Low Cost Currency Conversion with DLR/DLR.U ETF

With foreign exchange fees as high as 2.5% for discount online brokers, low-cost currency conversion methods are a great way to keep a little extra money in your portfolio. If you’re dealing with larger trades, those FX fees can really add up!

For example, say I wanted to purchase $10,000 worth of Walmart stock with Canadian dollars. If I did a straight purchase with CAD in my brokerage account the fee (on top of the spot rate and commission) would be up to 2.5%, or $250 in order to first change the CAD into USD, and then buy the American securities. The shares would need to increase by 2.5% just to break even on the trade.

To look at it another way, the $250 $199 is almost enough to purchase two additional shares. There has got to be a better way, right? Luckily, there is!

Norbert’s Gambit tops our list of the best low-cost ways to convert CAD to USD and vice versa. And in this article, I’m going to show you one simple way to do it, using an interlisted, currency-based ETF.

The Strategy

This tactic has been my go-to since I stumbled across a post on Canadian Money Forum (and Canadian Capitalist) back in 2012. The response thread discussed how to save money on currency conversions using Horizons DLR and DLR.U ETFs.

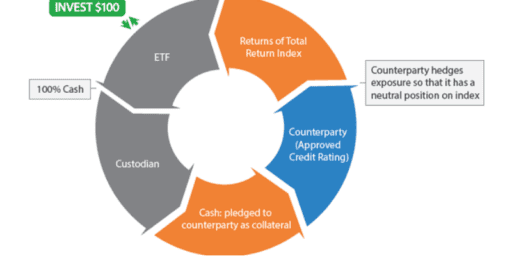

Basically, you buy DLR through your Canadian account and then sell DLR.U on the US side. DLR will track the CAD/USD exchange, so once you purchase the ETF, you have locked in your exchange rate. But let’s dig into exactly how to do it.

The Step by Step Procedure

I used this strategy with my Qtrade account, which was pretty straightforward. DLR/DLR.U isn’t currently on their list of free ETFs, which means I pay commission for buying as well as selling, but the savings still make the nominal fee worth it (their list can change occasionally, so it’s worth keeping an eye on it).

To Perform Norbert’s Gambit with Qtrade:

- Buy DLR. Purchase DLR using a limit order with your Canadian trading account. As of October 6, 2022, DLR costs $13.90. So if you want to exchange $10,000 CAD, purchase approximately 719 shares (total $9994.10)

- Journal the Shares. While some brokerages require you to contact customer support in order to journal shares, Qtrade lets you do it yourself. Select “Transfer Funds” from the “My Accounts” menu and then “Move Securities.” There should be no fees to journal the shares over to your US account. You may have to wait 3-4 business days for your trade to settle before they can journal the shares.

- Sell DLR.U. Once the shares are in your US account, sell DLR.U using a limit order. As of October 6, 2022, DLR.U costs $10.11, and selling 719 shares will net you $7269.09. With xe.com (spot rate) quoting 0.728107, this strategy gives you 0.72792. You have now exchanged your Canadian dollars into US dollars at a relatively low cost.

The Savings

So now that you have some CAD exchanged to USD, how much did you save? Using this strategy results in paying a fee of approximately 0.20% – 0.25% (plus spot rate and commissions) compared to a maximum FX fee of 2.5%. On $10,000 CAD, that’s a savings to the tune of $212. Do this a few times throughout the year, and the savings become significant.

Final Thoughts

Using DLR/DLR.U ETF combination for CAD-to-USD foreign currency exchange is one example of Norbert’s Gambit that has served me well for years. My instructions above are for Qtrade, but it’s been done with a range of other Canadian brokers as well.

Have you had success with Norbert’s Gambit? Let us know in the comments!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

OK. So I just tried this and it worked fine with Questrade. First purchase the DLR online, no problem. Chat with an agent to journal the shares, again no problem, but I had issues with the chat not working so this took longer than it should have. Overall I lost 3 days to clear the DLR purchase, and then 2 days to journal (then I sold). I haven’t checked the rates or savings yet, but once everything clears I will take a look and share my costs. FYI I used it for $10k CAD to US as it was my first time and I have another $40k CAD to move in that account.

The reason behind this was to buy VTI in USD with this money to avoid foreign withholding taxes in my locked in RRSP.

Settlement time: If they know the money is coming in, that is will be settled, can you use that equity to buy stocks right away? Or do you have to wait for it to “really settle” to start trading? Few of us could care less about withdrawing the funds. We just want our funds to be in play as soon as possible. I wonder if this is a good time to change brokers as well? Some people have no control over their investments if transferring between brokers for up to 2 weeks! A lot can happen in 2 weeks. The market can slide and months or years of gains can be wiped out. I called RBC and they seem to have a same day service now but who wants to change brokers just to move money? With Qtrade it seems like it would take 5 days normally or 2 or 3 days if you pay for a phone order (about $50 for a few hundred thousand). Some places are far more geared for this than others. RBC is very smooth. But their trading prices aren’t so smooth at all!

