadian dollar (not good for some, but good for vacations to the U.S!). On the down side, debt is about to get more expensive. From mortgages, lines of credit to fixed loans to margin trading accounts.

For us, we carry a relatively low amount of debt but it will make our investment loan a little more expensive. I’ve calculated that prime will need to reach about 7% (currently 3%) before the dividends will stop being sufficient to cover the interest. However, that is more of an abstract exercise as the HELOC interest pays for itself. For those of you unfamiliar with what I mean, we capitalize the interest on the investment loan.

This months increase was again due to savings and gains in investment accounts. Our RRSP and TFSA reported organic growth this month due to the rising market. There was quite a large jump in our non-registered account due to some volatile “play” stocks while other gains have been captured through trading. There has been some interest from readers in knowing what exactly is in my RRSP which I will dedicate a full post in the coming weeks.

On to the numbers:

Assets: $ 633,848.00 (+1.54%)

- Cash: $4,500 (+0.00%)

- Savings: $48,000 (+9.09%)

- Registered/Retirement Investment Accounts (RRSP): $119,900(+1.61%)

- Tax Free Savings Accounts (TFSA): $32,000 (+2.56%)

- Defined Benefit Pension: $35,200 (+1.15%)

- Non-Registered Investment Accounts: $29,300 (+8.52%)

- Smith Manoeuvre Investment Account: $73,200 (+0.27%)

- Principal Residence: $291,748 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $65,700 (+0.25%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $65,700 (+0.25%)

Total Net Worth: ~$568,148 (+1.69%)

- Started 2011 with Net Worth: $505,800

- Year to Date Gain/Loss: +12.33%

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

@Maverick: Sounds like you’ve got your own plan that works for you. Based on your net worth, you’re definitely doing something right so kudos to you.

Regarding owning physical gold and silver, I currently don’t own either but it’s in my plans to acquire some at one point.

My first preference would be to buy 2 to 3 1oz. bars of gold followed by adding physical silver at a later date.

From a personal standpoint, I have a difficult time determining whether or not gold & silver should occupy space in my overall portfolio at all, but as I accumulate more assets, I want to diversify into other areas.

I am looking to have some physical gold by the end of 2011. I prefer physical gold rather than the actual stocks. ScotiaMocatta is a good place to shop for it and you can purchase it online: http://www.scotiamocatta.com/

All the best,

TWC

@Frugal & @The Wealthy Canadian: Thanks! Yeah I’ve been thinking about the MERs and will have to look at how well the funds perform compared to the index or other funds with lower MER…I hold a couple that are fairly higher, but have yielded above average returns in the past, and some are Corporate Class so gains are tax sheltered…I also have some very low MER Dividend Funds and Mthly Income Funds from the big banks…haven’t tried ETFs or anything like that…maybe something I should look into, but I just dont have the experience to play stocks or funds that trade on the exchange…

@AcesHigh: I’m a telecoms consultant, so the $200K is also funding other stuff that an employee would take for granted, ex: health benefits, insurance, pension/RRSP matching, vacation and sick days, etc etc…

BTW, what are your opinions on owning physical silver? A friend of mine believes it is totally undervalued given the price ratio differential to Gold and the fact that it has many industry uses whose demand far outweighs the above ground supply availability….plus with all this volatility with the US$, Euros etc…maybe it is not a bad idea?

thx.

@Maverick: I totally agree with FrugalTrader in that you may want to check out what management fees you are paying on those mutual funds. They are likely taking a chunk out of your returns.

Hey Maverick,

Just wondering what you do for a living – $200k a year is pretty good for 34!

@Maverick, first, congrats on building a high net worth at a young age! I’m not going to recommend investments, but one thing you might want to consider is treating all of your accounts as one giant portfolio. Keep your bond allocation in alignment with your risk profile, and review the MERS charged on those mutual funds.

Hi there, I have been looking at your site on and off and am thinking it might be worthwhile for me to get some opinions from others who are undoubtedly way more knowledgeable than me when it comes to investing. I’ve been kind of lucky and haven’t fared too bad myself, but choosing the right investments haven’t been easy and I have trouble taking the leap into some of these types of investments (ex smith manoevere etc). I turn 34 this Sept and also have a goal to “retire” by 45…figure I need anywhere from $3-5 million to generate enough income to live on and given it has to hopefully last a long, long time, plus want to leave some to the kids (2 & 5 and one more on the way) and plus have to account of future value of money, so we shall see if that age is realistic or not. Our earning potential is around $300K (wife and me, but that will dip to $200K when she stops working from next year). I’ll give you a quick snapshot of my assets and then have some specific advice I would like to ask at the end:

Assets:

– House: $400,000 (paid off in full in 2009)

– RRSP: $190,000 (me & wife invested in Mutual Funds)

– Defined Pension: $52,000 (me & wife invested in Mutual Funds)

– RESP: $26,000 (invested in Mutual Funds)

– Stocks: $21,000

– Insurance: $13,000 (Investment portion of Universal Life in an Index A/C)

– TFSA: $31,000 (me & wife going from cash to Mutual Funds biweekly)

– Cash CDN: $65,000

– Cash US: $142,000

Total: $940,000

No liabilities, i.e. own all my cars outright, no credit card debt etc etc…

Was wondering what I should do with the Cash that I am sitting on currently ~ $207K esp the US$ portion…getting killed on the conversion so want to keep it in US for now. Also annual living costs are around 80K$ and I have to keep around $48K to pay into RRSP/RESP/TFSA every year, so part of the cash might go to that…was thinking realestate, but should I wait for the market to go down? Not sure if I should do more equities, currently at 60/40 split on fixed income and equities. Is 80/20 too aggressive given the timeframe? Is there anywhere else I can put my money? Any thoughts and ideas from anyone? BTW, sorry if this is the wrong area to post this type of message…

thx.

@ Graves, thanks for the kind feedback. As of right now, I plan on keeping the HELOC balance indefinitely. However, I may start paying down the balance a bit if it starts to creep over 50% of the limit, but I havent’ really decided yet. We will likely keep the investments for the long term, but pay down the HELOC with existing savings/cash flow.

Hi Frugal,

Great blog! I am 26 years old (and a fellow Eastern Canadian) and have been reading the site for the past couple of years. I have learned alot of great tips from your posts! Keep up the great work!

Just wondering about your HELOC. What strategy do you have to start paying this off? I know you are writing off the interest through your taxes so it is not very urgent. I assume you wouldnt be cashing out your Smith Manoeuvre investment account to start paying this down. Do you have a goal for when you would like to have this down to 0? Sorry if you have answered this 1000 times over already. Thanks.

^ Most banks are willing to do prime + 0.5@ on helocs now. Our net worth went down this month for the first time I started tracking it.

Great stuff. You do such a great job on your net worth updates.

I totally agree with you that it seems as thought interest rates are poised to rise in the coming months. I would like to see GIC rates go up, that’s for sure, but on the flip side, I am enjoying prime + 1 on my home equity line of credit.

Congratulations on your positive growth. Awesome stuff.