Best Canadian Dividend Stocks – April 2025

As we look ahead to April and May, our 2025 Best Canadian Dividend Stocks list has been updated to help your portfolio weather the economic storm caused by tariff uncertainty.

For example, while the TSX 60 and S&P 500 are down 3% and 6% respectively over the last month, slow and steady Fortis is up over 2% – plus it just keeps paying those ever-increasing dividends!

If you’re new to our top dividend stocks list, I update this list each month, and focus on the following four key metrics:

- Dividend Yield

- Dividend Growth Consistency

- Earnings Per Share

- Overall Company Revenues

Click here to jump straight to my top 10 dividend picks for April 2025.

As we look ahead to what 2025 has in store, I think we could be in for a very volatile year. Trade wars combined with sky-high valuations mean that stock prices could vacillate quickly. In uncertain times, the set-it-and-forget-it nature of Canadian dividend stock investing really shines.

When other investors are running for the hills or looking for non-existent “momentum trends” to jump on, dividend investors can rest comfortably as they look at their barely-moved quarterly profit numbers.

Given the strong earnings picture, and continued inflation moderation, Canadian dividend stocks look very attractive for the long term.

FT

You’ll see that many of the Canadian dividend picks below are in stable industries such as banks, insurers, pipelines, and utilities. I love these companies because they have such high barriers to entry. Good luck creating a pipeline from scratch in Canada these days!

Truthfully, I have no idea what artificial intelligence is going to mean for every company around the world. I think that it’s probable big companies like RBC and CNQ will figure out ways to get 3-5% more efficient using various types of AI to focus on more targeted marketing, getting more production out of fewer employees etc. That said, I don’t know where some of these bolder “10x” predictions are coming from.

Consequently, I think the trends from the second half of 2024 are a good bet to continue into 2025. In the latter half of last year we saw Canadian blue chip stocks outperform the Nasdaq tech darlings.

In fairness, the big tech companies in the US have been on an incredible run, and are great companies – you just have to pay a very, very, high premium to buy a piece of them right now. Canada’s best dividend stocks aren’t valued nearly as high. While it’s possible we see a sideways market for a few years, those 4%+ dividends are likely to just keep rolling right along!

Mike Heroux over at the Dividend Stocks Rock platform confirmed what my instincts were telling me in regards to interest rate movements and current events at his last free webinar. As my go-to source for dividend info, I highly recommend checking out Mike’s Pro services as it makes organizing these dividend watchlists so quick and easy. For a limited time, MDJ readers get a 33% lifetime discount – your price will NEVER go up.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Best Canadian Dividend Stock To Buy Right Now

After several years of picking National Bank as our #1 dividend stock, there is little reason to move on given the fantastic results that the company has seen over the last few years. I will say that for the first time in a while, I’m starting to see little cracks in the investment armour of the National Bank case.

First and foremost, there is simply the fact that the company’s P/E ratio is up around 12.5 at the moment, and the rapid price increase has dropped the dividend yield to 3.45%. Neither of those numbers is super scary, but they don’t exactly scream “buy” to me either, since the valuation is substantially over its long-term average.

The other news story that has me a bit worried is the re-emergence of the sovereignty discussion in Quebec. I think this is likely a 2026 story, but the market is often ahead of the news on these things. While I think any sort of serious discussion about Quebec leaving Canada is still a long shot, it’s a massive tail risk for a company based in Quebec. So, while I still love NB, my 2025 Canadian dividend stock pick is going to be the boringly-excellent company of Sun Life.

The insurance company has solid geographic diversification around the world, and that partly hedges the risk from being overexposed in any one market. Higher interest rates are generally ok news for insurance companies, and I don’t think we’re going to see as much rate-cutting as some of the experts are predicting.

I also really like the fact that Sun Life is a major player in the wealth management game. (Don’t get me wrong, I’d never recommend an insurance company as a wealth manager, but from an investment perspective, those high fees combined with an aging population are a great source of profits.)

Sun Life had a pretty good 2024, as it was up 23% or so (while paying out that nice 4% dividend yield). That said, its direct competitor Manulife posted a return of 50%+, and is now a much higher-priced company in essentially the same business model. IFC is another comparable insurance company with a much richer valuation. It seems pretty straightforward to me to suggest that Sun Life and its lower P/E ratio plus higher dividend yield have more room for growth.

March 31 Update: Sun Life isn’t blowing anyone right now – but as a life insurance company with business all over the world, it’s much less exposed to tariffs than National Bank or other Canadian banks are. With the banks down by double digits so far this year, my stock pick looks mediocre at the moment – but has avoided the worst-case scenarios.

Of course, knowing what we know now, going with the most-boringly stable of all Canadian dividend-payers (like Fortis) might have been the move in 2025, as it increasingly looks like a year that will be dominated by recession talk and tariff wars.

Good to Know:

Don’t only focus on dividend yield. A very high dividend yield can actually be a warning sign! If a stock’s yield is significantly higher than its historical average or sector peers, it could indicate financial trouble, a potential dividend cut, or a falling stock price. Our best high yield stocks in Canada goes into that in more detail.

Our Top 10 Canadian Dividend Growth Stocks (April 2025 Updated)

Here’s a look at our top 10 long-term Canadian dividend stocks in order of their dividend increase streak.

Ticker | Sector | Div Streak | Dividend Yield | 5yr Revenue Growth | 5yr EPS Growth | 5yr Dividend Growth | Payout Ratio | P/E | |

Fortis | FTS.TO | Utilities | 51 | 3.84% | 5.55% | -3.04% | 5.47% | 74.53% | 19.98 |

Canadian National Railway | CNR.TO | Industrials | 28 | 2.49% | 2.70% | 3.76% | 9.47% | 48.07% | 19.90 |

Canadian National Resources | CNQ.TO | Energy | 23 | 5.31% | 11.22% | 4.66% | 23.30% | 73.62% | 15.35 |

Telus | T.TO | Communications | 20 | 7.88% | 6.66% | -14.31% | 6.69% | 233.03% | 30.79 |

Emera | EMA.TO | Utilities | 18 | 4.90% | 3.33% | -9.13% | 3.91% | 167.81% | 35.21 |

National Bank | NA.TO | Finance | 14 | 3.79% | 9.34% | 10.99% | 10.18% | 40.08% | 10.98 |

Alimentation Couche-Tard | ATD.TO | Business | 14 | 1.11% | 3.72% | 12.27% | 24.25% | 16.60% | 18.13 |

TD Bank | TD.TO | Finance | 13 | 4.81% | 6.67% | -5.46% | 7.14% | 86.14% | 18.31 |

Brookfield Corp | BN.TO | Finance | 12 | 0.67% | 5.50% | -28.67% | -5.02% | 104.65% | 184.72 |

Sun Life | SLF.TO | Finance | 8 | 4.11% | -6.29% | 3.64% | 9.06% | 61.50% | 15.45 |

?????? (Hidden, click for access) | (Hidden, click for access) | ?????? (Hidden, click for access) | ?? | ?.??% | ?.??% | ?.??% | ?.??% | ???.??% | ??.?? |

For my full 32-stock list of Canadian dividend earners that I’m buying today – as well as the 74-stock list of US Dividend all stars that I recommend – check out the platform that I personally use to do my dividend stock research.

