Best Stock Brokers in Canada

I’ve been using and reviewing Canadian online stock broekrs for over fifteen years now. (Yes, my very first look at Canada’s online broker options was in 2006, and was one of the first posts on Million Dollar Journey.) Between 2006 and 2021 online stock brokers users have really benefited from increased competition and constant innovation. Online brokerage mobile apps weren’t even a thing back in 2006. This benefited customers and Canada’s stock brokers today are much better than they were 10, 5 or even 2 years ago.

Best Online Stock Broker in Canada: Quick Comparison

Broker | MDJ Score | ETF Comissions | Trading Fees | Description | Promotion | Learn More |

Qtrade |

| FREE buying and selling of 100+ ETFs | $8.75 ($6.95 elite accounts) | Canada’s Best Overall Broker – Buy & Sell ETFs for Free, Best Online Platform, Low Cost, Superb Service | Up to $2,000 Cash Back | |

Questrade |

| Free BUY of ETFs (full trading prices apply to ETF sales) | $4.95-$9.95 | Runner Up Best Broker – Best Options Trading, Advanced Data Streams, Customer Service Lacking | $50 in Free Trades | |

BMO Investorline |

| FREE buying and selling of 80+ ETFs | $9.95 ($7.95 elite accounts) | Best Big Bank Brokerage – 80+ Free ETF Trades, Big Bank Convenience, Medium Cost | Up to $2,000 cash back (use promo code MDJCASH) | |

RBC Direct |

| $9.95 per ETF trade | $9.95 ($6.95 elite accounts) | Canada’s Biggest Bank, Good Mobile Platform, High Fees | None | |

TD Direct Investing |

| $9.95 per ETF trade | $9.99 ($7 for Active Traders) | Serviceable Platform, Good Convenience, High Fees | None | |

Scotia iTrade |

| $9.95 per ETF trade | $9.95 | Medium Cost, High ETF Fees, Good Convenience, Integrated Savings Account | None | |

Wealthsimple Trade |

| Free to buy and sell | $0 Trades | $0 Trades, Poor and Buggy Platform / App, Terrible Account Options, Depends on high-fee crypto trading to make money | $50 Free Signup Bonus |

Best 2022 Broker Promo: Up to $2,000 Cash Back Instantly On New Accounts

Open an account with Qtrade before March 1st 2022*, and get up to $2,000 in cash back.

This Qtrade offer is exclusive to MDJ readers – get it by using clicking the button below.

* deposit/transfer at least $15,000 in assets by March 31, 2022 ** Applies to both New and Existing clients who open a new Qtrade account by March 1, 2022 ***Qtrade promo 2022: more details

What is an “Online Stock Broker”? – Cutting Out the Expensive Middle Man

If you’re wondering what an “online stock brokerage” or “discount online stock broker” is then think of how people used to buy glasses. You used to go to the optometrist (eye doctor) or an expensive store and either choose from what was in stock or place a very expensive custom-made order.

These days online companies compete with one another to cut out the middleman and allow you to buy exactly the glasses you want – when you want – at a fraction of the traditional price.

An online discount brokerage (often referred to as an online broker) is simply an online trading platform that allows you buy and sell investments such as stocks, bonds, ETFs, and options. If you want the ultimate control over your own investment portfolio – and you want to slash fees to the absolute bone by cutting out the middleman – then you need to open a discount brokerage account.

This is of course much different from the old days when a bunch of dudes would gather around a counter in NYC, Toronto, or London, and yell crazy stuff at the top of their lungs while pushing reams of paper at an overwhelmed stock exchange employee. If you’ve watched old stock broker movies like Wall Street or Boiler Room then you’ve got the right idea. Investors used to pay HUGE money to phone in their orders, and have these middlemen yell them out at the right time.

It was a financial stone age.

You’ll see that all of our list of best Canadian online discount brokers features numerous contenders that allow you to buy & sell ETFs for free, and stocks for a very small commission. It used to be $30+ in order to post a single buy or sell order! The more money you save on commissions, the more of it can stay in your account and compound the growth of your nest egg.

TL;DR Our Best Online Stock Brokers for 2021

Determining the best online brokerage for your specific needs and tastes might take a little trial and error. We’ve done our best to quantify discount brokerages according to the user friendliness of their platforms, their trading fees, account fees, customer service, and current promotions.

After discussing amongst our editorial team, we cross referenced our conclusions with traditional media sources such as the Globe and Mail, and various online publications. We combed through hundreds of user reviews and saw what other Canadian personal finance sites had to say as well.

Qtrade Direct Investing – MDJ’s Top Canadian Stock Broker

After all of that anecdotal and quantitative research, we think that Qtrade is likely to be the best Canadian online broker for the most people in 2021. That said, as always, we’ll be paying attention to our comment boards and inboxes in order to implement any real-time feedback we get from the Million Dollar Journey community.

Don’t take our word for it… longtime Canadian personal finance veteran, Rob Carrick of the Globe and Mail says that:

No other broker is good in so many different areas and no other broker makes such consistent year-by-year improvements.

Their ability to innovate new aspects of their platform, as well as to flawlessly integrate these new ideas – all while keeping their fees amongst the lowest in Canada – mean that Qtrade has shown its best-in-class stripes over the long term.

In past years we have ranked Questrade slightly above Qtrade in our Canadian discount broker rankings, chiefly on the basis on their lower fees – and while Questrade certainly remains an excellent alternative, and a solid #2 overall option – we have decided that Qtrade has overtaken them this year based on the following criteria.

Million Dollar Journey’s Overall Rating: 4.8/5

Qtrade Direct Investing Pros:

- FREE buying and selling of 100+ ETFs

- Consistently rated #1 over the past decade

- Excellent Customer Service

- One of the best apps on the market

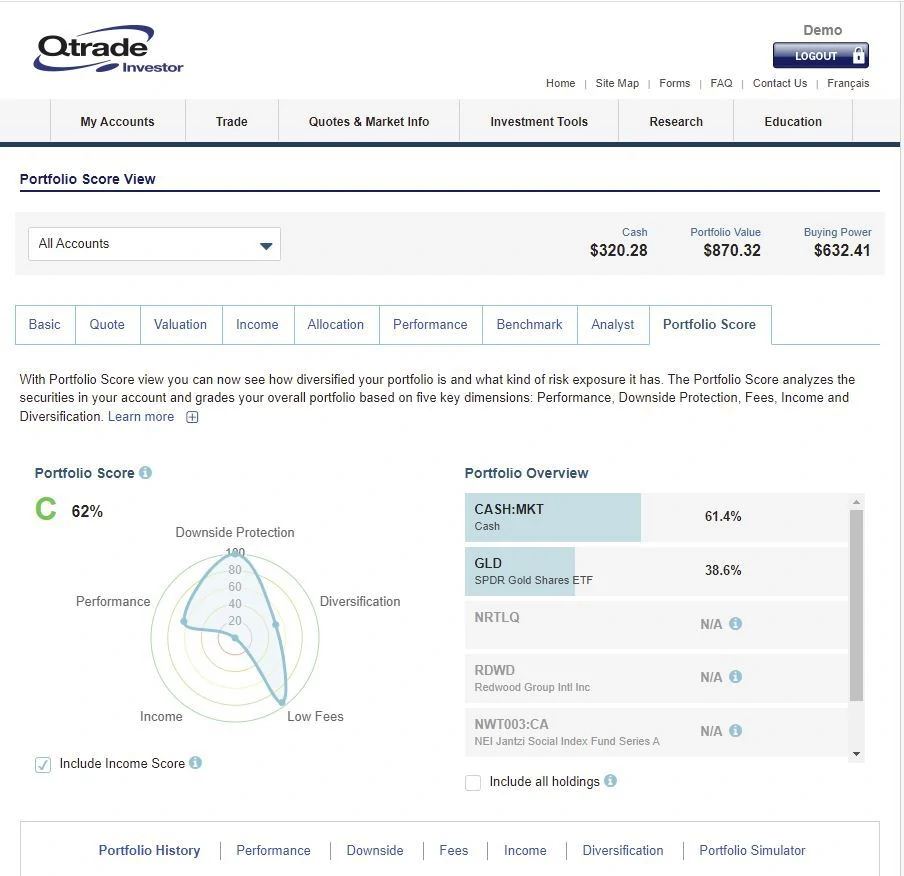

- Elite investor tools

- Ultra-easy account opening

- Globe and Mail’s #1-Rated Online Broker for 2021

- 50 free trades for accounts opened by December 31st 2021 – best promo offer in Canada (use promo code 50FREETRADES)

Qtrade Direct Investing Cons:

- Pesky inactivity fees (can be easily avoided)

- Not the cheapest trading fees in Canada for all instruments

Runner Up Canadian Stock Brokerage – Questrade

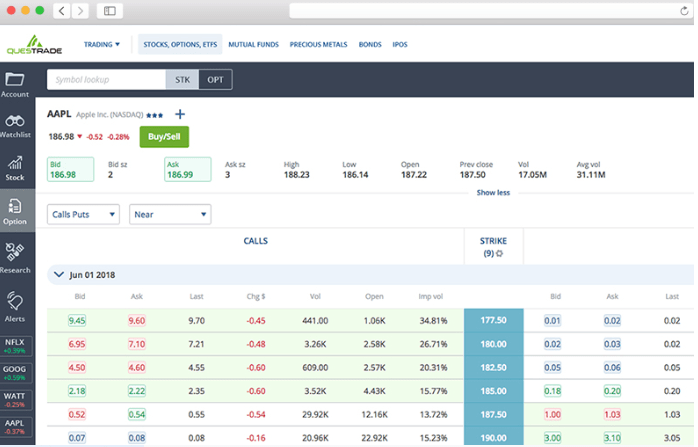

Questrade is a truly-usable discount brokerage that has amongst the lowest costs in Canada. Questrade charges a penny-per-share-traded (bought or sold) – but with a minimum of $4.95, and a maximum of $9.95. Personally, I’ve never bought more than 495 shares of a stock or unit of an ETF before – but I’d like to have an account big enough to try it some time.

There are no annual fees (no matter the size of your account, though there is an account minimum of $1,000) and no fees charged when you buy ETFs.

It’s not like the rest of the Questrade package is lacking something major, it’s simply a tribute to how far some of the other brokerages have come, that we no longer rank them #1. The Questrade app and website have seen tremendous upgrades in the last couple of years, and the vast majority of people that we have recommended Questrade to over the years have been quite happy with them.

That said, there is no doubt that customer service emerged as a weak spot for the quickly-growing company during the pandemic. Several of the writers on this website saw wait times of over four hours for both the online chat and call-in options. Emails went over a week between response times at various points.

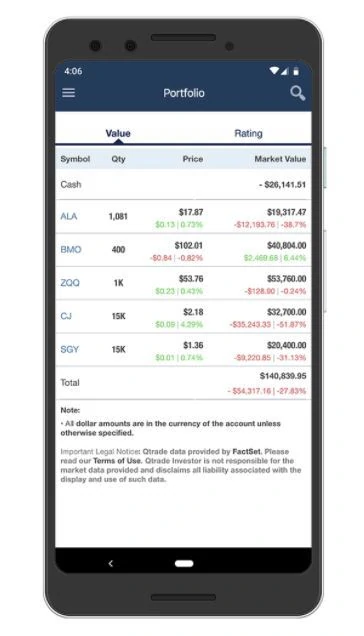

Of course, if you’re not the “customer service” type, and simply want access to a great platform at the lowest price – then Questrade makes a ton of sense for you. Check out our full Questrade Review for more information.

Mllion Dollar Journey’s Overall Rating: 4.4/5

Questrade Pros:

- No Fees To Build an ETF Portfolio!

- Very Low Trade Costs (ideal for building a dividend-heavy portfolio)

- $0 Annual Account Fees

- 24-Hour Paperless Account Opening

- Globe and Mail “A” Rating + Best DIY Brokerage Website

- Good Promo Offer

- Solid USD Trading Options

- $50 in free trades for new accounts

Questrade Cons:

- Better options online for those interested in doing in-depth analysis research on stocks prior to purchase

- Customer service rating took a real hit in 2020 – the main reason we now rank Qtrade ahead of Questrade.

- Only 2.9/5 app rating on Google Play – reviews mentioned delay in pricing on app vs desktop

Why did we decide to rank Qtrade above its primary rival, Questrade as #1 stock broker in Canada?

- During the pandemic, our MDJ inbox was filled with a constant flow of messages complaining about Questrade’s customer service standards. Wait times of 4+ hours for both phone and online chat options showed what the price of the lowest fees in Canada are. Qtrade on the other hand has consistently held the highest standards for their customer service according to our readers, the Globe and Mail, and Moneysense Magazine. For many Canadians this commitment to customer service makes a huge difference in their trust of a company.

- Qtrade’s free ETFs represent a nice little upgrade on Questrades “free to buy – but to not sell” ETFs.