If you’re going to use inter-listed stock, in my experience TD bank stock has even greater liquidity, taking into account volume on both sides of the border, if you want to be as careful as you can be (the hold up is likely to be on the side with the lowest volume, right?) However, it probably won’t make any difference as the volume of the other bank stocks you mention is still pretty high.

@Jeff, I was going to suggest to give your brokerage a call to see their process on journalling shares. It looks like they auto journal as well, which is great for you.

Good luck!

Hi all,

I’ve read all the above comments and the consensus is that if exchanging from CAD -> $USD, the currency exchange rate is locked in when buying the DLR:TO, so no need to worry about the 3-day journaling (if such wait is req’d at brokerage).

Now, I read that the reverse is not true. Since my interest is exchanging USD -> $CDN, I live in USA and Fidelity USA is telling me there’s definitely a 3-day journaling wait time. If I buy DLR.U:TO and have to wait 3 days to exchange into DLR:TO, and DLR:TO is the one that’s actually fluctuating, then this would mean that there’s a lot of risk in this trade, is that correct?

If not using DLR, do you suggest using any other symbol to perform Norbert’s Gamibt for USD -> $CDN conversion?

Jeff, which brokerage are you with? If you are with BMO or RY, your account with “auto journal” your interlisted stocks. Check out this article:

https://milliondollarjourney.com/save-money-with-usd-to-cad-foreign-exchange-using-norberts-gambit.htm

Hi FrugalTrader,

Tks for the quick responding.

I am a canadian living in USA and don’t have a CDN brokerage account. I looked into Questrade and others and it seems they won’t open accounts for US residents , so that’s not an option. That’s why I am limited to US options and Fidelity USA is one of the better choices out there, cheaper fees, more CDN stocks accessible…etc..

For whatever reason, Norberts Gambit isn’t big down here as I haven’t found much in my research; I found lots of info here at milliondollarjourney, but mostly canadian-centric. I still need some advice as to buying DLR and DLR:U and how to minimize the risk of currency exchange movement from the perspective of exchanging USD -> $CDN.

Thanks !

A quick update to my orig. question:

So I called Fidelity USA again to clarify about the “3-day settlement.” It turns out my understanding of the meaning of “settlement” was wrong – all it is, is just a back office, administrative, account recording procedure that the broker needs to perform to recognize that a inter-listed stock has been purchased, maybe on the NYSE exchange, and then sold on the TSX exchange. During the settlement time (3 days or whatever), you don’t have access to the sold proceeds (unsettled funds), but the price at which you bought and sold the security is already determined at the time when you bought and sold; hence when you sell, you already know how much proceeds you’ll gain (hence the currency exchange rate), it’s just not immediately accessible until 3 days later.

Since BMO/BMO:TSX and RY/RY:TSX have much higher liquidity compared to DLR, I specifically asked Fidelity if I can buy these and immediately sell them, I was told a “YES,” and this is what I intend to use to implement NG.

I don’t understand why people worry about currency fluctuations using Norbert. You are converting CAD to USD. After you do that, you are affected by future currency fluctuations whether you are holding hard USD, DLR, DLR.U, or shares of something on the NYSE. Closing out your DLR.U position into USD or a USD equity does not protect you in any from from currency fluctuations. The only practical effect of a 3-day wait on a NG is it just takes a bit longer to enter your new position. So you might miss out on a move there.

But if you’re converting CAD to USD, you can’t avoid the risk just by closing it faster.

@The Passive Income Earner: Must have been a bit nerve wracking the first time around, eh lol?

@sclim

That’s correct. Withdrawing the cash is not immediately available but proceeds from a sell towards purchases is available based on my experience. They allow your account to be negative through settlements I have found too due to the delay of transactions and transfers.

@The Passive Income Earner: It wasn’t clear to me whether the process of “journalling” was to apply the transfer of the bookkeeping entry of the share from one stock exchange to the other, or to specify the bookkeeping be conducted in the account applying to the other currency. I suspect, because it is required by some platforms (Questrade) for DLR/ DLR.U which only trades on the TSE, not anywhere else, that it is the latter situation.

I would like to be clear, too, that in your experience with RBC DI that you can purchase units of DLR.TO and then immediately sell them as as DLR.U.TO and then immediately use the proceeds in US Dollars to buy shares on, say the NASDEQ, priced in US dollars, such as VXUS. Is this the case? It’s just when you want to withdraw US Dollars as cash that you have to wait 3 days for the last trade to settle, is that correct?

Not sure if you’ve updated this on any newer pages; however, clients can email Questrade (support@questrade.com) to have DLR journalled to DLR.U. I’ve done this several times recently and it’s never failed on me.

Clients must email on the business day *after* the DLR units are bought (t+1). In my experience, the journalling happens the business day after that (t+2), or occasionally the next day (t+3). The email must contain a specific instruction, and specify the account number.

This has always worked for me.