Note: Data on this article updates periodically. If you are looking for real time data and guidance, read our recommendation below.

Good To Know:

When evaluating dividend stocks, also consider Dividend Payout Ratio. This ratio indicates the percentage of earnings a company distributes as dividends. A lower ratio suggests that the company retains more earnings for growth, which can be a positive sign for long-term investors.

Up to Date Dividend Stock Data & Picks

The easiest way to keep up to date with the best dividend stock picks, is by signing up with Dividend Stock Rock. DSR is not just a weekly newsletter with stock picks. It’s a program that will help you manage your portfolio and improve results using unique and sophisticated tools.

The person behind DSR is Mike, the most prominent and active dividend stock blogger in Canada and is a certified financial planner since 2003.

You can first read our detailed DSR review, or sign up now by clicking the button below. Our readers are eligible for an exclusive 33% off discount using code MDJ33.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Canadian Earnings Per Share vs Dividend Growth in 2025

Because I’m looking to invest in Canadian dividend stocks for the next several decades, I like to look at medium- and long-term trends when it comes to the company’s earnings and their dividend growth. These metrics tell me two important facts:

1) Is the company generally making more money each year?

2) Does management believe in rewarding shareholders with dividend increases on a consistent basis?

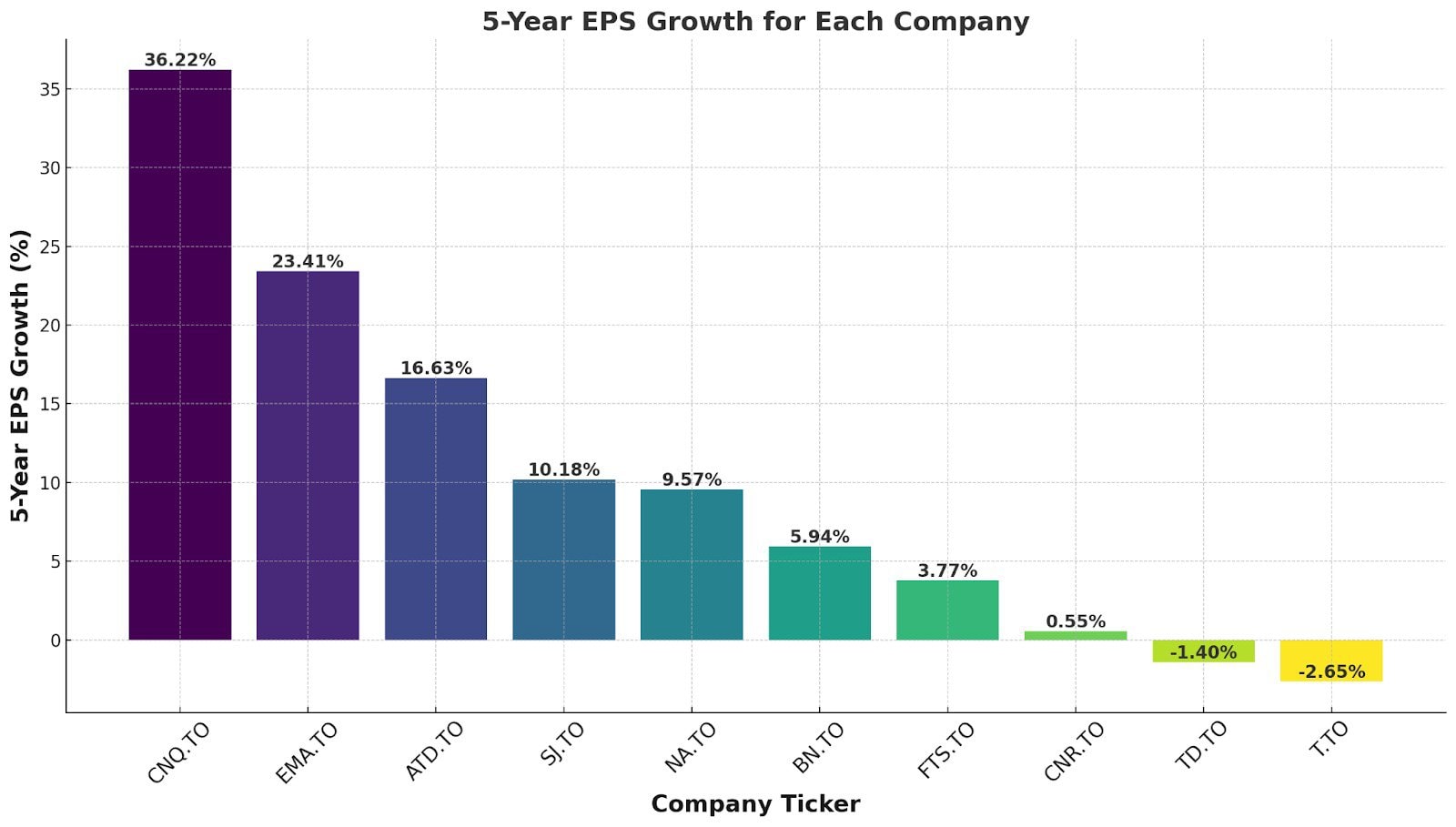

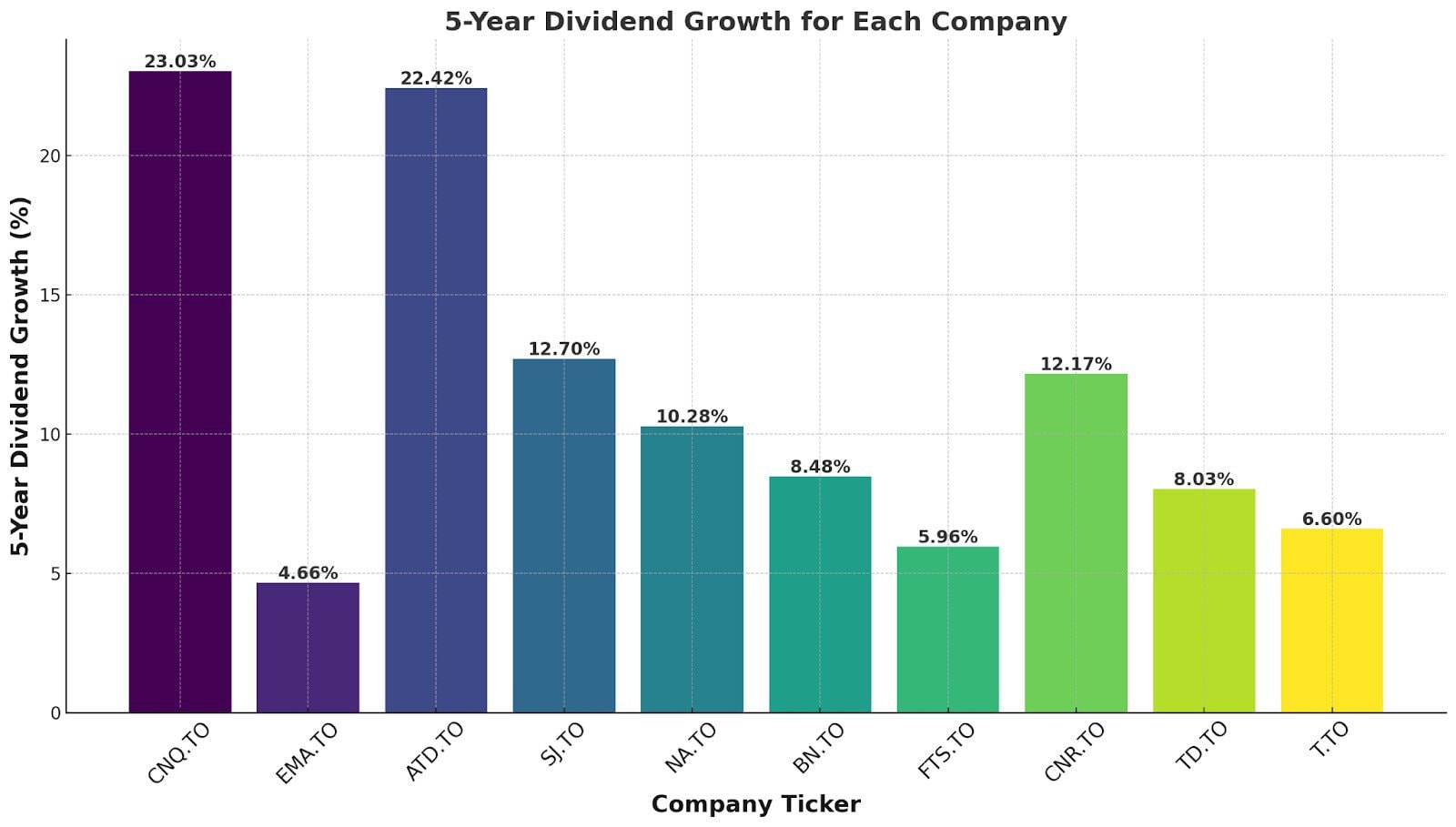

Here’s a look at how our top Canadian dividend stocks stack up over these two metrics (click each image to view in full size).

Now of course, 5-yr dividend growth and 5-yr earnings growth are not the only criteria that matters. It has to be taken in context.

For example when we look at the two charts above, the following facts jump out at me:

- CNQ has obviously benefitted big time from increased oil prices the last few years. This likely isn’t sustainable over the long term.

- ATD has been an earnings beast given that they’re a retail stock built for steady long-term growth. There’s a reason why this is Mike’s favourite stock.

- EMA, SJ, NA, BN, and FTS have the earnings growth to support their aggressive dividend growth policies.

- CNR, TD, and Telus, all bear closer scrutiny. Higher interest rates and large capital expenditure costs have weighed on the earnings of CNR and Telus over the past few years. Those expenses should go down, and the assets should continue to grow earnings – but they’re definitely on my “close watch” list.