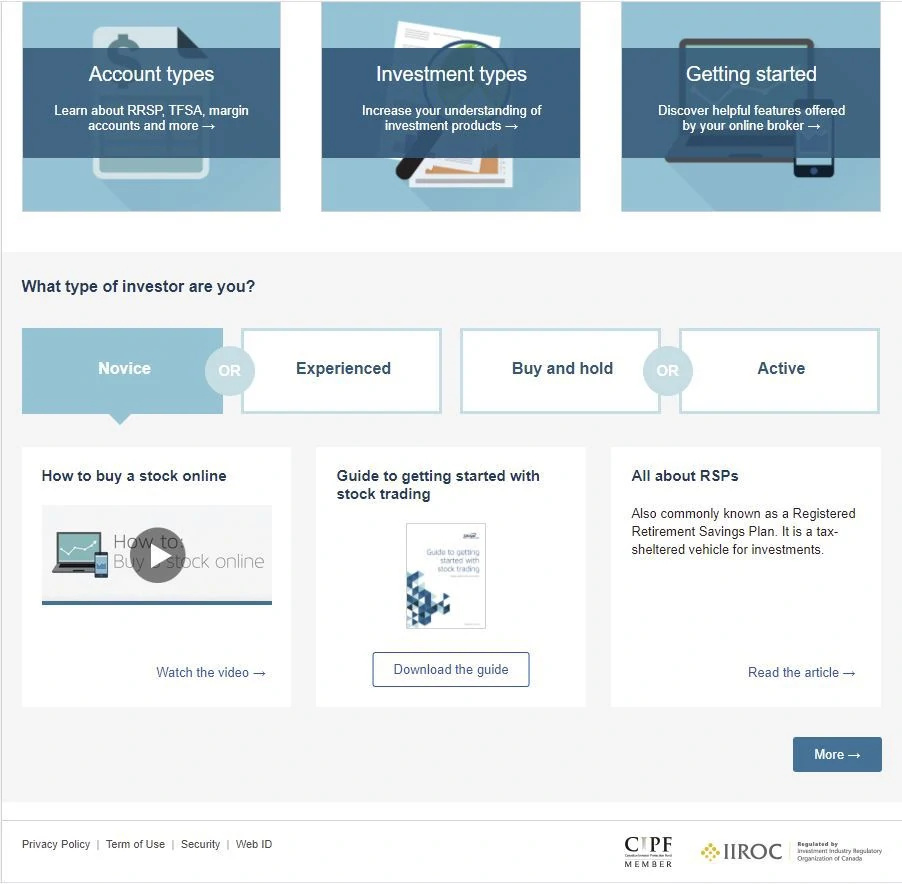

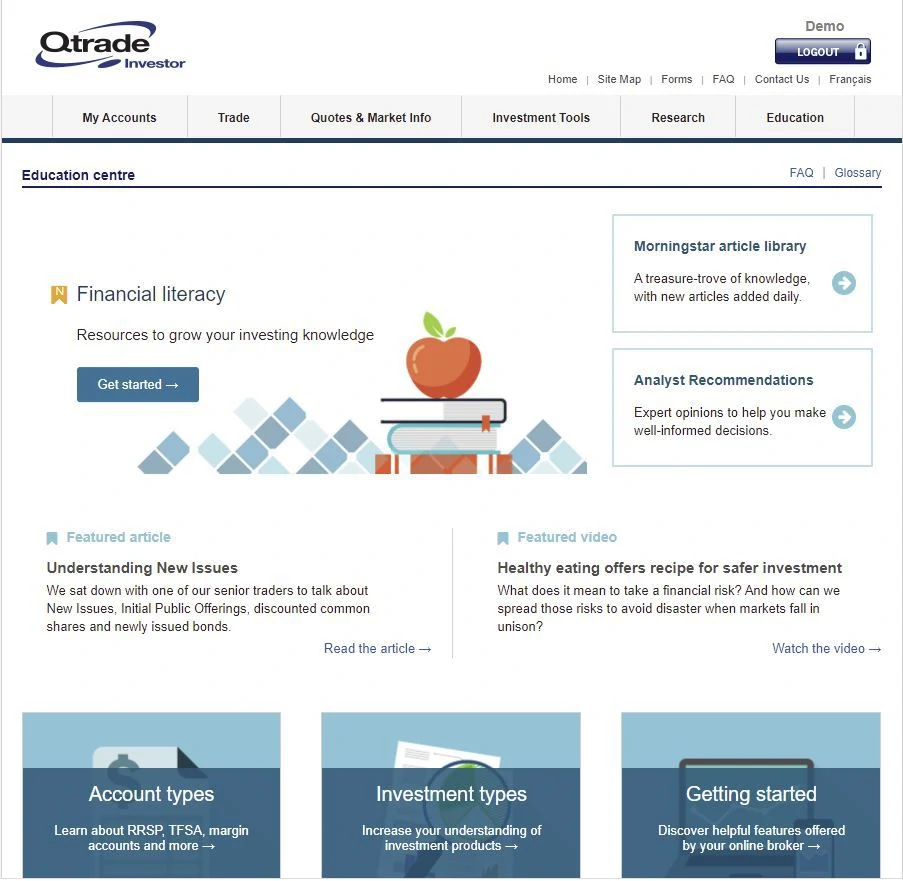

- Finally, we just think that Qtrade’s overall investor education package, combined with the app and desktop platforms they have refined give them a slight edge on what Questrade has put out there.

Qtrade isn’t the unchallenged leader in every single category – but they have no glaring weaknesses, and absolutely shine when it comes to free ETFs, elite customer service, and unparalleled access to information and education tools. See our in-depth Qtrade Review for more information, or this Questrade vs Qtrade comparison.

April 2021 Update: The newest edition of the Globe and Mail (with the help of Dalbar Canada) discount brokerage rankings just came out and once again ranked Qtrade as the best discount brokerage in Canada:

“Any broker can fill an order to buy stocks, exchange-traded funds, mutual funds, bonds and more. Qtrade helps you build a well-constructed portfolio and then monitor it to ensure it continues to work for you.” and, “They may be the king of steady year-by-year improvement.”

When they looked back at the market turmoil in 2020 and early 2021, Dalbar’s findings matched our own anecdotal evidence: Canada’s online brokers struggled with the increased demands put on their trading platforms. This confirms our own intuitive heavier weighting when it came to the customer service advantage that Qtrade enjoyed over their lower-cost competitor at Questrade.

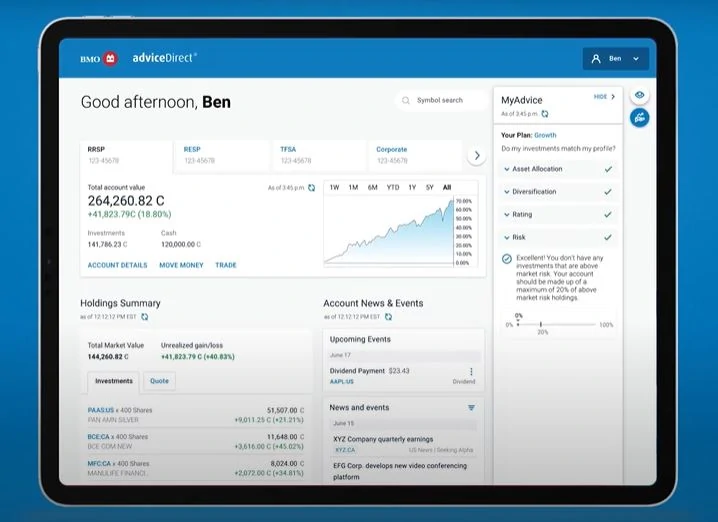

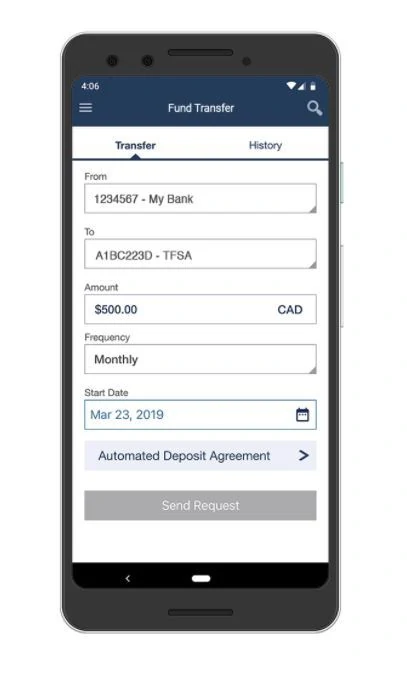

Most Convenient Big Bank Brokerage – BMO InvestorLine

Canadians love their big banks. Their names grace our sports stadiums, and many of us opened our very first bank accounts at their in-person locations – and then never looked back.

Here’s the thing – it can just be really really nice to have all your banking and investing in one place.

