Stocktrades ETF Insights Review

Stocktrade ETF insights Review

-

Price [With MDJ Discount]

-

Ease of Use

-

Fresh Data and Information

-

Comprehensive Comparison Features

-

“Shiny” Website and Branding

Stocktrades.ca Review Summary:

The ETF Insights platform is an incredibly useful tool for both experienced and new DIY investors.

If you’re just getting into DIY investing and you live in Canada, then this is a must have. The combination of an easy ETF comparison tool, plus the helpful monthly ETF newsletter and Live Q/As make this a very valuable way to get started as an investor, or to really create confidence in the earlier stages of your investing journey.

For more experienced investors, the 60+ data points that you can use to filter ETF search results offer the best ETF research tool that I’ve seen. You can endlessly refine your ETF comparisons to really zero in on the optimum portfolio solution.

Pros

- Finally: An ETF site for Canadians – by Canadians

- Over 5,200 ETFs Comparison

- Easy to Understand 5-Star Quick Rating System

- Updated Expert ETF Picks for Specific Portfolios

- Guaranteed to Get Your Question Answered via Q/As

- Useful Monthly Newsletter

- 60-Day Money Back Guarantee

Cons

- Restricted to ETFs – does not include Canadian individual stocks

- No flashy mobile app

What Is Stocktrades ETF Insights?

ETF Insights is a platform that wants to help you cut through the noise, and select the best ETF for your RRSP, TFSA, or other accounts.

It’s that simple.

Twenty years ago there were only a few Exchange Traded Funds (ETFs) out there to choose from, and they were basically all some sort of index fund. Then people like yours truly started writing about how great ETFs were, and why they were so different from high-fee investing options in Canada.

What happened next was fairly predictable: The big investment companies caught on and decided to slap the ETF label on every product they could. They started charging higher and higher fees, and even introduced “actively managed ETFs” which were essentially the same old mutual funds wrapped up in slightly different packaging.

This strategy could definitely be called “muddying the waters” or “throwing sand in the air.” The basic idea was to confuse investors enough that they essentially just said, I’m not sure what to believe anymore, is “ETF investing” the same as “index investing? I thought MER fees were supposed to be low for ETFs but some of these aren’t low at all. You know what, I’ll just stick with the mutual funds my bank adviser told me about. I’m sure they can’t be that bad.”

ETF Insights is about clearing up those waters, seeing through the sand the high-fee sales people keep throwing everywhere. The math doesn’t lie – and ETF Insights is going to boil that math down as succinctly as possible.

Why Use it?

Stocktrades ETF Insights is first and foremost a research tool for ETFs listed in Canada and the USA.

You can quickly compare and filter over 5,200 ETFs based on characteristics such as:

- What type of asset is in the ETF invested in (stocks, bonds, gold, crypto, real estate, etc)

- Where the assets are invested (aka: geographic diversification)

- How much the ETF takes in Manage Expense Ratio (MER) fees

- What is the distribution (often confused with dividends) of the ETF?

- Is the ETF an index fund or not?

- 60+ other data points.

That research ability is the most valuable part of the platform for seasoned DIY investors.