- TD is another story entirely, and despite their short term earnings missteps (which are substantial), I simply believe their competitive moat in Canada’s banking oligopoly, as well as their conservative payout ratio give me reason to delay panic… for now. As interest rates come down, TD will need to prove that they can increase earnings sooner rather than later.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Rogers, Bell, Telus Stocks in 2025

The inclusion of Telus (T) in our Top 10 Canadian Dividend Growth Stocks chart obviously indicates that we’re big fans of the Canadian telecommunications sector.

That said, 2024 was obviously a really rough year for these companies. This was mostly due to 4 major issues:

1) Telecom companies are like pipelines and utilities in that they require HUGE upfront capital investment – and then they gradually get paid over a long time period. Think about how much it costs these folks to dig up ground all around Canada and put new fibre optic cables in the ground, as well as new towers. It’s a huge expense – and they have to borrow money to fund that building. All of that borrowed money has an interest cost, and with interest rates up, that interest cost has really cut into profit margins.

2) The switch to 5G has just been a massive expense – without any payoff. Five years ago, Rogers, Bell, and Telus decided to make the big investment into building 5G networks thinking that when those networks were done, they could charge more for phone plans. That value just hasn’t been there. Instead, they’ve all spent big – with no increase to revenues.

3) Increased competition between the telecom oligopoly (likely due to the Shaw merger and Quebecor expansion) has led to a 20% cut in cell prices in Canada.

4) These companies have all invested in traditional cable TV to some degree. That revenue stream is obviously going to continue to trend downwards given the mainstreaming of cord-cutting.

Now, while those 4 points are undeniably true, they are also priced into the current share prices. I would argue that with capital spending now wrapping up as far as 5G goes, and interest rates going downward, profit margins should begin to fatten up again. I think we’ll see profit margins start creeping up again in 2025, and investors will begin to flow back into these dependable telecom companies.

At the end of the day, the fundamental strength of these three large telecommunications companies (Telus, Bell, and Rogers) stems from the fact that they have a stranglehold on the very profitable Canadian market. While the three companies are not noted for aggressive growth plans, the overall growth of the Canadian population should ensure stable growth for the foreseeable future. Telus continues to be my low-risk favourite stock to own out of these three based on their positioning in Western Canada, as well as their non-core activities in tele-health.

