Archive for March 2022

House Poor No More Book Review

House Poor No More: 9 Steps that Grow the Value of Your Home and Net Worth by Romana King is one of those books that every Canadian should read. It’s interesting, engaging, and absolutely packed with useful information. From a prioritized list of regular home maintenance tasks, to tips on how to pay as little…

Read MoreBest Money-Making Apps in Canada 2025

Maybe you’ve been scrolling social media at some point and seen that there are apps that will pay you for basically nothing and help you make money online. It’s not quite as ridiculous as it sounds at first! There actually are apps that will pay you for doing something that you would be doing anyway…

Read MoreWhat Insurance Do You Need For Your Investment Property?

If you own an investment property, you’re probably aware of how much earning potential your asset offers — especially in today’s housing market. But if you’re thinking of leveraging your property to make a profit, you will need to acquire the appropriate home insurance coverage to make your investment as safe and secure as possible. …

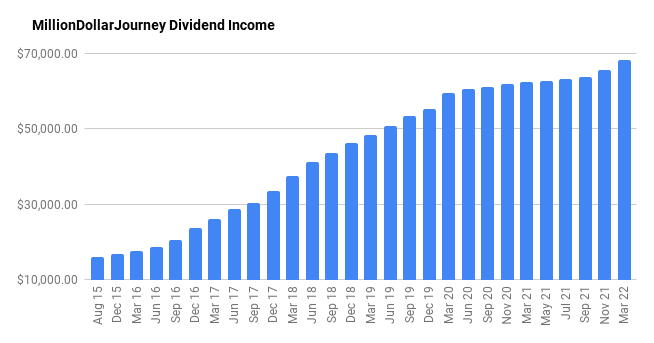

Read MoreFinancial Freedom Update March 2022 – First Update of the Year ($68,100 in Dividend Income!)

Welcome to the Million Dollar Journey March 2022 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to…

Read MoreHow To Retire Early in Canada

Have you ever thought about early retirement? Stopping work in your 50s (or earlier) and being able to relax and do the things you’ve always wanted to do? The Financial Independence/Retire Early (FIRE) movement has inspired many Canadians to take a hard look at their lifestyles and figure out if they can do just that.…

Read MoreHomeowners: Create Cash-Flow and Tax Write-Offs Using a Debt Conversion Strategy

Do you own a home? Do you make regular mortgage payments? There’s a good chance you’ve already spent tens of thousands paying mortgage interest – debt that is not a tax write-off. But what if you could turn your mortgage loan into a tax-deductible debt? Canadians are only allowed to deduct the interest paid on…

Read More