Feb 2010 Net Worth Update (+1.54)

Welcome to the Million Dollar Journey February 2010 Net Worth Update.

There was a small market correction in late January/early February but the market is still as resilient as ever bouncing back above the 50 day moving average. As a result, my portfolio numbers remained status quo.

The biggest financial move this month was that I finally opened a TFSA for myself. Late last year, I opened a TFSA for my wife but never got around to opening one under my name. However, I put some extra cash that I had and opened a new trading account. Now all I need is to sit down and determine what to invest in as my accounts are in 100% cash. Ideally, I’d like to purchase income producing REITs, but they seem a bit frothy at the moment. Hopefully we’ll get both accounts maximized by the end of the year.

As some of you know, I plan to pay off the mortgage by the end of 2010,or at least close to it. If you take a peek at the numbers below, you’ll notice that my savings amount is greater than my mortgage balance.

The question you’re probably asking is why not take the savings and pay it all off? The reason is I’d like to ride the low interest environment a bit longer as my current mortgage rate is P – 0.75%.

Our scheduled bi-weekly payments, which are topped up, should bring the balance down to almost zero on its own by the end of the year. After I file my taxes and sort out taxes owning (calculated behind the scenes), I will use the savings to max out the TFSA’s.

On to the numbers:

Assets: $ 503,050 (+0.99%)

- Cash: $4,500 (+0.00%)

- Savings: $31,500.00 (+6.78%)

- Registered/Retirement Investment Accounts (RRSP): $76,300.00 (+0.00%)

- Tax Free Savings Accounts (TFSA): $8,000 (+60.00%)

- Defined Benefit Pension: $28,300.00 (+0.54%)

- Non-Registered Investment Accounts: $15,200.00 (+0.00%)

- Smith Manoeuvre Investment Account: $54,000.00 (+0.56%)

- Principal Residence: $283,250 (+0.00%) (purchase price adjusted for inflation)

- Vehicles: $2,000 (2 vehicles) (-20.00%)

Liabilities: $78,800.00 (-1.87%)

- Tax Liability: $3,000 (-0.00%)

- Principal Residence Mortgage (readvanceable): $22,100.00 (-6.75%)

- HELOC balance: $53,700 (+0.19%)

Total Net Worth: ~$424,250.00(+1.54%)

- Started 2010 with Net Worth: $399,600.00

- Year to Date Gain/Loss: +6.17%

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker can prove useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of my wife’s defined benefit pension. I basically take the semi annual statement and add the contribution amounts on a monthly basis.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

FT,

Well done… another positive month for you. February was a negative month due to an investment gone wrong in HND/HNU. Our NW was down 1.19% primarily due to that.

Hey Frugal,

Might I suggest 50% in XIU and keep the rest ($2500) in cash for now?

Equities should climb in 2010 and XIU has a moderate yield. I know you won’t put your money in anything you’re not comfortable about (which is always good!)

http://www.tma-invest.com/files/portfolio_contruction/CDN_Large_Cap_60_fund_factsheet.pdf

http://cxa.marketwatch.com/tsx/en/market/quote.aspx?symbol=XIU

REI.UN or HR.UN aren’t bad choices for the long run, although they’ve been up and down lately and I’m personally down a little bit since my HR.UN TFSA purchase a month+ back. I still believe HR.UN is a great long-term hold because of the company’s stability and its distributions. Once that get that Bow building in Calgary occupied with Encana, distributions should increase…

Development Highlights…H&R REIT is currently building The Bow, a two million square foot office building in Calgary’s downtown financial district. EnCana Corporation has head-leased the entire office tower and all underground parking spaces on a triple-net basis for an initial term of 25 years.

Cheers!

canucktuary / Gary Caric

National Bank bought out all of Canadian Tire’s mortgages earlier this year (I had one). I even got a $450 gift card to Canadian Tire (not sure the rationale behind that one). CT still offers GICs, credit cards and that type of thing though….

Good to always see a positive gain for you FT!

I just opened my first TFSA as well, but only putting the minimum in each month in order to not have an effect on my savings.

My monthly Net worth increase for Feb. is +5.10%. It’s obvious I won’t be able to keep these high % Networth increases every month, seeing as my goal is to double my Net by next summer. But I try to save 10% more each month, sure keeps me busy.

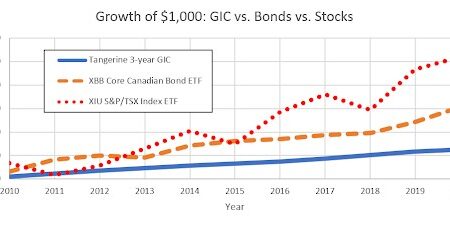

Financial Cents, be careful about the posted 4% yield on the XBB and XSB Bond ETF’s (broad market and short-term respectively).

Might be useful to listen/read to the Morningstar review/video on these that was posted a couple of months ago.

As the holdings of these ETF’s mature and are reinvested, the yield is going to go down, at least in short term.

Having said that I like these funds and own them both.

…Doug.

@Barry,

Seems XRE has a moderately high MER, compared to other ETFs (0.55%) and given the fact you could own almost 50% of the traded fund by directly buying and holding REI.UN and HR.UN.

I think either REIT would be a good hold in your TFSA.

Great job Frugal, keep that net worth growing! Ours increased 3% last month, mostly due to mortgage paydowns.

Any ideas on what you’re going to put into your TFSAs?

Which REIT? REI.UN or HR.UN perhpas?

What about an XBB or XSB ETF? Yields are about 4% on those right now.

Cheers!

Financial Cents, still unsure as to what to invest in within the TFSA. I’m 100% cash right now.

Canucktuary- Think maybe you should tell Canadian Tire that because I just received my Statement from them today(and the Canadian Tire Logo was there and when I called them with regards to your comment, they said that your statement was not true?????). I was not addressing “Mortgage” services but “Interest Rates” on savings as listed in the latter part of the article under “Savings”

Gary – Canadian Tire dropped their financial services department earlier this year. It is likely that your mortgage has been picked up by another firm.

Made the same comment in the past Canadian Tire Financial Services offers rates considerable better than the ones you are using, as I USE to use them as well.

The Plus is that it is a Canadian Corporation unlike ING, and PC Financial is just a dressed up CIBC