Welcome to the Million Dollar Journey April 2014 Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – yes this year!). If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the MDJ Newsletter.

The S&P500 took a little breather at the beginning of April, but has returned to form by approaching new highs once again. As of April 30th, including dividends, the S&P500 and MSCI EAFE (international index) were both relatively flat with a 0.7% gain month over month. The TSX, on the other hand, is on an aggressive uptrend returning 2.2% in April. With all the chatter about “Sell in May and Go Away”, there is more volatility in the market, especially in the technology sector. My view? If you are invested for the long term, then stay invested and forget all the noise. Personally, I like to keep some dry powder (cash) ready to be deployed in case market opportunities come up.

How did my portfolio do this month? As I’ve been cleaning up my RRSP to contain mostly US and foreign equities, it is starting to track the US market a bit better where our combined RRSPs returned +1%. Our leveraged Canadian dividend portfolio organically gained 2.32% (ie. no cash transfers into the account) and managed to keep ahead of the Canadian index by a very slight margin. The corporate investment account sat in cash again this month and will remain so until I find some value opportunities.

In the big picture, for the April 2014 update we are up 0.81% for the month and 17.29% for the year thus far. We are up to $1,197,685 in assets for a total of $970k in total net worth. With the deadline looming, there is about $30k left to go until the big $1,000,000 financial milestone!

On to the net worth numbers:

Assets: $1,197,685 (+0.78%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $182,500 (+1.00%)

- Tax Free Savings Accounts (TFSA): $65,000 (+1.56%)

- Defined Benefit Pension: $48,800 (+0.83%)

- Non-Registered Investment Accounts: $199,500 (+1.27%)

- Smith Manoeuvre Investment Account: $158,600 (+2.32%)

- Corporate Investment Account: $200,000 (+0.00%)

- Principal Residence: $318,785 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $227,350 (+0.66%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $118,600 (+0.25%)

- Future Tax Liability: $108,750 (+1.12%)

Total Net Worth: ~$970,335 (+0.81%)

- Started 2014 with Net Worth: $827,300

- Year to Date Gain/Loss: +17.29%

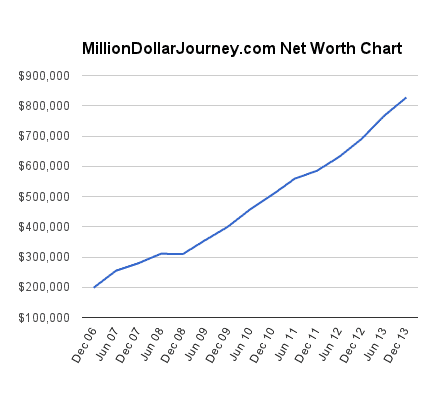

Readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

- December 2013: $827,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

The Tax Liability

Also in February 2014, I introduced a tax liability to my net worth statement. The tax liability is basically the amount of tax owing based on non-registered and corporate accounts and amount tax owing from future RRSP withdrawals. More information on the tax liabilities here in my February 2014 update.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I am 50 no job no money homeless uneducated and still have life in me. For what I don’t know. In society I am loser. Not my name or gmail. I live without anything. If I had 5thou I would take a trip and spend it. You all have eay too much money. What do you want so much money for? Ridiculous go spend 30thou on a long trip. Rich people are so boring. Once you have 5or more its enough to have fun…. If you know the secret to making money and saving.. Well then enjoy it. My God all that money… Broke but rich….

How has your net worth been doing over the last couple of months?

I see that u have not listed a car as an asset. Do u and your wife take a bus to work? How much is your estimated monthly or annual savings for the family, that adds to your net worth calculation?

(please note I have not re-read or edited what I wrote therefore please forgive me for any spelling and all grammatical errors)

Mr. Frugal. I am a new member. (since about 15 minutes ago) However, for the last month or so, as I’ve been doing my research on ‘The Smith Manoeuvre’ and kept coming back to your site quite often. (for other financial subjects as well)

I am very impressed with your discipline and work ethic. I am anxious for you to reach that 1 million dollar threshold and it’s not a question of if, but when you will get there. I just wanted you to know that I am rooting for you all the way. It’s like watching a long distance runner finally enter the stadium for his final few hundred meters in a grueling marathon run.

I am taking a much more aggressive approach to a similar lofty goal. I am documenting everything I think, say and do. It makes for an absolutely inspiring story for those that like the underdog to come out on top. Why do I say that? Well, albeit, I am nowhere near your goal from a financial stand point, I am mentally, spiritually and emotionally on top of the world at this time and nearly completed my plan of action to add (the 4th and final increment) FINANCIALLY to the list.

