Archive for April 2023

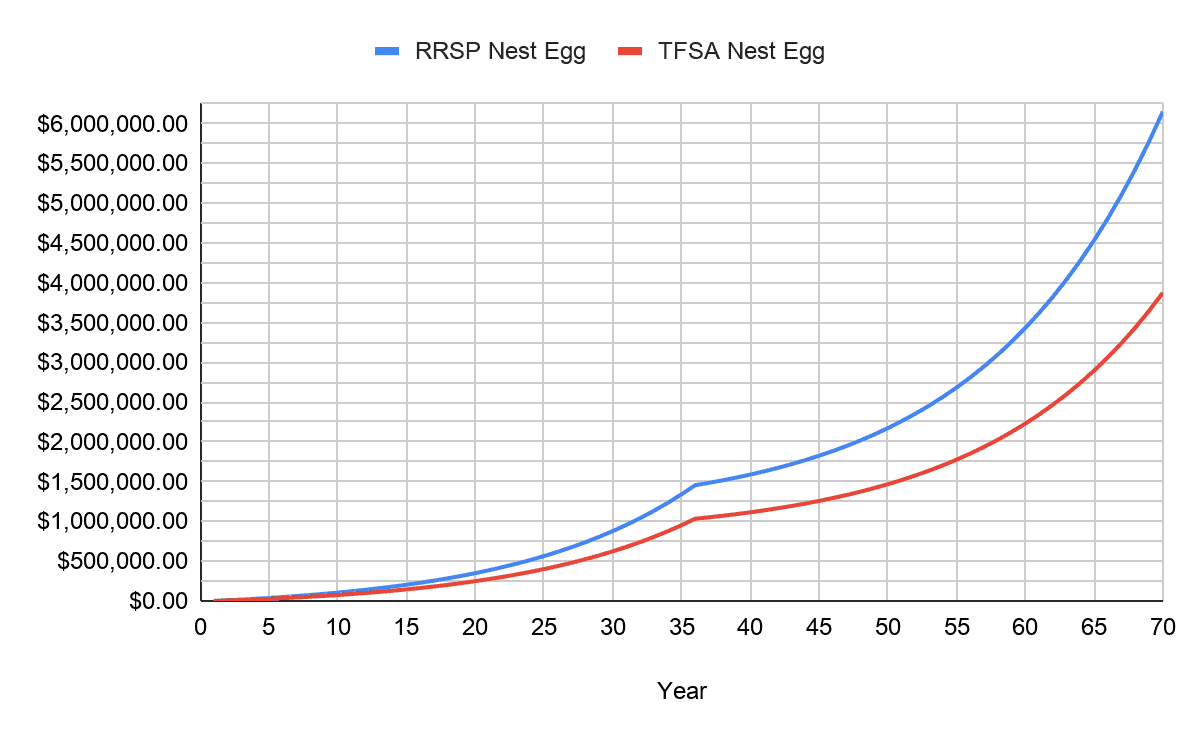

TFSA vs RRSP- Which One is Better?

Canadians have fantastic options when it comes to registered accounts. Registered accounts are beneficial for many reasons, the main reason being that they are tax advantaged. Tax advantage accounts are those that allow you to grow your money tax-free or allow you to defer paying taxes until later. However, all registered accounts are not created…

Read MoreSmith Manoeuvre Calculator/Spreadsheet

By now, most people here know that I’m interested in the Smith Manoeuvre. If you are new to this concept, you can read more about them in my article “Mastering The Smith Manoeuvre“. Originally, I discovered the Smith Manoeuvre, through a great thread on RedFlagDeals.com that talks exclusively about the strategy. This includes the tax…

Read More46 Ways to Save Money in Canada

Editor’s Note: This article was originally written by FT back in 2017. Due to its popularity, we have asked FT to update it for 2023 with more relevant advice. As always, we encourage you to comment below and tell us how you save money in your day to day life. If you are looking for…

Read More