Name | Ticker | Price | Dividend Yield | Payout Ratio | P/E | Market Cap |

Telus | T.TO | 19.69 | 8.07% | 251.01% | 32.08 | 29.98B |

BCE Inc. | BCE.TO | 33.1 | 11.84% | 176.69% | 365.72 | 30.78B |

Rogers | RCI.B.TO | 41.83 | 4.60% | 123.20% | 15.43 | 23.88B |

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

My Top Canadian Dividend Stock Recommendations

Sorted in order of dividend streak:

Fortis (FTS.TO) – 51 Years of Dividend Growth

- 3.84% Dividend Yield

- 5.55% 5 Year Revenue Growth

- 5.47% 5 Year Dividend Growth

- 74.53% Payout Ratio

- 19.98 P/E

Investment Thesis:

Fortis invested aggressively over the past few years, resulting in strong and solid growth from its core business. An investor can expect FTS’ revenues to continue to grow as it continues to expand.

Bolstered by its Canadian based businesses, the company has generated sustainable cash flows leading to nearly five decades of dividend payments. The company has a five-year capital investment plan of approximately $20 billion over the period of 2022 through to 2026. Only 33% of its CAPEX plan will be financed through debt, while 61% will come from cash from operations.

Chances are that most of its acquisitions will happen in the US (which I’m a fan of at the moment). We also like the company’s goal of increasing its exposure to renewable energy from 2% of its assets in 2019 to 7% in 2035. The recent market downtrend offers a great entry point at the current price level.

Dividend Growth Perspective:

Management increased its dividend by 6% like clockwork for the past 5 years and has declared that it expects to increase dividends by 6% annually until 2026. We like it when companies show motivation for growth through acquisitions and reward shareholders at the same time.

After all, Fortis is among the rare Canadian companies who can claim to have increased their dividend for 50 consecutive years. Fortis is a great example of a “sleep well at night (SWAN)” stock.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Canadian National Railway (CNR.TO) – 28 Years of Dividend Increases

- 2.49% Dividend Yield

- 2.70% 5 Year Revenue Growth

- 9.47% 5 Year Dividend Growth

- 48.07% Payout Ratio

- 19.90 P/E

Investment Thesis:

CNR has been known for being the “best-in-class” for operating ratios for many years. CNR has continuously worked on improving its margins and was among the first to do so. Today, peers have caught up and all railroads are managed in the same way. CNR also owns unmatched quality railroads assets.

It has a very strong economic moat as railways are virtually impossible to replicate so we can therefore count on increasing cash flows each year. Plus, there isn’t any more efficient way to transport commodities than by train.

The good thing about CNR is that an investor can always wait for a down cycle to make an investment. We can often spot a good occasion around the corner since we see railroads as attractive investments.

Finally, the cancellation of the Keystone XL pipeline will drive demand for oil transport via railroads and CNR has benefitted. Management is being challenged, and we should see more growth emerging from this challenging period.

Dividend Growth Perspective:

Railroad maintenance is capital intensive and could adversely affect CNR in the future. It is a difficult balance to obtain an efficient operating ratio and well-maintained railroads. Continuous (and substantial) reinvestments are required to maintain its network.

However, CNR continues to boast one of the best operating ratios in the industry. CNR’s growth could also be negatively impacted from time to time as it depends on Canadian resource markets. When the demand is low for oil, forest, or grain products, demand for CNR’s services will obviously slow accordingly.

We saw how quickly the winds can shift the last couple of years. For example, the pandemic caused a slowdown in weekly rail traffic of about 10% over the summer of 2020. When the oil price is low, trucking steers some business away from railroads. CNR is a captive of its best assets since you can’t move railroads!

Canadian National Resources (CNQ.TO) – 23 Years of Dividend Increases

- 5.31% Dividend Yield

- 11.22% 5 Year Revenue Growth

- 23.30% 5 Year Dividend Growth

- 73.62% Payout Ratio

- 15.35 P/E

Investment Thesis:

In a world where the West Texas Intermediate (WTI) trades at $70+ per barrel, CNQ is a solid investment. If it gets back to $90 per barrel it’s an excellent investment – but I don’t see we’re likely to see those days for a while.

With the WTI price of oil trading around $70 lately, CNQ is likely to produce good-not-great returns. That said, the company has been ruthlessly focused on efficiency over the last few years, and has stated their breakeven WTI price is now down to $35. That’s the sort of safety margin I like to see!

What cools our enthusiasm is the strange direction oil has taken along with the fact that oilsands are not exactly environmentally friendly. Many countries are looking at producing greener energy and electric cars. This could slow CNQ’s ambitions for the long term.

However, CNQ is very well positioned to surf any oil booms. The stock price has more than doubled in value since the fall of 2020. It has previously invested very heavily, and it is now generating higher free cash flow because of past capital spending.

CNQ exhibited resilience in 2020, and this merits a star in their book! If you are looking for a long-term play in the oil & gas industry, CNQ appears at the top of our list at DSR.

Dividend Growth Perspective:

On top of an impressive dividend growth streak of over 20 years, CNQ has recently shifted gears with highly generous dividend increases (28% at the beginning of the 2022, a special dividend, and then another increase of 13% in late 2022!).

CNQ has proven the resilience of its business model and confirmed its ability to be a strong dividend grower. This is truly impressive. Now that the oil market has strengthened, CNQ should be able to generate healthy cash flows for years to come.

Telus (T.TO) – 20 Years of Dividend Increases

- 7.88% Dividend Yield

- 6.66% 5 Year Revenue Growth

- 6.69% 5 Year Dividend Growth

- 233.03% Payout Ratio

- 30.79 P/E

Investment Thesis:

Telus has grown its revenues, earnings, and dividend payouts on a very consistent basis. Telus is very strong in the wireless industry and is now tackling other growth vectors such as internet and television services.

The company has the best customer service in the wireless industry as defined by their low churn rate. It uses its core business to cross-sell its wireline services.

The company is particularly strong in Western Canada. Telus is well-positioned to surf the 5G technology tailwind. Finally, Telus looks to original (and profitable) ways to diversify its business. Telus Health, Telus Agriculture and Telus International (artificial intelligence) (TIXT.TO) are small, but emerging divisions that should lead to more growth going forward.

Dividend Growth Perspective:

This Canadian Aristocrat is by far the industry’s best dividend payer. Telus has a high cash payout ratio as it puts more cash into investments and capital expenditures.

Capital expenditures are regularly taking away significant amounts of cash due to their massive investment in broadband infrastructure and network enhancement. Such investments are crucial in this business. Telus fills the cash flow gap with financing for now.

At the same time, Telus continues to increase its dividend twice a year, exhibiting strong confidence from management. You can expect a mid-single digit increase year after year.