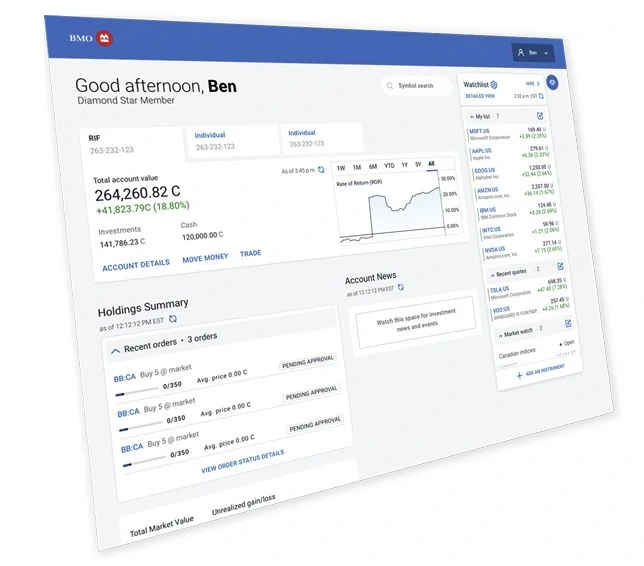

taken from BMO’s webiste

There is no denying that there is a bit of tradeoff when it comes to price – as BMO’s trading fees are higher than those of Questrade and Qtrade – but for many Canadians, a hundred or two hundred bucks a year in trading fee differences are simply worth it to not have to worry about mixups in transferring money or having paperwork with several different companies.

There is absolutely nothing wrong with deciding to be on one side of that tradeoff or the other! It’s simply a matter of being an informed consumer so that you can get the most value for your personal needs. In general, the bigger your investment account, the more leverage you have with your bank in other matters such as credit card fees or chequing account perks for example.

BMO Investorline brokerage made some big headlines in June 2021 when they introduced 80+ ETFs that are free to buy and sell. This made them the first big bank brokerage to embrace low-cost investing and decisively set them apart from their peers. The list is not packed full of niche limited-use ETFs either, but rather includes all of the Vanguard and BMO all-in-one portfolio ETFs, as well as the vast majority of ETFs that any Canadian would ever need.

Even before they fully differentiated themselves with this excellent offer (which is similar to what Qtrade and Questrade do for index investing clients) the MDJ editorial team rated BMO as the best brokerage account out of the “Big 5 Banks” due to their superior user experience and edge in investor education materials. It’s great to see BMO embrace low-cost investing like this, and should really benefit from the synergies involved with their in-house ETFs.

Million Dollar Journey’s Overall Rating: 4.4/5

BMO InvestorLine Pros:

- Best bank-owned broker

- One of the top online trading platforms

- Strong app

- 80+ FREE ETFs (both buying AND selling)

- Trust and reputation of 200+ years

- Great consumer education

- Up to $2,000 instant Cash-Back Promo on your first deposit – Use code MDJCASH

BMO InvestorLine Cons:

- Not as cheap as discount brokerages such as Qtrade or Questrade

- More suited towards large portfolios

Check out our full BMO Investorline Review for more information, or sign up by clicking the button below and using the code MDJCASH to enjoy our exclusive promotion.

Lowest Fees Canadian Stock Broker – National Bank Direct Brokerage

National Bank Direct Brokerage shook up the world in August of 2021 when they announced that they would be the first of Canada’s “Big Banks” to roll out commission-free purchases of not only ETFs, but also shares of Canadian stocks as well. This was a crafty move by NBDB, as the online broker has struggled to make any headway in the past, and this has garnered the a unique value proposition.

If per-trade fees are the be-all and end-all when it comes to what you need from your brokerage account, then National Bank Direct Brokerage is definitely worth a look. That said, there are several reasons why the broker perennially receives one of the lowest grades in Canada from many of the personal finance authorities.

NBDB does not have a mobile app of any kind yet, and its online platform leaves much to be desired when compared to the well-oiled machines that our top choices bring to the table. Finally, there are no real portfolio analysis tools or investor information sources available at NBDB, so it really is the “no frills” option when it comes to the Big Bank brokerages.

If you’re wondering how NBDB is going to make money if they don’t charge any fees, it’s important to point out that they will charge you a $100 account fee if you’re account is under $20,000, and that they will make money off currency exchange when you buy stock in US Dollars, and/or when you “buy on the margin” (borrow money from National Bank in order to make investments). So don’t worry about poor old National Bank – they’ll still do just fine!

Million Dollar Journey’s Overall Rating:

2.8/5

NBDB Pros:

- No Fee Trades

- Good bricks-and-mortar presence if you live in Quebec

NBDB Cons:

- No Mobile App

- No Portfolio Analysis Tools

- $100 Account Fee

- No Sign Up Promotions

- Poor Overall Platform Rating

- Onboarding Process is Labour Intensive

Other Canadian Online Stock Brokers

Even though Qtrade and Questrade are practically neck and neck for the title of the best online broker, and BMO represents the best compromise option when it comes to using a discount brokerage that Canadians are familiar with, that doesn’t mean they are the only viable choices. Luckily, we Canucks have plenty of good options available if you want to see if there is a better fit.

Read on to find out a little more about “the best of the rest”, including what we like and dislike about each of the other broker options in Canada. We also have detailed reviews for all of those companies which will be linked from the relevant part of text – so if you want to learn more about a specific one you can simply click the review link and get all the added info you need.

