Archive for April 2024

Best Swap ETFs in Canada: Horizons Total Return Funds

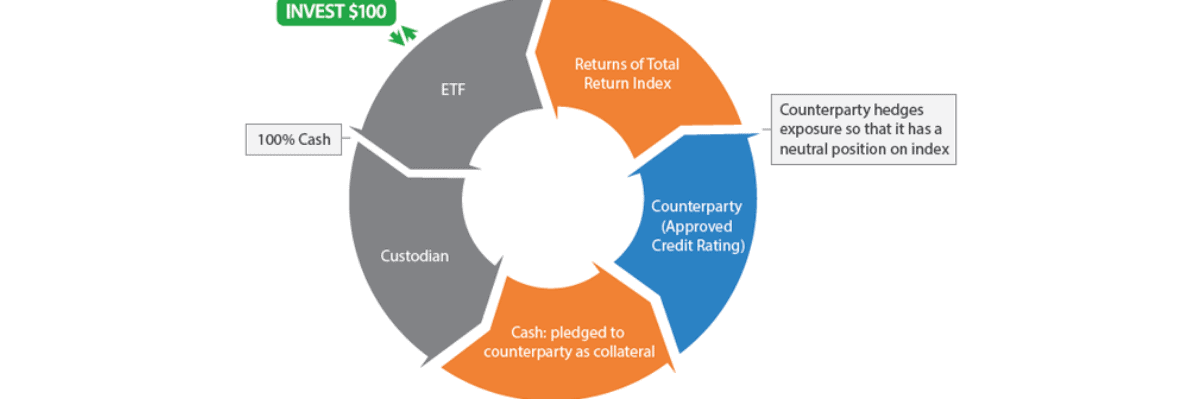

In writing about corporate and expat investing over the past couple of years, I’ve come to realize just what an advantage using Canadian swap-based ETFs from Horizons can provide certain groups. Horizons calls these exchange traded funds “Total Return ETFs” and there are three main groups of investors that really need to be paying attention…

Read MoreStudioTax Review 2025

What is StudioTax? StudioTax is certified tax preparation software for Canadian personal income tax returns. It is provided by BHOK IT Consulting and is now also available for Quebec residents (as well as available in French). It suits the needs of most people although it does have some restrictions. I’ll provide an overview of its…

Read MoreCanada’s 2024 Budget – New Taxes on Capital Gains

Canada’s new tax rules on capital gains mean that you’re now likely to pay more taxes if you own a cottage, pass away with an unregistered online brokerage account, or investing inside of your corporation. Of course, right when I’m in the middle of writing a series on corporate taxes for CCPCs and am writing…

Read MoreSalary vs Dividends in Canadian Corporations: Paying Yourself as a Small Business Owner

In preparation for our dividends vs salary comparison for Canadian small business owners, we took a broad look at Canadian corporate taxes last week. I admit – it wasn’t exactly light fare. But the low-tax juice will be worth the squeeze! Today, we’re going to focus on Canadian Controlled Private Corporations (CCPCs) with annual income…

Read MoreCCPC Taxation: Canadian Corporations for Small Business Owners

I’ve been getting a lot of questions recently in regards to Canadian corporations and taxes for small business owners that have a CCPC (Canadian-Controlled Private Corporation). Most of these inquiries want seemingly simple questions answered – something along the lines of, “Ok, so if I made this much profit in my company this year and…

Read More