Emera (EMA.TO) – 17 Years of Dividend Increases

- 4.90% Dividend Yield

- 3.33% 5 Year Revenue Growth

- 3.91% 5 Year Dividend Growth

- 167.81% Payout Ratio

- 35.21 P/E

Investment Thesis:

Emera is an interesting utility with a solid core business established on both sides of the border. EMA now has $32 billion in assets and will generate annual revenues of about $6 billion. It is well established in Nova Scotia, Florida, and four Caribbean countries.

This utility is counting on several green projects consisting of both hydroelectric and solar plants. Between 2022 and 2025, management expects to invest $8.4 to $9.4B in new projects to drive additional growth. These investments decrease the risk of future regulations affecting its business as the world is slowly making the shift toward greener energy sources.

Most of its CAPEX plan (about 70%) will be deployed in Florida, where Emera is already well-established. In general, Florida offers a highly constructive regulatory environment; in other words, EMA shouldn’t have any problems raising rates. This is a “sleep well at night” (SWAN) investment.

Dividend Growth Perspective:

Emera has been increasing its dividend payments each year for over a decade. With the purchase of TECO, energy management intends to uphold this tradition. The company forecasts a 4-5% dividend growth rate through to 2025 while targeting a payout ratio of 70-75%.

At a 4%+ dividend yield, this is a keeper for several years. Don’t be fooled by the high payout ratio as the adjusted earnings exhibit a payout ratio of approximately 80%, including recent dividend growth. This is the type of company that fits perfectly in a retirement portfolio.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

National Bank (NA.TO) – 13 Years of Dividend Growth

- 3.79% Dividend Yield

- 9.34% 5 Year Revenue Growth

- 10.18% 5 Year Dividend Growth

- 40.08% Payout Ratio

- 10.98 P/E

Investment Thesis:

My personal #1 pick for 2022, 2023 and 2024!

NA has targeted capital markets and wealth management to support its growth. Private Banking 1859 has become a serious player in that arena. The bank even opened private banking branches in Western Canada to capture additional growth.

Since NA is heavily concentrated in Quebec, it concluded deals to provide credit to investment and insurance firms under the Power Corp. (POW). The stock has outperformed the Big 5 for the past decade as it has shown strong results.

National Bank has been more flexible and proactive in many growth areas such as capital markets and wealth management. Currently, NA is seeking additional growth vectors by investing in emerging markets such as Cambodia (ABA bank) and the US through Credigy.

We wonder if it can achieve more success than BNS on international grounds. It seems like they may have found the right formula to do so! This is one of the rare Canadian stocks having a near-perfect dividend triangle.

Dividend Growth Perspective:

National Bank is still highly dependent on Quebec’s economy. As a hyper-regional bank, NA is more vulnerable to local economic events. To date, this has not affected the bank significantly, but we advise to keep track of its provisions for credit losses.

Recessions and rising interest rates could also affect the bank’s debt portfolio. Capital markets’ revenues are also highly volatile. NA could experience a bad quarter if the stock market becomes bearish.

Overall, the bank has performed very well, but it usually takes a little more risk to find growth vectors (such as the ABA bank investment and capital markets). So far it has paid off, but it does not mean it will always be this way in the future. Keep in mind that investments like the one in Cambodia are unpredictable and could shift very fast.

Alimentation Couche-Tard (ATD.B.TO) – 14 Years of Dividend Growth

- 1.11% Dividend Yield

- 3.72% 5 Year Revenue Growth

- 24.25% 5 Year Dividend Growth

- 16.60% Payout Ratio

- 18.13 P/E

Investment Thesis:

In the long-term, dividend payouts should grow in the double digits, and investors should see strong stock price growth. ATD’s potential is directly linked to its capacity to acquire and integrate additional convenience stores.

Management has proven its ability to pay the right price and generate synergies for each acquisition. ATD exhibits a solid combination of the dividend triangle: revenue, EPS, and strong dividend growth.

The company counts on multiple organic growth vectors such as Fresh Food Fast, pricing & promotion, assortment, cost optimization and network development. It has also proven that it has anticipated the shift to electric, and is ready to profit from that model as well.

While Couche-Tard generated big headlines in the second half of 2024 with its proposed acquisition of the 7-Eleven empire, that deal doesn’t look like it will be completed in 2025. That said, ATD has repeatedly shown that it knows when to walk away from the acquisition deal table and continue to make solid smaller-scale purchases. Look what they’ve done since their big merger with Carrefour didn’t go through. I expect more disciplined growth by acquisition in 2025 and 2026.

Dividend Growth Perspective:

In the long-term, dividend payouts should grow in the double digits, and investors should see strong stock price growth.

ATD’s potential is directly linked to its capacity to acquire and integrate additional convenience stores. Management has proven its ability to pay the right price and generate synergies for each acquisition. ATD exhibits a solid combination of the dividend triangle: revenue, EPS, and strong dividend growth.

The company counts on multiple organic growth vectors such as Fresh Food Fast, pricing & promotion, assortment, cost optimization and network development.

Toronto Dominion Bank (TD.TO) – 13 Years of Dividend Increases

- 4.81% Dividend Yield

- 6.67% 5 Year Revenue Growth

- 7.14% 5 Year Dividend Growth

- 86.14% Payout Ratio

- 18.31 P/E

Investment Thesis:

TD had a tumultuous 2023 and 2024 where negative newspaper headlines definitely played a part in driving down the value of this stock. That beat up stock price is why I like the value in 2025. Long-term investors know that the bank enjoys number one or two market share positions for most key products in the Canadian retail segment.

In addition to Canadian retail though, what I continue to like about TD is that a third of its business comes from the U.S., including their stake in Charles Schwab from their TD brokerage merger back in the day.

I don’t think the Canadian banking sector is going to get hurt nearly as badly as people are predicting due to a slowing economy. Sure, TD’s days of gobbling up US banks are on hold for a while – but all the negative news south of the border has clouded just how much Canadian banking dollars continue to pour into TD’s coffers every month!

Dividend Growth Perspective:

TD is a Canadian dividend aristocrat (which permits them to have a “pause” in the dividend increase streak). TD shareholders were lucky enough to enjoy a dividend increase in early 2020 (+6.8%), right before regulators forced a break in dividend growth.

In 2021, the bank rewarded investors with a 12.7% dividend increase. It returned with a more regular increase in 2022 (+7.8%). In 2023, TD announced a 6.25% dividend increase at the end of the year. In 2024 we saw the bank raise the dividend 2.9%, bringing the yield to a sparkling 5.5%!