In conclusion, (and to give your readers a little taste of my ‘underdog’ cycle) I attended the world renowned school – THE SCHOOL OF HARD KNOCKS (Knox depending on whom you speak with – lol) Anyhow, in one sentence I have kicked 6 (out of 10) of the hardest substance addictions known to man right in the ass. (albeit the battle will continue until my death) However, these are, Nicotine/Cigarettes (February 9, 2001), Crack (October 3, 2009), Caffeine (March 1, 2010 – during my first stint in rehab), Alcohol (September 26, 2010 – during my second stint in rehab of the same year), Cocaine (June, 2012 – don’t remember the exact day sorry), Crystal Meth (January 26, 2014), and finally FREEDOM in early March of this year. Unlike anything anyone can ever feel. Then about 6 weeks ago, I began having the same fire I had when I was younger with regards to going into business. (No thanks to the substance abuse that fire had long been extinguished and in part because I suddenly found myself not getting hired as easily as I once did – 5 years ago. (yes even with my addictions I somehow was able to function somewhat)

Although, I didn’t know what I really wanted, I did have one idea (for a business) and it wasn’t anything too big or extravagant either. So began my research as I was NOT about to make the same mistakes I’ve done in the past. (that in itself is a somewhat entertaining story on its own) So there was some positive coming out of my failures after all. I knew what NOT to do. Great start!!!!

As I researched this little venture I was thinking of starting, I came across many ‘get rich quick’ schemes, right, left and center. Yawn! Grrrrr! It was a lot of time wasting. Then I realized I was Googling the wrong questions. Once I started asking the right questions LO and BE fu*^%$g HOLD. Door, after door, after door kept opening for me. It was like my entire business plan was unraveling right before my eyes and I’d done nothing (yet) to get started. Your blog, Mr. Frugal Trader, came up VERY often in my searches for information which I was easily able to corroborate. For that THANK YOU a million times.

I will not share at this point what the revelations are/were as I am in the home stretch of finalizing all the finer points (ugh) and to ultimately put into a business plan, all the while reading some motivational books, walking, eating healthy, being as awesome of a father as I can be, (tonight I coach my very first soccer game ever – and have NO clue at all what to do – I will Google the details just before game time and wing it from there – God help me) trying to be as great of a husband as possible, and ALWAYS, ALWAYS living right here, right now, in this very moment at all times. I’ve NEVER in most of my adult life felt this confident about what I am doing, (albeit I have absolutely no idea how the money I require for financing will come) but I …….. just ……………. well ………. I just know in a very strange and calming manner that I will find it. I have my ideas on what I will try to do. But it seems that, the more prepared and informed I am becoming (thanks in large part to your blog as a starting block) the more confident I am about the eventual results. It’s like putting your hand in a fire. I don’t know the actual mechanics (at the biological level) of what will occur to your skin as your hand burns but I do know with unequivocal certainty that you will burn yourself. I am nearly at that point with my plan.

This can be the result of two things. I have either missed something, or overlooked something, or am simply not seeing the bigger picture OR (for which I prefer to believe) that THIS time I did do my due diligence (for which I think I have) and finally have created the map to amass a small fortune (a bit ambiguous but enough money to live comfortably and do what it is I want to do – see: The Four Hour Work Week by Tim Ferris – kind of comfortably) and do exactly what I wish to do in life – all the while remaining on guard at all times against my demons each and every day, for they lurk not far from me always waiting for a moment of vulnerability and weakness to pounce.

I WILL make this happen and it will happen in a much shorter period then what you have done Frugal. Not because I am better or more experienced or anything. As a matter of fact you know much, much more then I do about all the technical aspect of things. I am an idealist. I run with the information I have. Only this time (the upteenth time) I am hitting the ground running with both legs, armed with ALL the necessary information (both current and anticipated) to make this (ad)venture a Grand Slam right from the get go. Now that I think about it, right up to this point, it is already a Grand Slam.

I will keep you all posted and will (in the near future) have some sort of blog (not like this awesome blog here but) where I will write down my entire story. It’s very unique. It’s original. It’s raw. It’s painful. It’s happy. It laughs and it cries. (a lot of crying) It will be real and unedited. The language is bold yet very powerful. There will be no BS in it. Just real hard facts, about where I cam from, where I went, what I did, how I felt, how I thought. It’s about survival. It’s a journey to find the truth about myself. It’s very much an awesome story, if ONLY I can finish what I have started recently. Either way, I shall post it soon. It won’t cost anyone, anything. But as I said, it’s about truth, the whole and nothing but.

Take care everyone, my name is Daniel and I hope speak with you in the near future Mr. Frugal Trader, (if not thank you [regardless] for this awesome and very helpful site) and also to all the readers.

Back to the grind and the research. The business awaits.

Salut!

Daniel

Very good nice to see some real numbers. I few comments – I’m wondering if it’s time to “round off” some of your numbers. Does it really matter if you have a future tax liability of $108,750 or is $100,000 close enough? NW is a good number to keep track of but IMHO not really the only number. I’m new here maybe you have an Income statement somewhere which would show all current sources of income, sources and estimated target income for retirement ? A liquid asset statement with a target of 1 mil of assets you have control of could also be a new target.

So close! I say you throw a huge party once you reach the BIG M!

It looks like you are making positive process! You’ve done a great job breaking down all the components clearly, and I agree the visual chart of your growth over time is helpful. Thanks for sharing this!

That’s an interesting observation and it would make sense if it did grow more exponentially. I think its because that my investable assets have been a smaller part of the overall net worth up until now. As the investable assets get larger, increases (and decreases) will be more dramatic.

Thanks for sharing – but I’m with Under the Money Tree — why is the net worth growth so constant?

I would have expected some acceleration as the investments piled up.

I just found your story and very impressed! Thank you for sharing!