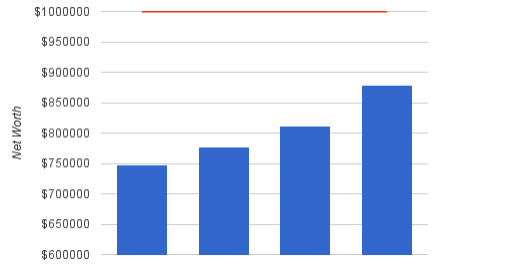

Oct 2009 Net Worth Update (+1.58%): Halloween Edition

Welcome to the Million Dollar Journey Oct 2009 Net Worth Update – The Halloween Edition

Halloween is here once again, it’s hard to imagine where time goes. It seems that the more we age, the faster time passes.

This year, we expect a lot of trick or treaters ringing our doorbell as our street is now fully developed (with street lights and everything!). I’ve heard rumour that there are over 200 kids in our immediate area, so I guess it would be a good idea to be over stocked with treats than under prepared. In terms of treats, we typically do the chips and bar thing, like Kathryn, we purchase our Halloween treats from Costco.

Nothing too scary to report in Octobers net worth summary. Most of the growth is due to steady savings and some portfolio growth. I did see a fairly signifant correction in my non-registered account as a speculative stock I own took a dive.

With regards to liabilities, if you take a look at the mortgage balance, you’ll see that it’s within striking distance of being completely paid off. I’m actually in a bit of turmoil with regards to what I’m going to do with the large HELOC space available. Should I continue to use the HELOC to invest with? Or should I use the increased cash from the previous mortgage payment to fund my investments? Or perhaps a combination?

Assets: $ 470,500 (+0.99%)

- Cash: $4,500 (+0.00%)

- Savings: $16,500.00 (+22.22%)

- Registered/Retirement Investment Account: $73,800.00 (+2.22%)

- Pension: $27,700.00 (+0.73%)

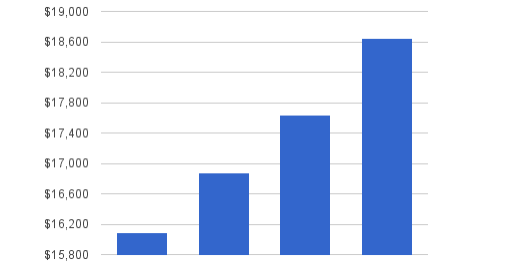

- Non-Registered Investment Account: $16,500.00 (-4.07%)

- Smith Manoeuvre Investment Account: $51,500.00 (+3.00%)

- Principal Residence: $275,000 (+0.00%) (purchase price)

- Vehicles: $5,000 (2 vehicles) (-16.67%)

Liabilities: $85,500.00 (-1.61%)

- Tax Liability: $3,000 (-0.00%)

- Principal Residence Mortgage (readvanceable): $29,200.00 (-4.89%)

- HELOC balance: $53,300 (+0.19%)

Total Net Worth: ~$385,000.00(+1.58%)

- Started 2009 with Net Worth: $309,950.00

- Year to Date Gain/Loss: +24.12%

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker can prove useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence plus a rental property. The value of the principal residence remains valued at the purchase price despite significant appreciation in the real estate market that we’re in. I will most likely be adjusting the value of the home come the new year.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hi Swati,

Engineers get a special package at the National Bank. You do get a line of credit at prime plus 1% but you have to pay an annual fee for the required credit card.

Ahh it’s always fun looking at these net worth update posts, and the balance sheets balance! =D I am curious though… what kind of fees would you pay if the balance of your checking account was below $4,500?

Thank you,

Jean

Saver-Scott,

We used many methods at our disposal. I should correct myself – it will only take us 7 years to eliminate the mortgage – if that is something we want to do. We can slow that down to about 7 1/2 years so we can allocate $ to TFSA’s.

We upped our monthly payments by 20% (which is the maximum) 3 years in a row once we felt comfortable with the additional impact to cash flow.

We put down the maximum 20% prepayment when I had 2 consecutive years of exceptional commissions. In other words, additional money went to the mortgage/RRSP’s/RESPs before it went to discretionary income. In fact, except for a vacation I can’t remember “frittering” any of the unexpected windfall.

Any tax refunds/raises went to mortgage paydown or RRSPs/RESPs as required.

When our mortgage came up for renewal last year, we had paid down $183k in the first 5 years. Now, we have an SM mortgage and it is down another $50k since.

This turned out to be a great compromise – I don’t mind debt as long as its productive debt as I favour investments. My wife takes the opposite stance. We’ve been very fortunate to be able to eliminate debt (or convert into good debt) while still being able to invest in our children and our retirement.

One of the reasons why we were so focussed on eliminating our mortgage is that is, for my wife, the number one priority for her. So, when we moved from a townhouse to our 2 storey it became obvious that if we had stayed put we would have been mortgage free only 2 years into owning the new home. (We moved because we thought we’d need the space with the children from two previous marriages growing up – turns out one left the nest right after!)

Our current VRM mortgage is completely open and is only at 1.5% so obviously the amount we pay each month into our mortgage is almost exclusively paying down the principal. Each month accelerates the paydown ratio which helps keep the motivation high.

One item that helped us with the additional cash flow burden is that we didn’t have any car payments (finance or lease) for the last 6 years. Just this year we finally retired one 14 year old vehicle because the rust was too much. Our “new” vehicle is 4 years old while our “well enjoyed” vehicle is 8 years old. I hope to get at least another 5 years out of it since we’ve been diligent in rust proofing it every year.

We take at least one vacation each year and I don’t think we deprive ourselves. But, we focus on putting money towards the mortgage, RRSP’s and RESP’s with unwavering focus. By taking care of that first, you can get a lot more accomplished than waiting to see how much money is left at the end of the year.

Cannon,

Forgot to answer your question- YES I will have a Mortgage Burning party!!!

Hopefully 4 years

Cannon_fodder— Can you elaborate on how you paid off you 300k mortgage in 8 years?

My wife and I are trying to pay our $150,000 off we have 92k left.

We currently pay bi-monthly and add extra to our payment.

If anyone has any ideas please let me know.

FT,

Next year, my wife and I should be in a position to pay off our mortgage for the first time in our lives. That means we would have eliminated a $300k mortgage in 8 years.

However, we would still have a very large HELOC (because of the SM). While it may be technically better to just pay the interest on the HELOC, there is nothing wrong per se with paying down the balance of the HELOC. It is not the suggested SM end game, but my wife would feel better entering retirement with no debts if possible.

I think a smaller retirement portfolio with no debt is a pretty good compromise considering she supported us embarking on the SM in the first place.

Would you have a ‘mortgage burning party’ to celebrate the momentous occasion?

CF, paying off a $300k in 8 years is quite the accomplishment, congrats! A mortgage burning party may be just what the doctor ordered, but will have to wait a year or so!

Congratulations on your earnings this year! It is nice to see that our accounts are now on the way back up. Hopefully a steady upward trend instead of shooting way up and then back down. Good luck on hitting a Million. I will be watching your progress.

Reading this article has caused me to sit back and ask myself… where has the year gone?

Congratulations on the year you’re having so far. Hopefully the market doesn’t collapse on the expectations of a slow recovery. For the HELOC I would recommend paying it off and using it only for specific goals, investment or otherwise. Having any balance means paying interest of some sort and I don’t advocate paying anybody interest unless you have to.

Congrats on the healthy YTD % gain increase in net worth!