Going forward, you can expect a mid-single-digit dividend increase as payout ratios are quite low and TD is well capitalized. (That’s a fun way of saying that because they got out of a potentially-bad US acquisition of First Horizon Bank, they have a ton of cash sitting in their bank account. With further US acquisitions on hold, a lot of that cash will likely go to dividend raises and stock buybacks.)

Brookfield Corp – 12 Years of Dividend Growth

- 0.67% Dividend Yield

- 5.50% 5 Year Revenue Growth

- -5.02% 5 Year Dividend Growth

- 104.65% Payout Ratio

- 184.72 P/E

Investment Thesis:

I’ve been a bit tentative when it comes to the Brookfield family of companies, as it can be quite difficult to really dig into their quarterly statements due to their size and complexity. That said, their past results and unique corporate structure have ensured access to billions of dollars in liquidity to finance its projects.

Brookfield is estimating alternative allocation to increase to 60% by 2030, from 25% today, so it’s definitely a lower-risk way to make a renewables play. It’s a huge company that is present in many countries demonstrating high growth potential for years to come and a diversified business foundation. Over the last few years, BN has witnessed an increase in both the number and size of average client commitments.

Brookfield Corporation will not only do the asset-light manager’s job (strategy + earning fees on AUM), but it will also contribute with its own assets. Therefore, it can benefit from its strategies by selling those assets at a profit in the future.

Asset recycling happens when a company sells assets it deems to be at a high value (e.g. good time to sell) to reallocate the proceeds into new projects or undervalued assets. This is the classic “buy low, sell high” concept.

Basically, Brookfield is a classic example of “corporate synergy” where they can profit at multiple points in a project’s development – all while offering unique expertise and simple all-in-one packaging to potential clients. At the current price-to-book of 1.35x, this looks like a great bet for 2024, but of course, it might take slightly longer than one year for BN to pay off to the degree I think it will.

Dividend Growth Perspective:

After the spin-off of the original Brookfield Asset Management (BAM), it has become clear that BN is a relatively low-yield (less than 1%) stock with great growth expectations. We expect this dividend to increase each year and continue the aggressive dividend growth policy. However, if you are looking for a more generous yield, the original (BAM) is the better option.

BN has the advantage of owning a stake in various assets (across the Brookfield family) while BAM has the advantage of simply managing the money (and earning revenue on a fee charged on the assets under management).

Sun Life – 8 Years of Dividend Growth

- 4.11% Dividend Yield

- -6.29% 5 Year Revenue Growth

- 9.06% 5 Year Dividend Growth

- 61.50% Payout Ratio

- 15.45 P/E

Investment Thesis:

Sun Life is one of Canada’s large oligarchy of insurance behemoths. Its revenues come mainly from life insurance, group benefit plans, and wealth management. Its ability to cross-sell its older client base on high-margin financial products gives the company a reliable source of long-term income.

If interest rates stay somewhat higher than they have been over the last decade, that only helps the safety-first investment portfolios that insurance companies depend on in order to provide insurance payouts to customers.

Sunlife’s return on equity was up a scorching 23.8% in 2024, and that built on strong 16.6% growth in 2023. The current P/E ratio is very close to its long-term average (which you can’t say about many companies these days). It’s well positioned to weather any storms that come our way.

Dividend Growth Perspective:

After pausing its dividend growth policy between 2008 and 2014, management has been steadily increasing its dividend over the last eight years. The current payout ratio is pretty darn safe at under 60%, and I expect Sun Life to continue to raise their dividend by about 5% per year for the foreseeable future. The current yield of 4% is nothing to shake a stock at either!

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Canadian Dividend Stocks with 10 Years of Dividend Increases

The last few years have seen intense change and turmoil. First the pandemic caused widespread panic and made folks sell off their portfolios. Then we had meme-stock mania and a small bubble in certain markets. Finally, we’ve been dealing with inflationary effects over the last 18 months that have increased interest rates and led to smaller overall margins due to increased debt costs.

Throughout all of this, there are 38 companies in Canada that have just boringly raised their dividends year after year. Click below for the list of Canadian dividend growth stocks that weren’t shaken by the pandemic, bubbles, panic, inflation, or interest rates.

Canada’s 38 Dividend Growth Stocks

(Ten Years or More Dividend Increases)

Click below to find all the new additions to the previous top Canadian stocks. The following have been handpicked for their ability to face the economic lockdown and thrive going forward.

Dividend Investing in Canada – Frequently Asked Questions

“How do dividend stocks work?”

Simply put, dividends are the payment that businesses make to their owners after expenses have been paid for during a specific time period. Some companies produce yearly dividends, but most pay “quarterly” (every three months).

Most dividend-heavy companies (certainly all of the Canadian dividend stocks on the list above) announce their dividend intentions for the next year, and then split up their after-tax profit between dividends and retained earnings. The retained earnings are put back into the company in one form or another, while dividends are simply paid out to shareholders.

Companies can “slash” or cut their dividend whenever they wish – there is no law saying they must pay out a certain percentage of profit or anything like that. Consequently, there is often an emphasis on long-time dividend growth stocks that have a proven track record of not only paying out dividends, but increasing them as time goes on, and thus rewarding shareholders.

“How is a dividend being paid?”

Dividends are paid to shareholders. They are paid out on a per-share basis, and for each share you own as an investor, you get paid a certain amount. This amount is most commonly expressed a percentage of the current price of a stock.

So for example, you might hear, “Enbridge currently has a dividend ratio of 8%.” This simply means that if Enbridge’s current stock price was $40, (.08 x 40 = $3.20) an investor would expect to earn $3.20 in dividends from Enbridge for the upcoming year. That $3.20 would likely come to them in four separate installments of $0.80.

Companies can also announce “Special Dividends” at any time. In this situation, there is a unique one-time payout to shareholders.

In order to qualify for a dividend you must purchase a share before the “ex-dividend date” – which is announced by each company fairly far in advance.

“How to buy dividend stocks in Canada?”

While you can still buy dividend stocks through the old fashioned telephone brokerage systems, the vast majority of investors now purchase dividends as DIY investors using their discount brokerage accounts.

At Million Dollar Journey, we have put together dozens of reviews and comparisons pieces destined to provide our readers with insights regarding the best Canadian broker for long term investing.

Good to Know:

Many Canadian dividend stocks offer DRIP (Dividend Reinvestment Plans), which automatically reinvest dividends into additional shares without paying trading fees. This can accelerate your portfolio growth through compounding.