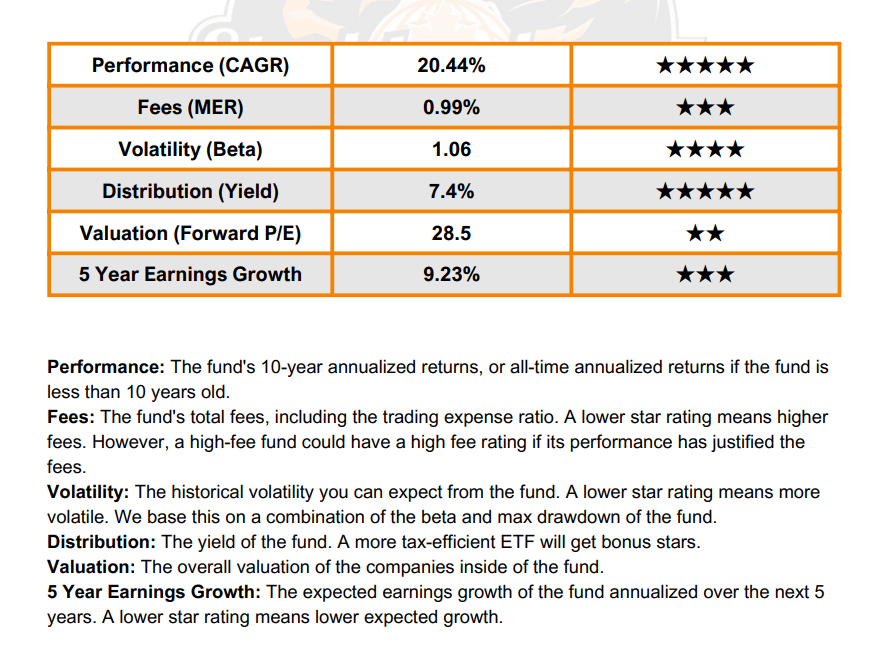

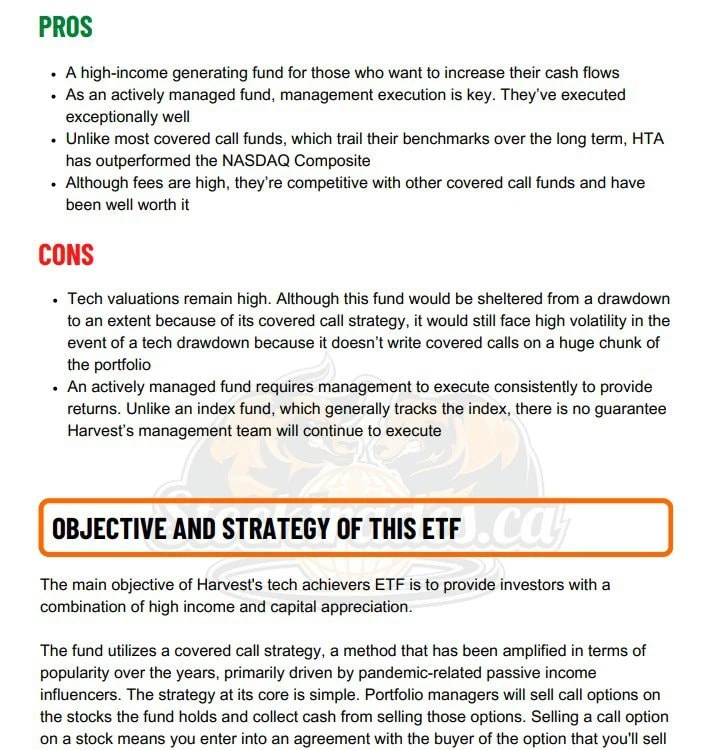

When you zero-in on a potential ETF, you can read an in-depth profile that looks like this (a sample ETF: Harvest Tech Achievers – HTA).

ETF insights also includes some other valuable perks such as:

- Curated lists of the top ETFs for the most common types of investors

- The ability get all of your burning questions answered via LIVE Q/As

- A monthly newsletter that focuses on unique aspects of ETF investing in Canada

- A simple 5-star rating system for investors to see at a glance how their ETF selections stack up

- Access to numerous articles and videos that detail how to nail the specific logistics of ETFs when it comes to constructing your personal portfolio.

How Does It Work?

For a one-time fee [that NEVER goes up – you’re locking it in] you get access to EVERYTHING.

This isn’t some multi-tiered VIP upselling deal.

It’s pretty simple. You pay one time – you get access to everything that ETF Insights brings to the table. You get the ETF screener (the most detailed in Canada), the Q/As, the newsletter, the videos, the community – everything.

Right now, ETF Insights is doing an exclusive launch offer where they are giving you access to your first year for a hundred bucks.

You won’t see this price ever again, the price will only go up from here. That $99 price tag is only for your first year, and it will be $149 after that – but considering the price point for other research platforms like this is $999+, I think that’s pretty good value. I wouldn’t be shocked to see ETF Insights raise prices to $299 in the next few years, so that’s something to consider when you look at locking in now vs at a later time.

The best part about buying the introductory offer is that you get the first year at a crazy value, but then you lock in that $149 price tag for the rest of your life. Literally ZERO inflation. Who else is promising that these days? In ten years, you will still only be paying $149!

And hey – if you don’t like it – you’ve got 60 days to simply tell them that it isn’t for you and they’ll send you your money back no questions asked.

Who Is Behind Stocktrades ETF Insights?

The main fellow behind ETF Insights is Dan Kent. Dan has been a DIY investor since 2009, and created Stocktrades alongside his partners, Mathieu Litalien and Dylan Callaghan in 2016.

Since getting started in the DIY advice space, Dan has helped millions of Canadians and his writing has been featured in the Globe and Mail, Forbes, Business Insider, CBC, Yahoo Finance, Entrepreneur, and Kiplinger, amongst other publications.

Dan has completed his Canadian Securities Course and he has been a part of the Canadian Financial Summit.

In short – they guy is a DIY Canadian investor who wanted to help other DIY Canadian investors. If that sounds familiar, it’s because it is essentially the same origin story as yours truly!

You can Google Dan – he is in this thing for the long haul, and has a solid track record of in-depth research when it comes to investing from a Canadian perspective.

Is ETF Insights a Safe Platform?

Yes, ETF Insights is Safe.

These folks aren’t new to the game, they’ve been running a major Canadian investing site for over a decade now.

But the key thing to understand here is that you aren’t actually investing any money with ETF Insights. They aren’t a bank or an investment company.

Furthermore, Stocktrades doesn’t actually handle your money. They use the same payment processors as massive companies – namely Stripe and PayPal. This is the same way almost all companies on the web accept payment, and they’re obviously amongst the world’s leaders in cyber security.