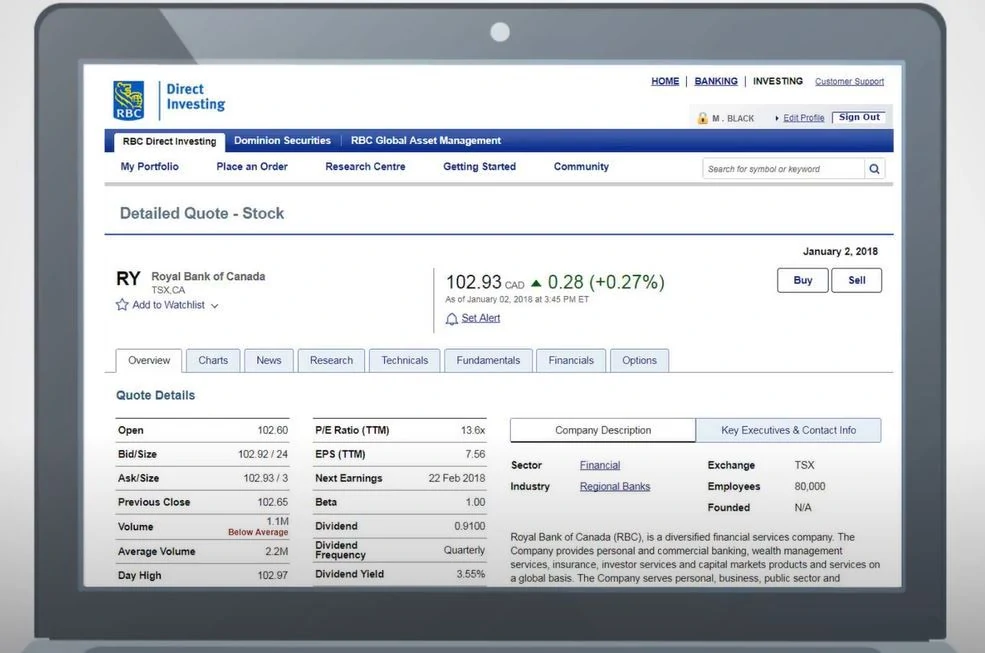

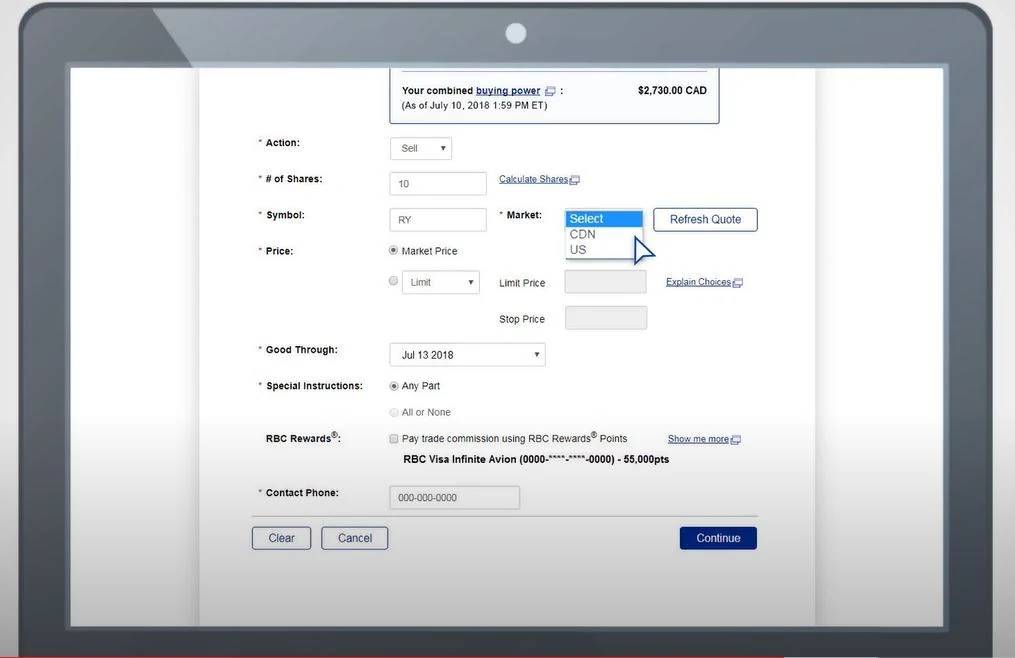

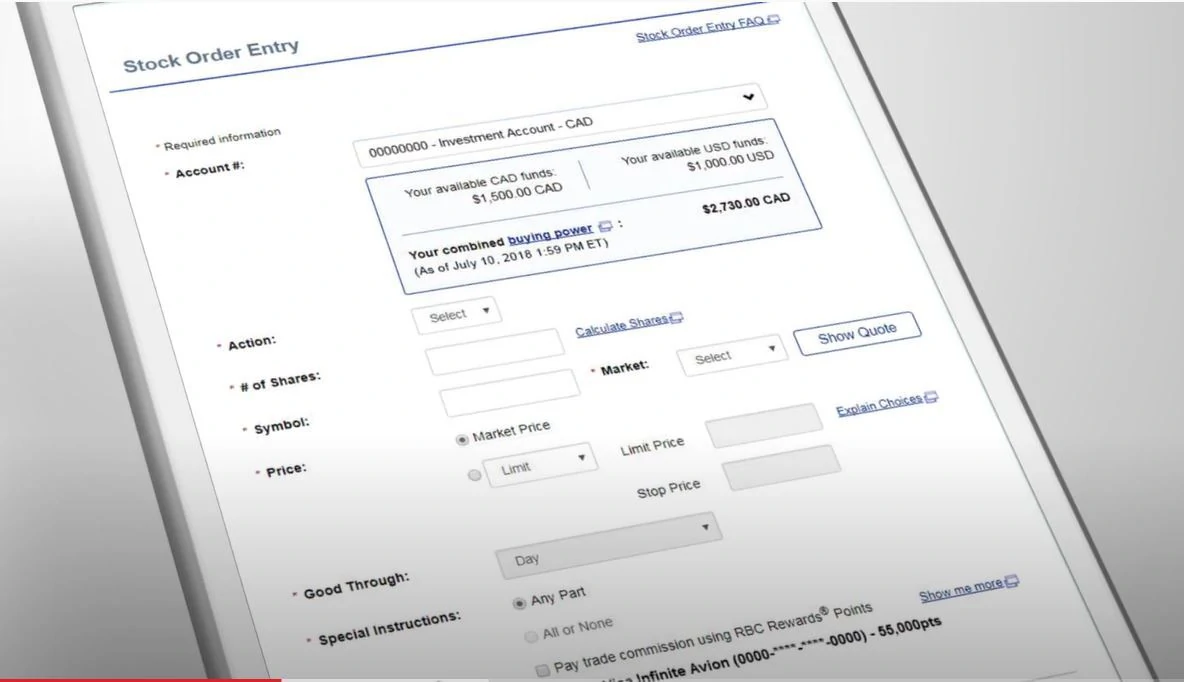

RBC Direct Investing – 2nd Best Mobile App (After Qtrade)

As mentioned above, all of the big banks trading platforms are quite comparable and could all be classified as ‘elite products’. The biggest upside is of course the fact that if you already bank with them, opening a brokerage account with a specific bank becomes easier and much more convenient. In that regard, RBC is no different.

RBC Direct Investing offers you the same trade-off as other big banks do – you pay higher fees and in return enjoy an excellent platform and a lot of account options to choose from. In RBC’s case, their biggest advantage is their mobile app, which has the best ratings out of all the options listed on this page.

Million Dollar Journey’s Overall Rating: 3.9/5

RBC Direst Investing Pros:

- User friendly, advanced platform

- Fantastic mobile app

- Easy to set up if you bank with RBC

- Safe and trustworthy company

RBC Direct Investing Cons:

- Much higher fees compared to other online brokers

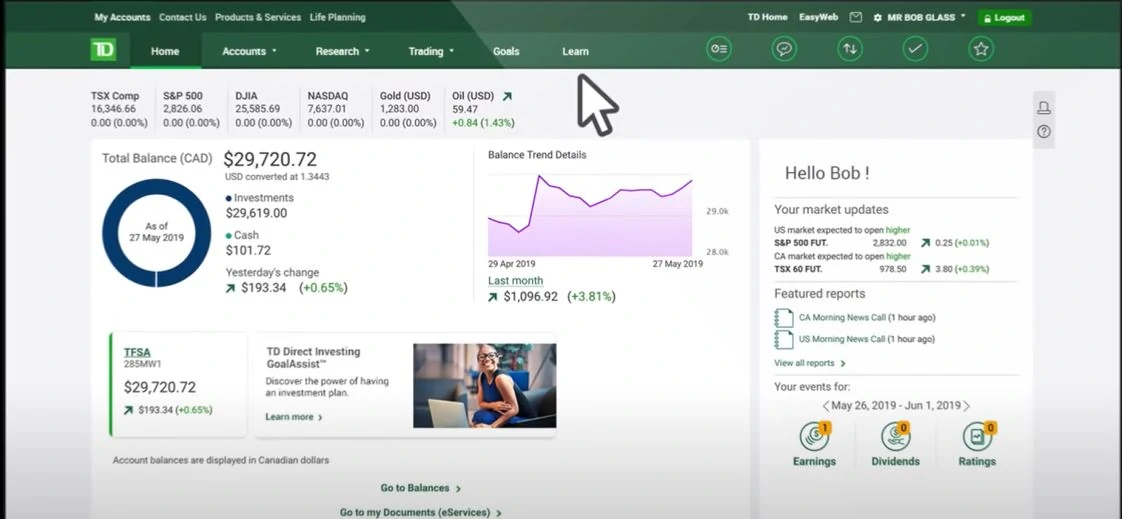

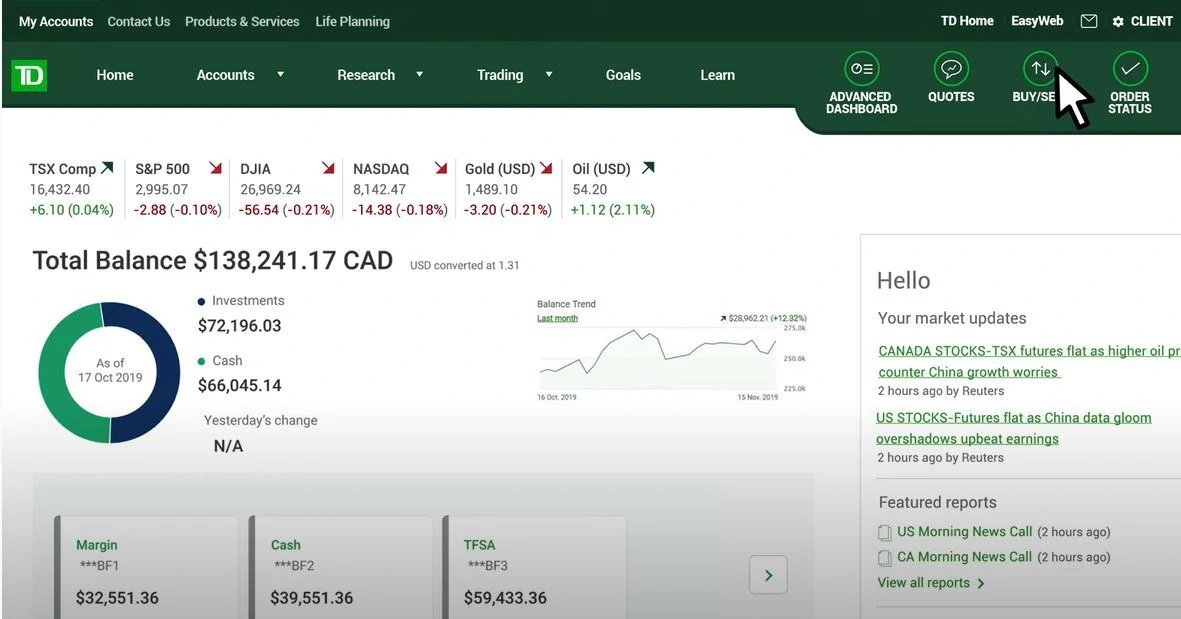

TD Direct Investing – Great platform

If it weren’t for the fact they neither have an ongoing promotion, nor offer free ETF trading, TD Direct might well have been placed higher on our list. With the TD Webbroker, they have arguably the best trading platform in Canada – at least for desktop users. While their mobile app isn’t the best, it is also a very good product and overall user reviews are very positive.

If you already bank with TD, or if you know you are going to make a lot of use of their excellent trading platform, then signing up with TD Direct Investing can’t be a bad decision ever. That said, even though their software might be a little bit better – they simply can’t compete with the value one might get from Qtrade’s low fees or BMO’s excellent promo offer.

Million Dollar Journey’s Overall Rating: 3.8/5

TD Direct Investing Pros:

- One of Canada’s most trusted financial companies

- Easy and convenient if you already bank with TD

- Modern, easy to use platform

- Good amount of account options to choose from

TD Direct Investing Cons:

- Higher trading fees, ETFs in particular

- Very high account fees unless you maintain a $15K balance

Virtual Brokers – Competitive Fees + Extra Consideration for Canadian expats

Virtual Brokers is a very good option for active investors and Canadians who are living overseas. They are one of the bigger and most well known brokers in Canada and have been in business since 2009 and are now backed up by CI Direct Investments, giving them solid stability going forward.

This broker is ideal for Canadians who live overseas but prefer to keep their portfolios back home. Unlike other companies on this list – other than Questrade – Virtual Brokers don’t shy away from expat clients and will assist you with all the necessary paperwork. Not only that, but there will be no added charges for that! The only requirement is a $25,000 account minimum.

VB’s fees are comparable with Questrade as some of the industry’s best. The reason it falls short of a top spot for me is because the platform over there is quite outdated and hard to use – the mobile app in particular is really not polished enough. Add to that the fact they currently have no promo on offer, and they simply fall short of being the best choice for most Canadians.

Million Dollar Journey’s Overall Rating: 3.7/5

Virtual Brokers Pros:

- Very competitive fees, similar to industry leaders

- Best solution for Canadian expats

- Trustworthy and safe with a long positive track record

- Great fees and platform for very active traders

Virtual Brokers Cons:

- Not the best product for passive investors

- Platform is overall not very user friendly or nice

- Pretty basic mobile app

- No promo offers for new signups

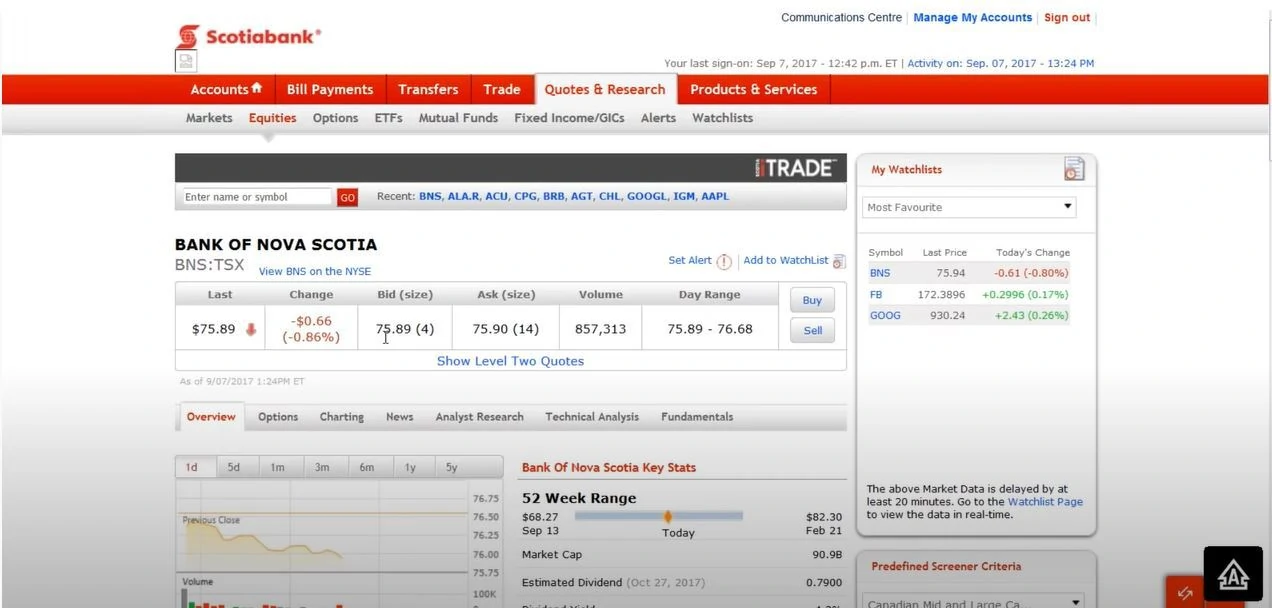

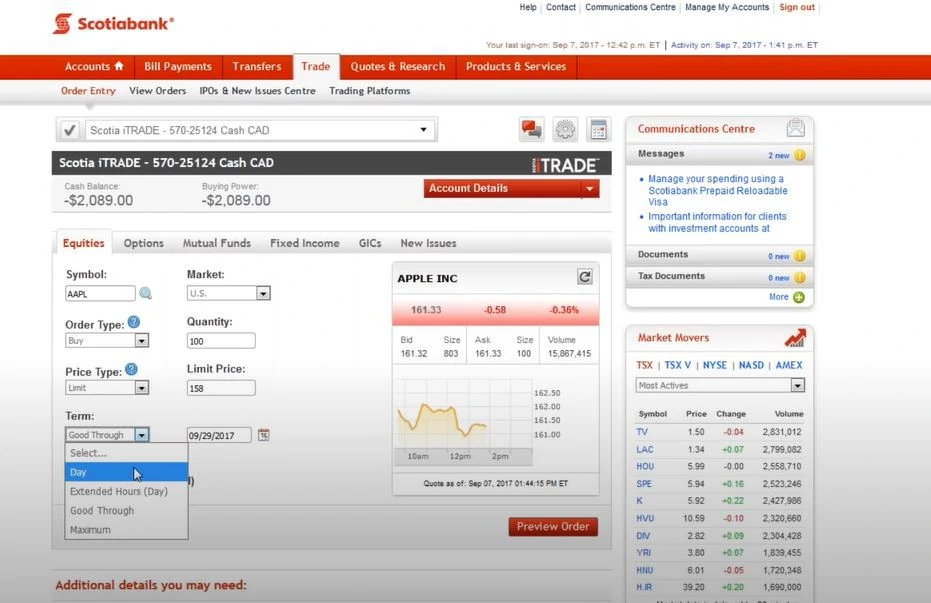

Scotia iTrade – Excellent for Traders Who Like Scotiabank

Like most of the big banks, Scotia’s stock trading product is an elite one. The platform is modern and integrates very easily with all other Scotia products so you get a very good ‘all in one’ solution for your financial needs.

Scotia iTrade is particularly attractive for those who want to deposit large amounts of money and be very active with their accounts. If you do that, then it somewhat mitigates the higher fees and the overall convenience and ease of use really shines through.

Scotia’s trading fees are higher than the top brokers on this list, but are on par with all the other big banks. The only real major downside is their mobile stock trading app – it got abysmal reviews and hasn’t been updated in a long while.

Million Dollar Journey’s Overall Rating: 3.7/5

Scotia iTrade Pros:

- Great all-in-one solution

- Ideal for day traders

- Excellent desktop platform

- Well known and trusted company

Scotia iTrade Cons:

- Fees are much higher than other brokers

- Bad reviews for their mobile app

Editor’s Note: Still looking for more brokers? Read our reviews of HSBC, Interactive Brokers or Desjardins. All 3 are perfectly fine choices, but we failed to identify any field where they shine above the rest, and our user’s reviews weren’t stellar to say the least.

Top Discount Stock Broker Promo Offer Codes for 2021

BMO Promo:

Use our exclusive promo code MDJCASH to receive cash back offers.

For the minimum deposit of $50,000 you will get $100 cash back, with tiered bonuses going all the way to $2000.

Questrade Promo:

Sign up with Questrade to get $50 in free trades.

Questrade continues to be the low-cost leader, and one of the best brokers in Canada.

Qtrade Promo:

Deposit at least $10,000 to get 50 free trades worth almost $500.

Enjoy multiple other rewards and benefits with Canada’s best broker! Use code 50FREETRADES

Are These Canadian Stock Brokers Safe?

When I approach most new investors about opening a discount brokerage account, their first question is: Are Canadian online stock brokers safe?

The short answer is Yes.

The longer answer goes something like: Canada’s online brokers are as safe as any on the planet when it comes to protecting your assets from theft, fraud, malware, viruses, phishing schemes, and data breaches. That said, obviously there is a relatively small risk whenever information is stored online. There is no larger safety risk than if you were invested in a mutual fund or even just a basic bank account.

Canada’s big banks have been around for hundreds of years, and even the relatively new brokerages that we recommend have over a decade under their belt. If their security wasn’t top notch.

Common online broker security measures include the following:

- SSL encryption

- Ultra-secure servers

- Two-step authentication process when logging in

- Automatic logout

- Regular system monitoring

Of course, it’s not just up to the online broker. You need to be cautious as well. If you are investing online (or sharing any personal information online, really), you should take the following steps to better protect yourself online.

Recommended Steps

- Install anti-virus and anti-spyware programs on your computer

- Use strong passwords that are hard to guess

- Take advantage of two-factor authentication when offered

- Always be mindful of who is around when you are entering your account information. As much as possible, this should be done when you are alone at home. If you need to step away from the computer, make sure to log out first.

At the end of the day, yes, investing online does have risks, it’s not typically seen as a risky activity. As mentioned above, there are plenty of security measures in place and procedures you should be following as well. It’s really just about being smart and cautious with your personal information.

Are Qtrade and Questrade as safe as BMO, RBC, TD, CIBC, and Scotia?

I think most Canadians understand intrinsically that the Big Banks are safe. After all, the massive banks have been around for over two hundred years, and are some of the biggest businesses in Canada. People assume that their money will be safe.

Fewer Canadians make the same assumption about our other top discount brokerages.

The bottom line is that Q trade and Questrade have all of the internet safety measures that are described above, but additionally, they have the same CIPF-insurance backed accounts that the big banks enjoy.

What is the CIPF you might ask? The Canadian Investor Protection Fund is essentially an insurance coverage that the Canadian government has in place in case a brokerage company goes bankrupt (aka “insolvent”). It covers each Canadian investment account up to $1 Million. That’s per account. So you could have a $1 Million TFSA, $1M RRSP, $1M non-registered, etc.

So even if the company was in trouble (which it isn’t – since Qtrade for example is owned by Canadian financial conglomerate Avisio Wealth), your personal assets would still be safe – just like BMO, TD, RBC, Questrade, and any other online broker in Canada.

Now, it shouldn’t need stating, but I’m going to say it here anyway: No brokerage account or financial advisor can protect you against basic investment risk!

The Canadian online broker can keep your information safe from being hacked, there are steps that can be taken to minimize vulnerability to fraud, and the CIPF will protect your assets from a company that is in trouble – but there are no guarantees when you invest in stocks, bonds, ETFs, or commodities. Again, this might be obvious to you – but you wouldn’t believe the questions that end up in our inbox sometimes!

Ultimate Comparison of Canadian Discount Brokerages

Below you can see a much more detailed table, which will hopefully give you better insight as to how we rate and pick the different brokers in Canada. You can also scroll down below the table for a more in-depth analysis and breakdown of each key factor.