Read about the most popular brokers like Qtrade and Questrade as well as robo-advisors like Wealthsimple and learn how to maximize your savings in that regard.

The other common way to get portfolio exposure to Canada’s best dividend stocks is through dividend-ETFs on the Toronto Stock Exchange (TSX). Using a dividend ETF provides your investment dollar with instant diversification to companies that have a strong dividend profile.

“When to buy dividend stocks?”

The honest answer is: “Any time you have the investing funds available to do so”. There are many folks out there who think that they can time the market and purchase stocks at the absolute perfect time. Despite that belief, there is very little evidence that this is true.

It’s also quite difficult to time when stocks are nearing the peak. Consequently, the most successful dividend investors that I’ve seen are folks who stick to a pre-planned strategy and simply invest their surplus funds as soon as they are able, into shares of dividend-payers that they have done their homework on and anticipate holding for the long term. We have a whole article dedicated to when is the right time to buy dividends stocks.

“When is the time to sell dividend stocks?”

If you are like Warren Buffett and buy stocks that, “You want to hold forever” – then the answer to when you should sell your dividend stocks is: Never! In practice, there are a few times over the past 15+ years when companies have significantly cut their dividend, and to me, this is a flashing red sign that something is majorly wrong with the company.

Cutting a dividend is usually seen as a last resort because it has such a dramatic effect on the stock price. Major shareholders hate the idea of sacrificing that cashflow – so when the decision is made, I usually sit up and take notice.

That said, I prefer to do my homework before purchasing any single stock. Consequently, I almost never sell my dividend stocks, because I am quite confident in their long-term growth. You can read my articles about Canadian dividend kings and beating the TSX for some specific suggestions.

The statistics around trying to jump in and out of the market just aren’t very good, and it really pays to be confident in your reasons for choosing a stock – so that you can not only hang on to your shares during tough times in the market – but also “Be fearful when others are greedy” and buy more shares of your favourite dividend stocks when prices are down.

“What are the best dividend stocks?”

Well, clearly if you’ve read this far into our article you know what our choices are for best Canadian dividend stocks! After years of personal dividend investing and research, I’ve come to the conclusion that the Dividend Stocks Rock way of judging dividend stocks by their “Dividend Triangle” is the best long-term way to value solid Canadian companies. The main idea is to equally weight a company’s overall revenues, their Earnings-Per-Share (EPS), and their commitment to dividend growth over the long term.

I used to simply look at dividend yield as the “be-all and end-all” of dividend investing, but Mike has convinced me over the years that your long-term dividend payouts and capital gains are more secure by focusing on the three metrics of revenues, earnings, and dividend growth.

Good to Know:

Not all dividend-paying stocks are Dividend Aristocrats! A Dividend Aristocrat is a stock that has increased its dividend for at least 25 consecutive years, while a general dividend growth stock may have a shorter but still strong history of increasing payouts.

“Are there tax benefits for dividend stock investing in Canada?”

Gaining income from dividend stocks is one of the most tax-efficient ways that you can put your

money to work for you. This is especially true at lower income levels (such as those that many retirees typically account for at the end of the year) when the dividend tax credit really shines.

If you’ve never heard of the dividend tax credit or the dividend gross up, here’s the basic idea:

1) There are actually two different dividend tax credits: the Provincial Dividend Tax Credit and the Federal Dividend Tax Credit

2) The reason for these tax credits is rooted in the idea of tax fairness. Because businesses pay corporate taxes before money is disbursed to shareholders, there is a process where your dividend income is “grossed up” and then a tax credit applied.

3) What this so-called “gross up + tax credit” often looks like in practice is that your income gets artificially inflated, but then a very generous amount of your taxes owing is cancelled by the government.

Here’s an example:

If I owned 1,000 shares of Enbridge (ENB) during 2020, and earned $3.20 for each share, then my dividend income would be $3,200.

Now, depending on what other income that I had, I would be placed in a specific tax bracket. Obviously I might have dividend income from other stocks, I might also have worked for a living and have earned income.

If I made $60,000 in earned income, and Enbridge was the only stock that I owned, then the following calculation would be made for my dividend income:

$60,000 of earned income would be taxed by the federal government at a rate of 0% on the first $13,000, then a rate of 15-20.5% on the rest. My $3,200 in Enbridge dividends would only be charged a tax rate of 7.56% after the dividend gross up and dividend tax credit were applied.

Looking at the provincial side of the equation. If I lived in Ontario, my $60,000 of earned income would be taxed at a rate of 0% on the first $10,000, then a rate of 20-30% on the rest. My $3,200 in Enbridge dividends would only be charged a tax rate of

For many retirees, who no longer earn a paycheque, it’s possible to actually experience a negative tax rate on the first $30,000 or so of dividend payments – less than a 0% tax rate!

Most Recent News on Canadian Dividend Stocks

Trump’s tariffs are dominating the news channels and investor sentiments right now. Even stable Canadian dividend stocks are not immune from this constant depressing drumbeat of a regressing economy.

There’s no doubt that all of the talk of “higher for longer” interest rates affected several of our top Canadian dividend stocks over the last couple of years. When you can get an ultra-safe risk-free GIC [See our Best GIC Rates In Canada] with an automatic 5.25% return, the risk-reward balance of Canada’s utilities, pipelines, or telecommunications companies didn’t look particularly attractive.

But now, with low risk investments only yielding 3% or less, those 4%+ dividend yields are starting to look juicy again.

Good to Know:

When interest rates rise, dividend-paying stocks may become less attractive compared to fixed-income investments like bonds. However, high-quality dividend growth stocks tend to outperform over the long term due to their ability to increase payouts even in tough economic conditions.

Year-in and year-out the 2-3% capital gain, plus 4%+ dividend yield (for a total return of 7-8%) can look a bit low next to the supercharged returns of tech stocks like Shopify or Constellation Software. But remember, dividend stocks don’t have crazy down years like those high-flyers back in 2022 .

It’s important to remember that these companies we are recommending have durable long-term competitive advantages.

For example, look how hard it has been to get a single pipeline built – along a previously-existing route – in BC. They aren’t building more pipelines, telecoms, utilities, or major banks in Canada. While telecom companies have been feeling a bit of a competitive itch over the last year, the long-term track record leans towards quite sustainably-high profit margins.

As a side note, I think that the rush to buy the US Dollar (and its appreciation against the Canadian Dollar) is actually really good for the Canadian economy.

What many people don’t realize is that while a weakening currency vs our most important trading partner (by far) is kind of a drag when it comes to planning holidays or importing goods, it’s incredibly valuable to our companies. Canadian goods and services are effectively getting priced at a discount right now. That’s going to help take away some of the sting when it comes to tariffs.

It also gives a boost to our financial companies and utilities that do a lot of business south of the border. These service-based industries look to completely be avoiding the trade war, and when they earn USD by providing services down in the States, those earnings look pretty nice when converted into Canadian Dollars.

As always, I place a lot of importance on dividend growth stocks, their overall revenues, and effective management that builds value. I remain rock-solid in my personal conviction for my portfolio. The advantages the companies hold are too durable, the current valuations quite reasonable, and they have simply proven themselves over and over again in all market conditions.

My Recent Dividend Track Record

I started making public dividend stock picks beginning in 2021. That year, I predicted that Canada’s midstream companies were getting way too much bad press and that their value was being driven down by the underlying price of commodities like oil and natural gas.

We thought there was a market inefficiency there as the pipelines only have a loose relationship between commodity prices and their profit margin. Our top Canadian dividend stock pick was Enbridge, and it has paid off quite well for us. We sold about 10% before the stock hit the top and haven’t added to our position since. It has consistently paid out an excellent dividend ever since.

More recently, my Canadian dividend kings pick for BOTH 2022, 2023, and 2024 was National Bank, and I’ve been very happy with its overall performance. So while my Sun Life pick (and its 4.14% dividend) isn’t looking superb early in 2025, it has held up better than most financials, and the majority of the broader TSX.

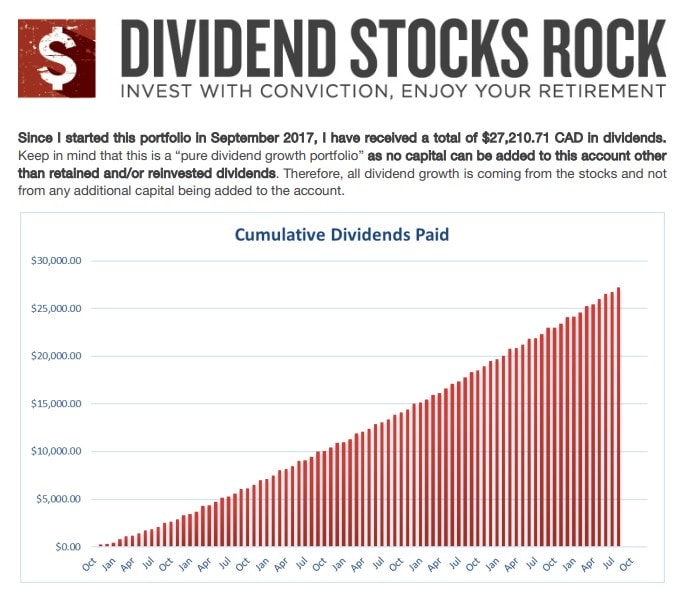

I’m stacking up well against the benchmarks, and I’m even beating my dividend buddy Mike Heroux for a couple of his portfolios. Here’s a cool look at Mike’s public dividend stock portfolio since he started the DSR service back in 2017 (and made his picks 100% public knowledge the entire way).

Further Research on Top Canadian Dividend Stocks

When it comes to building a consistent long-term income strea, my focus is usually on Canadian dividend growth stocks. But when I want deeper insights – whether it’s about U.S. dividend stocks, undervalued dividend plays, or sector-specific opportunities – I turn to Dividend Stocks Rock (DSR), run by Mike Heroux.

Mike and I have been in the personal finance space for about the same length of time (maybe that’s a nice way to say that we’re old), and he brings a unique perspective as both a CFA and former wealth manager. Over the years, I’ve subscribed to premium research tools like the Globe and Mail’s investment channels and widely respected newsletters like Morningstar – but Mike’s DSR service continues to stand out.

He’s not just an analyst; he’s an excellent communicator, breaking down complex dividend investing strategies into practical, easy-to-follow insights. Whether you’re looking for the best Canadian dividend stocks or need a data-backed strategy for international exposure, Mike’s got you covered.

I also appreciate how often Mike does webinars for his subscribers. During these exclusive online meetings he answers live questions from whoever shows up and really showcases his thorough knowledge in a way that I’ve never seen a columnist or newsletter writer do!

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

ATD.TO when does a growth stock cease being one ?

How does an UNDER 1.5% dividend put Stella Jones anywhere CLOSE to being on your list of “Best Canadian Dividend Stocks”.

It’s not all about the dividend – but total return as well Michael.

Thanks FT, Particularly enjoyed “Most recent news “

Any thoughts on what government policy towards transitioning from natural gas to electricity will do to companies like Fortis? (and to a lesser extent, pipelines and other oil utilities?) I’m wondering if they may no longer have as solid a future as once believed.

About 2 years ago, the City of Vancouver changed the building code to; no more heating of newly constructed homes by nat/gas. Apparently there is now a problem getting power turned on for occupancy due to BC hydro being overwhelmed. Allegedly, the City now has reversed their thoughts on no more nat gas for heating new homes!

Does Algonquin count as a eligable dividend for a non registered account? It pays its distributions in USD no? So is there the 15% withholding tax? Wondering about using it in a smith manoeuvre

No withholding tax. Buy it on the TSX and you’re good to go!

how does the pe ratio play ? what should we be looking at in a pe ratio

Thank you so much for the list ! what are your thoughts in regards to BCE and Telus payout ratio you think the dividends are safe even though they both are paying aprox 130% ?

New to this board. Just curious about the energy space further to Paul N and FT comments in Sept. I got burned in the downturn with energy (ie opportunity cost of holding a under-performing sector only to be hit by the coronavirus cyclical downturn that may last years). There is no question that the sector was cheap before the downturn, but thanks to the green folks, ESG investors, and the Canadian government, I am not sure that in the long term a proper multiple will ever return. I have no doubt that earnings and cash flow will return, as well as probably $100 oil due to chronic under investment, but it appears to me that these stocks – even SU and CNQ – are no longer buy and hold investments, but have become more like trades on the hopes of a large and quick spike in oil price. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the way investing is going. Ultimately the sentiment could spread to TRP and ENB despite stable outlook (I still hold the pipelines though).

Great updated list. I recently bought some more Fortis myself.

For some reason, I thought Savaria was like a Cannabis company… turns out it’s exactly the opposite of ‘sexy’ haha!

FT, will you make a post about your BTTSX picks for 2020?

I know that FT is planning to do that one in a few months Abad!

Hey Abad, as Kyle mentioned, I will be posting about BTTSX soon!