Qtrade | Questrade | BMO InvestorLine | RBC Direct | TD Direct | Scotia iTrade | CIBC Investor’s Edge | Virtual Brokers | National Bank | |

Free ETF Buying | |||||||||

Free ETF Selling | |||||||||

User Experience | |||||||||

Customer Service | |||||||||

ECN Fees | $0 | $0.0008- $0.004 per trade | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

Trading Fees for Average Investor | $8.75 | $4.95-$9.95 | $9.95 | $9.95 | $9.99 | $9.95 | $6.95 | $1.99-$7.99 | $0 (expect for options trading) |

Trading Fees for Elite Day Traders | $6.95 | $4.95-$9.95 | $4.95 | $4.95 | $4.95 | $4.99 | $4.95 | $1.99-$7.99

| $0 (expect for options trading) |

Automated Dividend Re-Investment Plans (DRIP) | Both Canadian and U.S. DRIPs are free of charge. | $0 for balance above $5k $19.95/ quarter if balance < $5k | $100/ yr if balance < $25k | $25 / quarter if balance < $25k | $100 / yr if balance < $25k | $100/ yr if balance < $25k | $100 / yr if balance < $25k | $50/ yr if balance < $15k, $50/ yr for USD RRSP

| Free |

Current Promotion | None | None | None | None | None | None | |||

Full Review |

|

Comparing Canadian Stock Broker Trading Fees for ETFs and Stocks

Everyone is looking for low investing fees in Canada, and there’s no doubt that online discount brokerages offer the best rates relative to mutual funds and even robo advisors. But, just how much better off are you with a discount broker? Let’s take a look:

Broker | ETF Trading Fees | ECN Fees |

Qtrade | Free to buy or sell the top 100+ | $0 |

Questrade | $0 to buy, $4.95-$9.95 to sell | $0.0008- $0.004 per trade per order |

BMO InvestorLine | $9.95 to buy and sell | $0 |

TD Direct Investing | $9.95 to buy and sell | $0 |

RBC Direct Investing | $9.95 to buy and sell | $0 |

National Bank Direct Brokerage | Free to buy and sell | $0 |

When it comes to ETFs we need to remember that even though a few of the online brokerages mentioned in this article offer free ETFs to buy, you often need to pay a fee to sell. This is one area that allows Qtrade, BMO, and NBDB to really shine.

Another fee that you will want to keep in mind are ECN fees. So, what exactly is an ECN fee? ECN stands for Electronic Communication Network and these fees are essentially service charges that you will pay on your trades, although they can sometimes be avoided.

You can see from the chart above what the average price of an ECN fee is for each broker. If you’re buying and selling relatively small amounts of shares, the fee won’t add up to much. However, if you’re making large Market Orders (as opposed to limit orders) and “removing liquidity from the market” – then you might end up paying something like $2-$5 per trade on a 500 share purchase or sale.

I think it’s also worth mentioning that Canada has some of the highest investment fees in the world. A Morningstar 2017 global study compared the investment fees and expenses in 25 different countries around the world. So, where did Canada fall on the scale?

At the bottom.

We paid the highest investment fees out of all the other developed countries on this list. When you read or hear stats like that, it’s really no wonder that more and more Canadians are becoming interested in taking the proverbial bull by the horns and getting into DIY investing themselves rather than paying others to do it for them. After all, the end goal is to make money – not flush it away on unnecessary expenses such as buying yachts for mega-wealthy yacht owners..

Bottom Line: If you’re a passive investor or prefer to diversify through ETFs, you really can’t beat Qtrade’s free ETF policy. If you’re more into margin trading, or want to specialize in trading options, then Questrade is worth a strong consideration as well.

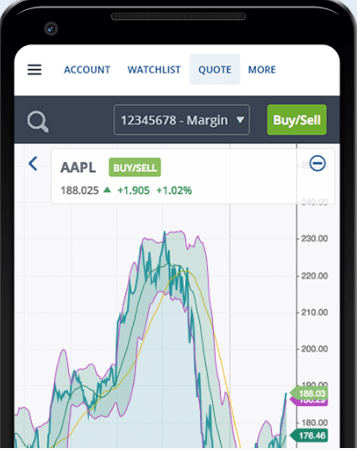

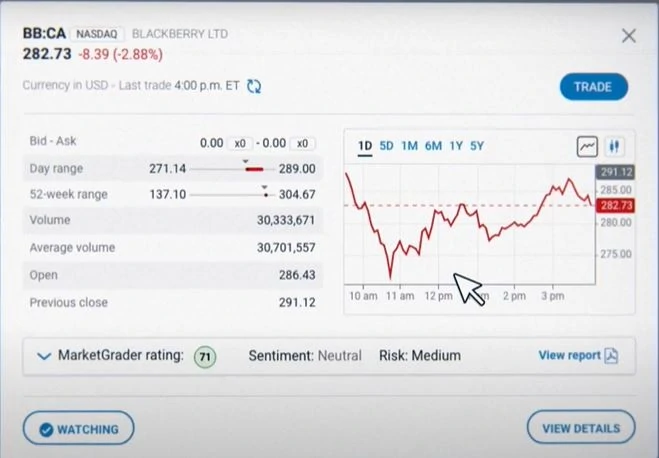

The Best Discount Brokerage Mobile App in Canada

While I prefer to use my online brokers website platform, I know that several of Canada’s discount brokerage mobile apps got redesigned in 2020 and 2021 in order to meet demand for cutting-edge usability. There is a fine balance to be struck when it comes to providing brokerage app users with a high number of features, but also a simple & clean user experience.

Once again we see Qtrade come out as the best Canadian online brokerage app, as they have yet again refined their already-best-in-class offering from last year. Qtrade’s app has the best ratings in the app store for good reason, as they offer a smooth user experience combined with the ability to view and trade from all of your accounts in a simple intuitive manner.

Read our full stock broker app comparison here.

Who Should Use an Online Trading Platform?

The promise of low investing fees is attractive to everyone, but the concept of doing your own trading can also be quite intimidating.

The good news is that it doesn’t have to be!

Part of what makes online trading platforms so enticing is that they really can work for everyone due to the fact that they are so customizable. Online trading platforms can work well for both active and passive investing. For those who are unsure of the difference between the two, active investing is a much more hands-on approach.

An active investor will try to pick and choose which stocks or bonds will perform best and trade accordingly. Passive investing, on the other hand, involving having a little piece of every company or bond in a market, rather than relying on a select few.

Passive investors usually rely on index investing (the couch potato strategy) when it comes to their investments and is seen as an effective long-haul investment strategy. For those interested in active investing, you will essentially have to become your own portfolio manager.

Alternative to Stock Brokers in Canada: Robo Advisors

I should take a second to point out that if you really want the ultimate in low-maintenance hands-off investing (like many of my friends do) then the Wealthsimple robo advisor platform has really distinguished itself from the rest of the pack when it comes to instant portfolio solutions, and is rated our best robo advisor in Canada. You’ll pay more in fees than you would with a discount brokerage account, but it is still less than 25% of what you’d be paying with a typical Canadian mutual fund. They’ll even give you $50 cash when you open an account!

Canadian Online Broker Frequently Asked Questions

Final Words of Wisdom About Canada’s Stock Brokers in 2021

Becoming a successful active investor requires knowledge and understanding of the stock market. It also involves you needing to do your own research. It will take time and effort; however, if this is the strategy you wish to use and you are confident in your abilities, then using an online trading platform instead of a traditional financial planner can save you a lot of money. That being said, you don’t need to be an active investor to make an online trading platform work for you. You can go with buying an all-in-one ETF, sit back, and relax.

If you want to copy the same index investing strategy as a robo advisor, you absolutely can; no one will stop you. That being said, using an online trading platform will require slightly more time and effort than a robo would but, again, you are saving yourself money in terms of the fees so it just might be worth your time.

Using an online trading platform and becoming a DIY investor can mean anything from simply re-buying the same basic index ETFs a few times a year, to far more complicated “momentum” trading strategies that can involved 150+ trades per quarter. Consequently, finding the best discount brokerage to fit your needs is essential to long-term success and commitment.

Please let us know in the comments if your personal experiences don’t align with our most recent Canadian online broker comparison or individual stock broker reviews. Because we know just how important online brokers and promotional welcome offers to our readers, we promise to continue updating our Best Canada Online Broker Comparison monthly throughout 2021.

4.9 / 5

4.9 / 5